The big news of the domestic session is China shutting its stock market after plummeting into ‘limit down’ territory. Essentially this means the market’s fallen too much (more than 5%) and the market has shut for 15 minutes. After re-opening the lower most limit of 7% was breached and markets subsequently closed for the day. From what I can decipher markets will open as normal again tomorrow, but not before the PBoC and the CFFE get stuck into stemming the rout somehow and perhaps find the source of the extraordinary selling.

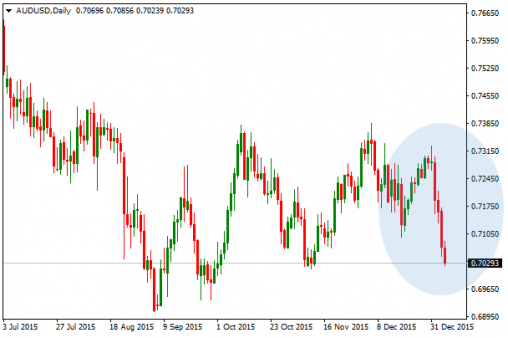

This is of course not good news for the local unit. The Australian dollar has entered its fourth consecutive day of losses, sinking below 71-figure in the US trading sessions and now eyeing 70 US cents. Broadly speaking, Chinese concerns and losses across commodity markets have prompted a general lean towards the Greenback and Yen – which is a good indication that the appetite of market participants have little tolerance for risk assets. The Yen’s the ultimate winner with the USDJPY pair falling below the 118-figure.

The Aussie and Kiwi are getting smashed across the board, but not more than against the Yen which is of course the preferred currency in times of adversity.

Aussie slides – AUDUSD Chart by MT4There’s been much talk in the press recently about the falling Yuan, known as the Renminbi or RMB (CNY). While the PBoC have the capacity to set the daily trading range for the (onshore) Yuan, lower limits continue to be breached, forcing the hand of China’s Central Bank to continue to lower the daily trading range. Meanwhile, the offshore RMB (CNH), which trades in major hubs such as Hong Kong, London, Singapore among other locations, is trading at a (growing) discount to the onshore price. This discrepancy could be seen as a reflection of lower confidence in the region, notwithstanding the PBoC’s efforts to control the depth and ferocity of the decline.

To provide a little background, in recent years China has been taking active steps to internationalise their currency by establishing offshore trading hubs. The internalisation of the RMB (by introducing external, offshore trading hub) provides China a greater capacity to deal in its own currency with the rest of the globe, rather than settle transactions in US dollars or other currencies.

The below chart represents the performance of the CNY (onshore) against the CNH (offshore) over the last 12-months. As we can see, since Oct/Nov there’s been a material rise in value.

CNY/CNH – Chart by BloombergPerhaps a better way of looking at it is by overlaying price action. As we can see below, the CNH is trading at a (growing) discount.

CNY & CNH – Chart by Bloomberg

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.