GBP/USD Current price: 1.2770

- Brexit uncertainty, the main reason for lackluster economic growth.

- UK employment data to be out this week but no fireworks expected there.

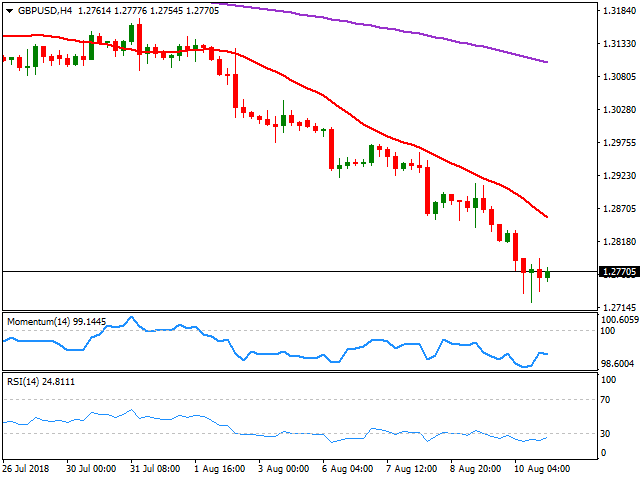

The GBP/USD pair fell to 1.2722, its lowest since June 2017, as the Pound remained undermined by Brexit-related fears, unable to attract investors after a batch of mostly positive data. According to the official releases, the UK preliminary Q2 GDP expanded as expected 0.4% QoQ, matching the market's forecast, and better than the previous 0.2%. Additionally, the June Total Trade Balance deficit shrunk to £-1.861B from a previous £-3.141B. In the same month, Industrial Production expanded 0.4% in and Manufacturing Production also rose 0.4%. UK Finance Minister Hammond attributed the lackluster economic expansion to uncertainty over Brexit but added that chances are that a Brexit trade deal will be achieved. The UK will release this Tuesday fresh employment figures, with the ILO unemployment rate seen steady at 4.2% and wages' growth in line with the recent modest advances. The pair fell for a third consecutive week and for nine days in-a-row, although there are no signs that indicate downward exhaustion, given that in the daily chart, technical indicators maintain their strong downward slopes, with the RSI currently at 23. The 20 DMA is over 200 pips above the current level, bearish, losing relevance for intraday trading. In the 4 hours chart, the pair also presents a bearish stance, with the 20 SMA heading south around 1.2865, the Momentum indicator consolidating in negative territory after a modest upward correction, and the RSI indicator hovering around 24. The mentioned level is a potential target in the case of a due correction.

Support levels: 1.2720 1.2680 1.2645

Resistance levels: 1.2795 1.2830 1.2865

View Live Chart for the GBP/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.