Good morning everyone! Hope all is well. Today also we could be in for some action on many currency pairs as it is day 2 of the G20 meetings. Their decisions/outcomes could affect many currencies across the board. There are two more fundamental watch items that could affect the US Dollar majorly, so all in all we could be in for some decent moves through the course of the day. We did have a good forecast yesterday with GBPUSD, USDCAD, USDCHF, NZDUSD and EURJPY performing to our expectations. That is 5 out of the 7 pairs that we had forecasted. US Dollar is a bit hard to read at the moment and on the other hand since Japanese Yen has already come out of our blue zone this morning, hence it may continue to weaken. Adding two hedged pairs to offset the trading risk. Happy Trading!

Forecasts Outlook

US Dollar: Mixed Sentiments

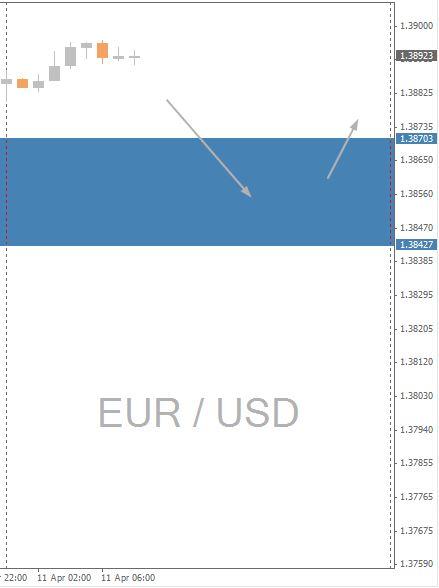

Today we're expecting the EURUSD to proceed Long above the barrier levels of 1.38427 and 1.38703.

Fundamental Watch

- PPI m/m

- Prelim UoM Consumer Sentiment

- G20 Meetings

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Urbanforex will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.<7p>

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.