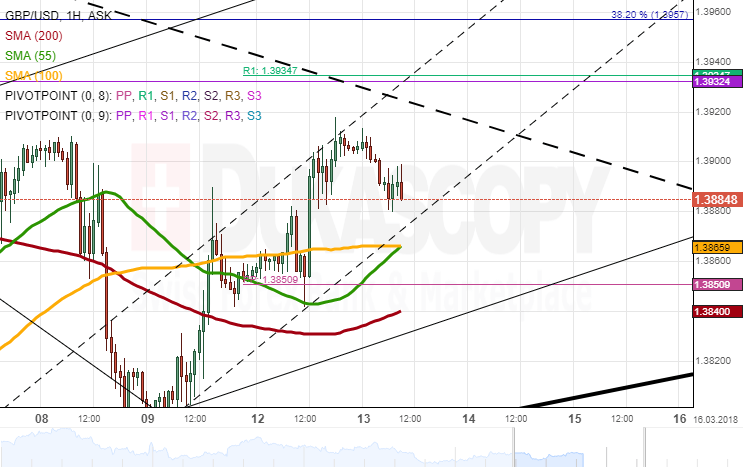

As previously expected, the Pound continues moving closer to a downward-sloping trend-line located near the 1.3910 mark for the third consecutive session. A 20-pip surge mid-Monday added some ground to the bullish sentiment, thus pushing the rate up to the 1.39 mark.

The Asian session began with a slight decline for the Sterling that is likely to continue until the British Annual Budget Report and the US CPI published at 1130GMT and 1230GMT, respectively, introduce changes to the overall market sentiment.

In general, it is likely that fundamentals, especially the second event, dominate the market during the second part of the day. A possible trading range is the 55– and 100-hour SMAs and the weekly PP at 1.3850 from below and the weekly R1 and the monthly PP at 1.3935 from above.

Interested in GBPUSD technicals? Check out the key levels

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.