Talking Points:

- Emerging market, Indian inflation seasonality is not in the Indian Rupee’s favor during 2Q.

- Food inflation year-to-date is disconcerting in the context of India’s CPI basket.

- Confidence in the April/May elections, RBI may be stretched.

It is fair to say that the appreciation of the Indian Rupee (INR) may have gone too far. Originally bid as confidence in the Reserve Bank of India returned on the back of Raghuram Rajan’s move to the central bank, recent USDollar weakness and Indian election confidence has pushed USDINR below the 60 handle. Over the past few months we’ve detailed multiple bullish factors for the Rupee, but certain factors developing into this summer may begin to disrupt trends seen in the first quarter.

In the near term, it appears as though confidence in the RBI and the month long Indian election cycle has reached a positive extreme. Market participants can front run a win by the opposition party today, but there is no guarantee that confidence will remain tomorrow. Post-election euphoria has faded before and would likely fade again, especially in the context of emerging market uncertainty and higher rates out of the RBI.

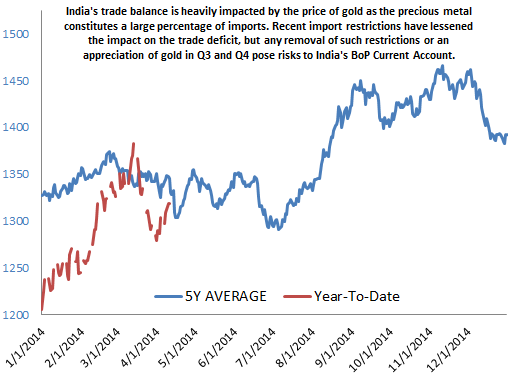

Although the Rupee survived the EM FX selloff, we’ve noted seasonal factors that include higher inflation into the summer pose risks in the second quarter. The Reserve Bank of India is likely to struggle with combating inflation in the near term, especially in the context of recent developments in the agricultural sector. Food prices constitute a large part of the CPI basket and poor weather around the globe combined disruptions in the grain market vis-à-vis Ukraine have led to higher than normal food inflation for this time of year.

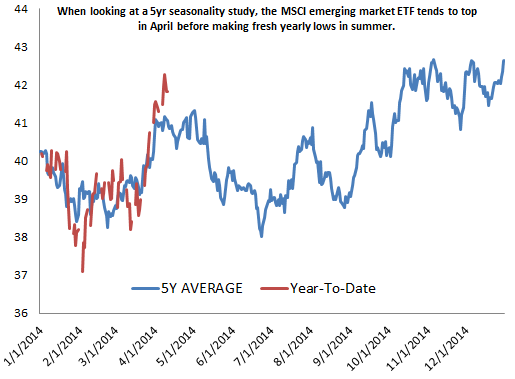

As we discussed, the Indian Rupee held up well during the EM FX selloff, but the currency has been further helped by emerging market strength over the past few weeks. Looking at seasonality studies on the MSCI EM ETF, flows tend to top in April before heading south until summer. If this trend pans out, we could very well see emerging market currencies come under pressure in the second quarter, especially if we have set a concerted USDollar low as of last week.

Seasonality Study: MSCI Emerging Market ETF

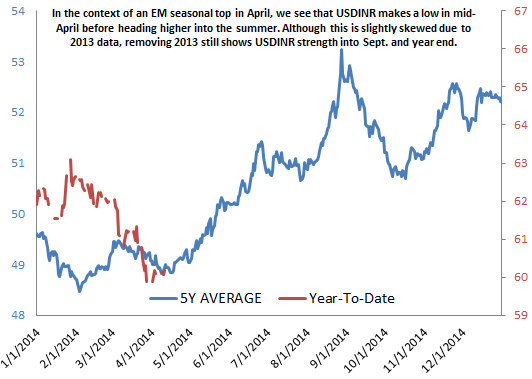

The Indian Rupee has strengthened(USD/INR lower) year-to-date, but the rest of the year does not look as bullish for the Rupee if the past 5 years are any indication. Just as seasonal CPI strength and EM weakness looks to bottom in summer, the Rupee looks to weaken into August and September.

USD/INR: Seasonality Study

Part of the usual INR weakness in August and September may not be as pronounced in 2014 if we do see gold import restrictions hold. Although it may be a tough political sell post-election, keeping the measures in place could help lessen the adverse impact of higher gold prices in the third quarter.

Spot Gold Price: Seasonality Study

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The Fed’s Bostic, Barr, Waller, Jefferson, and Mester are set to speak on Monday.

EUR/USD: Could FOMC Minutes provide fresh clues?

The EUR/USD pair advanced for a fourth consecutive week, comfortably trading around 1.0860 ahead of the close. Progress had been shallow, as the pair is up roughly 250 pips from the year low of 1.0600 posted mid-April.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.