- Broad-based USD selling helped stage a goodish bounce on Wednesday.

- The up-move seemed unaffected by dismal NISER UK Q2 GDP estimate.

- Thursday’s focus will be on the BoE financial stability report and US CPI.

The GBP/USD pair took advantage of the broad-based US Dollar selling on Wednesday and bounced off six-month lows set in the previous session. The greenback took a sharp knock in reaction to the Fed Chair Jerome Powell's prepared statement for the semi-annual Congressional testimony, reiterating the central bank will act as appropriate to sustain the US economic growth. Powell highlighted the risk that weak inflation will be persistent - more than the Fed currently anticipates and also acknowledged that uncertainties continue to dim the outlook.

Adding to Powell's dovish remarks, the June FOMC meeting minutes revealed many policymakers judged that additional monetary stimulus would be needed soon and revived speculations of an aggressive rate cut. This was evident from a sharp intraday turnaround in the US Treasury bond yields, which exerted some heavy downward pressure on the greenback and assisted the pair jump back above the key 1.2500 psychological mark.

The positive momentum seemed rather unaffected by the UK National Institue of Economic and Social Research (NIESR)'s release, indicating that the economy was on course to contract by 0.1% in the second quarter of the year. Earlier on Wednesday, the monthly GDP report showed that the UK economy expanded by 0.3% in May, having contracted 0.4% in the previous month, while goods trade deficit declined to £11.524 billion in May £-12.76 billion previous. Meanwhile, the UK manufacturing and industrial production staged a goodish rebound in May, though were slightly below market expectations.

The pair built on the overnight positive momentum and in absence of any negative Brexit headlines, climbed to the top end of its weekly trading range during the Asian session on Thursday. Moving ahead, market participants now look forward to the BoE's financial stability report, which will be followed by a press conference, where comments by the BoE Governor Mark Carney will influence sentiment surrounding the British Pound. Later during the North-American session, the US Consumer inflation figures and the second day of Powell's testimony might further collaborate towards producing some meaningful trading opportunities.

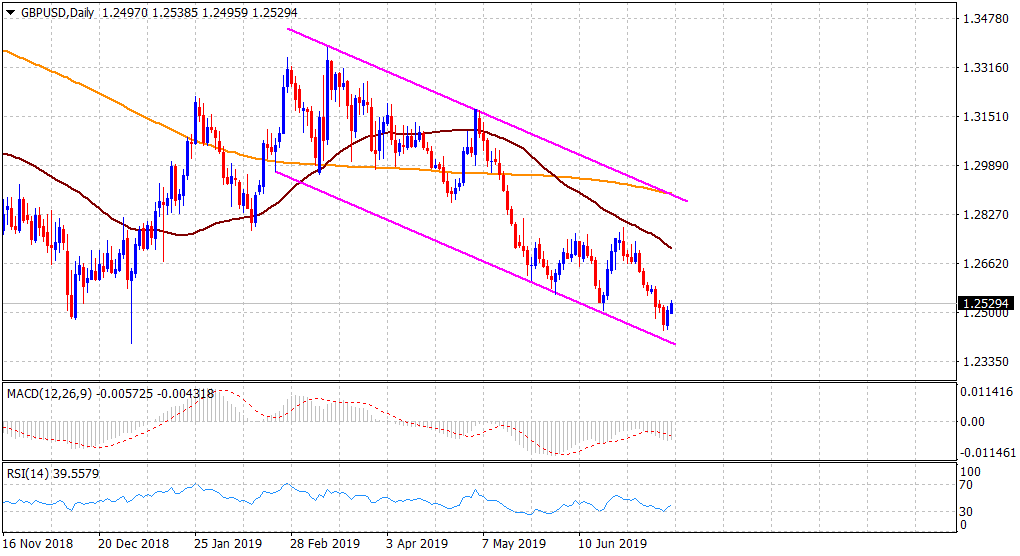

From a technical perspective, any subsequent recovery is likely to confront some fresh supply near the 1.2565-70 region, above which the momentum might get extended, though runs the risk of fizzling out rather quickly near the 1.2600 handle amid persistent fears of a no-deal Brexit.

On the flip side, the 1.2500 handle, closely followed by the 1.2480 horizontal zone now seems to protect the immediate downside, which if broken might turn the pair vulnerable to break through the recent swing lows support near the 1.2440 region and head towards challenging yearly lows, around the 1.2400-1.2395 area. The mentioned region coincides with a four-month-old descending trend-channel and should act as a key trigger for any further near-term depreciating move.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.