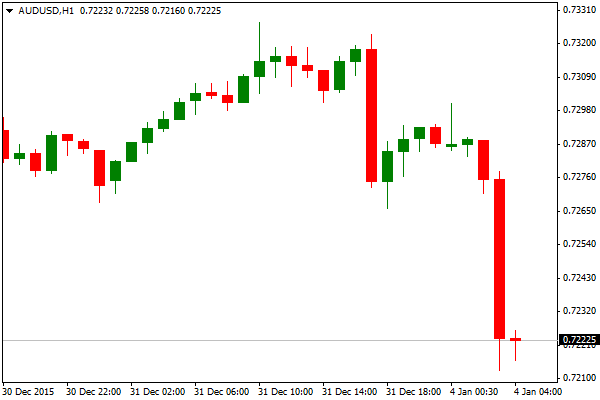

The US dollar has kicked off the year in solid form against its major counterparts. Judging by both USD and JPY movements, the balance of risk appears to be falling on the side of caution amid escalating tensions the Middle East as Saudi Arabia cuts its diplomatic ties to Iran. Furthermore, a magnitude 5.1 Earth quake in New Zealand may have prompted a little more (temporary) weakness for the Kiwi and residual weakness for the A$. Still, it does appear to be Middle Eastern issues that are the primary catalysts, and naturally high beta currencies are the first to fall.

Of course, it’s worth looking at the steep drop across Asian markets which is – in part – responsible for the poor performance from the antipodean currencies. Less than inspiring Chinese PMI is all the talk around the traps this morning with the Caixin/Markit manufacturing purchasing managers index recording a drop to 48.2 in December, down from 48.6 in November. Expectations were for around the 48.9 level. The Aussie and Kiwi are down around 0.9 and 0.8 percent respectively on the day.

AUD takes a hit on China / Geopolitical TensionsAs liquidity begins to return, there’s plenty to keep market participants interested this week, and certainly the US Dollar/US rates dynamic remains a key theme. We’ve seen a rate hike in the US and now it’s time for the US economy to both justify the rate hike and show cause for more, in accordance with market expectations. For this, participants are looking to this Friday’s US non-farm payrolls for inspiration among a raft of high to mid-tier US data through the week which we will be covering in tomorrow’s report.

Locally, as the RBA are taking a breather this month, the focus will be on trade, housing and retail sales data. Without any major local themes, one may expect the Aussie fortunes will rest on what’s happening abroad, with geopolitical risk, China, and further US rates conjecture likely to be the primary directives.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.