- GBP/USD attracted some dip-buying on Tuesday amid the post-US CPI USD selloff.

- The US bond yields fell to three-week lows and further undermined the greenback.

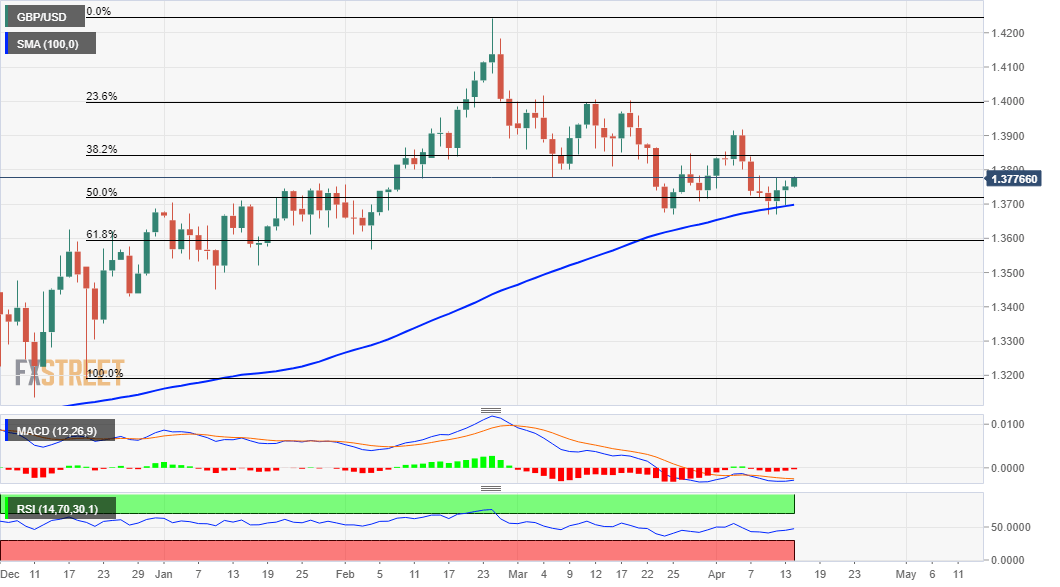

- Bulls might wait for a move beyond the 1.3825-30 region before placing fresh bets.

The GBP/USD pair witnessed some intraday selling on Tuesday, albeit showed some resilience below the 1.3700 mark and recovered around 75 pips from daily lows amid some heavy US dollar selling. The British pound initially was weighed down by a rather unimpressive UK GDP report, which showed that the economy expanded by 0.4% in February as against 0.6% anticipated. This comes on the back of a possible link between the AstraZeneca coronavirus vaccine and a rare blood clotting disorder that could delay the UK government's plan to reopen the economy. The pair lost some additional ground after the Bank of England (BoE) announced that Chief Economist Andy Haldane will quit his position and step down from the Monetary Policy Committee (MPC) after June's meeting.

On the other hand, the USD witnessed a dramatic turnaround and tumbled to three-week lows following the release of US consumer inflation figures. The headline CPI recorded the biggest increase since August 2012 and rose 0.6% in March. The yearly rate accelerated to 2.6% versus 1.7% in the previous month. The readings were stronger than consensus estimates, though were not evident of broadening price pressures. This, in turn, triggered a fresh leg down in the US Treasury bond yields and prompted some aggressive selling around the USD. Meanwhile, the US Food and Drug Administration (FDA) halted the use of Johnson & Johnson's coronavirus vaccine amid rare and severe blood clots issues. This aggravated the USD bearish pressure and provided a modest lift to the pair.

The USD remained depressed through the Asian session on Wednesday, which allowed the pair to gain some follow-through traction for the third straight day and climb to near one-week tops. In the absence of any major market-moving economic releases, either from the UK or the US, the pair remains at the mercy of the USD price dynamics. Later during the US sessions, a scheduled speech by Fed Chair Jerome Powell will influence the greenback and produce some meaningful trading opportunities around the major.

Short-term technical outlook

From a technical perspective, the pair, so far, hasn't been able to find acceptance below the 50% Fibonacci level of the 1.3135-1.4243 positive move and managed to defend 100-day SMA support. From current levels, any subsequent positive move might confront some resistance near the 1.3800 mark. This is closely followed by the 38.2% Fibo. level, around the 1.3825-30 region, which if cleared decisively will negate the near-term negative bias. The pair might then accelerate the momentum back towards the 1.3900 mark before eventually climbing to monthly tops, around the 1.3920 area.

On the flip side, any meaningful pullback might continue to find decent support near the 1.3700 mark, or 50% Fibo. level. Some follow-through selling, leading to subsequent weakness below 100-day SMA will shift the bias back in favour of bearish traders. This, in turn, will set the stage for an extension of the recent downward trajectory and drag the pair towards the 1.3635-25 intermediate support, en-route the 1.3600 mark. The downfall could further get extended towards the 61.8% Fibo. level, around the 1.3560-55 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.