Introduction

The Reserve Bank of Australia sent AUD tumbling overnight as it cut the benchmark interest rate for the nation to 1.75%. The central bank mentioned that growth this year was not at the pace expected whilst it indicated a lower inflation outlook than previously anticipated. Its Antipodean cousin suffered too, partly due to poor Caixin manufacturing PMI from China. As London begins its trading week, the market looks ahead to the US employment rate and non-farm payrolls figures on Friday May 6th, with the former figure expected to print as it did last month, at 5.0%.

Asian Session

USD/JPY has also taken a hit this morning and trades below the 106.0 level right now, the first time that the pair has been this low since October 2014. This comes despite the Golden Week holidays that lead Japanese markets to be closed. Notable support on the downside can be seen at 105.45 and subsequently 104.97.

Bloomberg reports that the decision by The RBA to slash its main interest rate during APAC trading was due to the fact that industries outside of the mining sector were seen as in need of a boost. Governor Glenn Stevens pointed out that there was not too much concern regarding risks to the Aussie housing market.

The day ahead in Europe and NY

EUR/SEK trades at approx. 9.1800 ahead of industrial production data which prints out of Stockholm at 08:30 BST today. PMI figures were released from individual regions within Europe yesterday with mixed results, whilst the continent-wide figure proved better than expected. European PPI data is released at 10:00 BST today too, whilst the European budget is released and the European Commission releases its economic growth forecasts.

Cable traders will pay attention to manufacturing PMI info. released at 09:30 BST, with the currency pair trading at 1.4727 currently. The market will then look to Redbook and ISM New York Index figures after the European lunchtime, with speeches from FOMC member Mester and BoC governor Poloz also orating later.

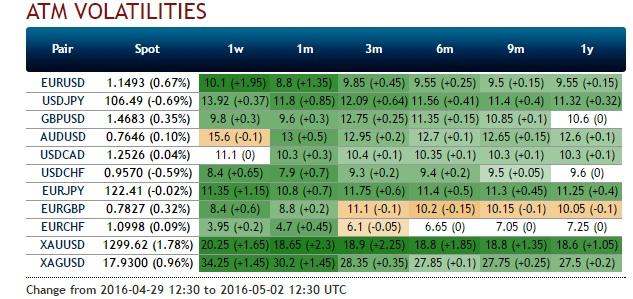

FXO

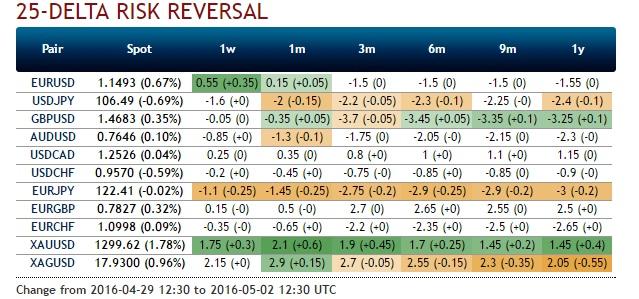

As USD/JPY spot continues to move lower, the currency options space in this regard feels nervous. The one week 25-delta risk-reversal has traded at a volatility differential of 2.0%, bid for the downside.

Within the retail currency options market at Saxo Bank A/S, 82% of traders are bid for the downside regarding USD/JPY. Similar bias is notable in XAG/USD options where 90% of traders favour long put and/or short call options. Within the EUR/USD space, a slight shift is notable in the fact that 57% of traders now favour the upside. There has been a 50% split for quite some time regarding options in this currency pair.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.