Analysis for August 14th, 2014

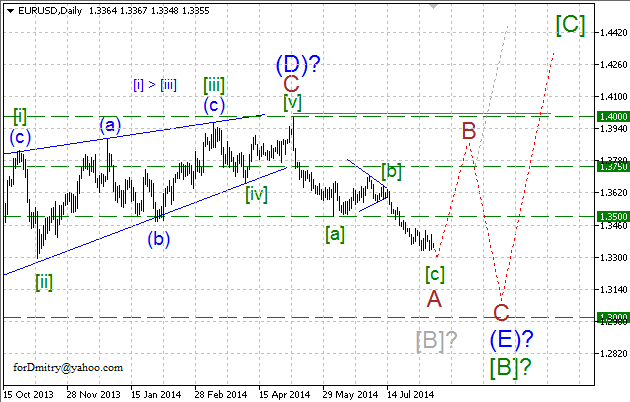

EURUSD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of flat or some double pattern.

Probably, the price is finishing a descending zigzag A of (E), which may be followed by an ascending zigzag B of (E).

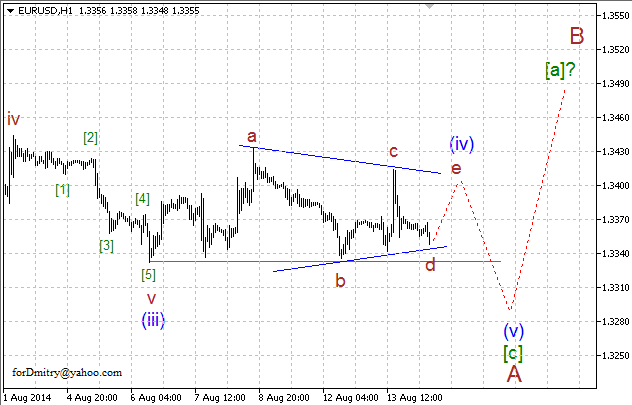

Possibly, the pair is about to finish a descending zigzag A. Right now, the market is completing a horizontal triangle (iv) of [c] of A, which may be followed by the final descending wave (v) of [c] of A.

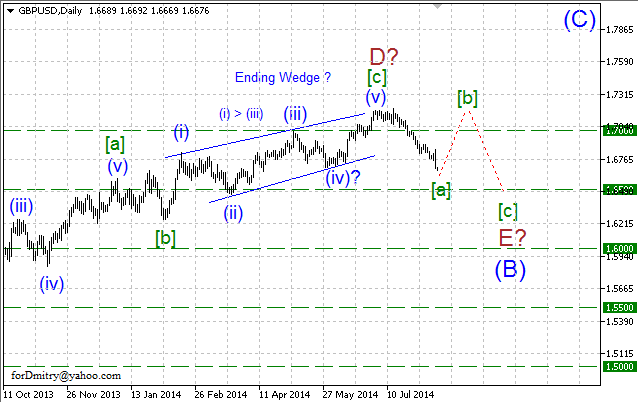

GBPUSD, “Great Britain Pound vs US Dollar”

Probably, Pound completed the final wedge [c] of D of an ascending zigzag D of (B) of a large skewed triangle (B). Right now, the pair is forming the final descending wave E of (B), which may take the form of double three, flat, or another long horizontal pattern.

Possibly, the price is forming flat [a] of E of the final descending wave E of (B). Later the pair is expected to form an ascending zigzag [b]of E.

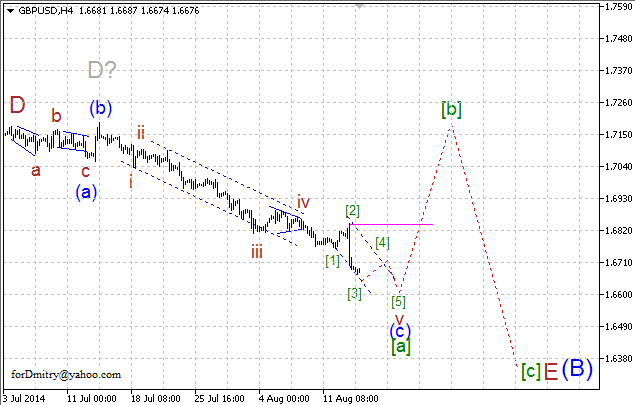

Probably, the pair is completing a descending impulse (c) of [a], which may be followed by an ascending zigzag [b].

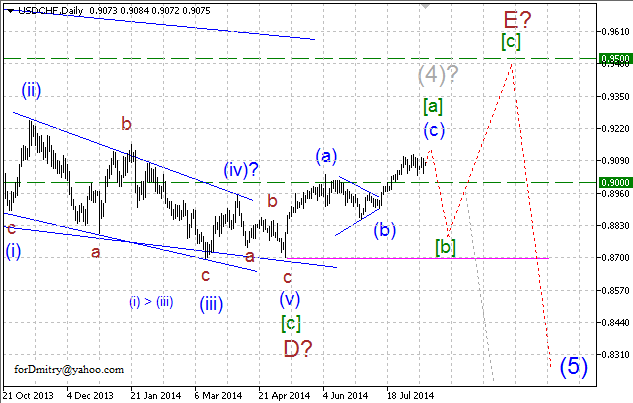

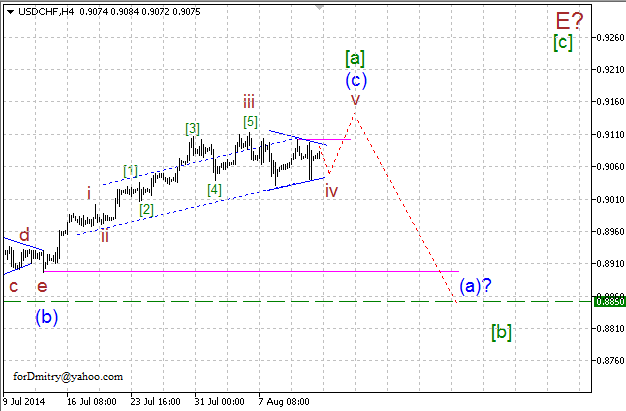

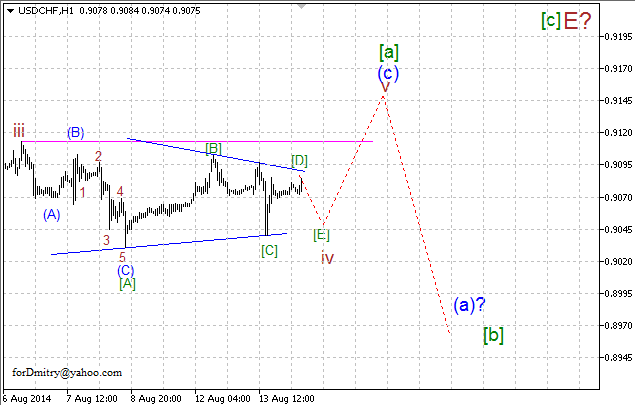

USDCHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E of (4), which may take the form of double zigzag or flat.

Probably, the pair is about to finish an ascending zigzag [a] of E, which may be followed by a descending zigzag [b] of E.

Possibly, the pair is completing an ascending zigzag [a] of E. Right now, the market is finishing a horizontal triangle iv of (c) of [a], which may be followed by the final ascending wave v of (c) of [a].

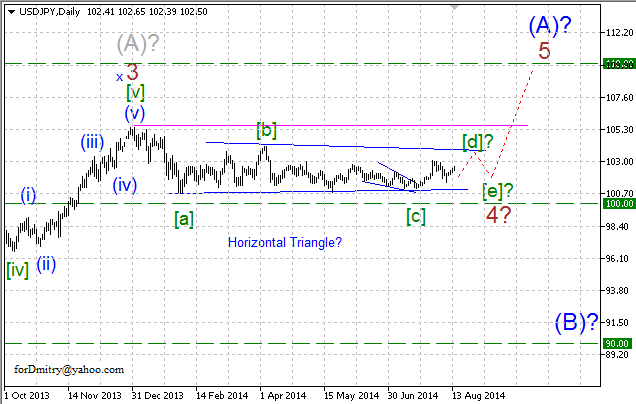

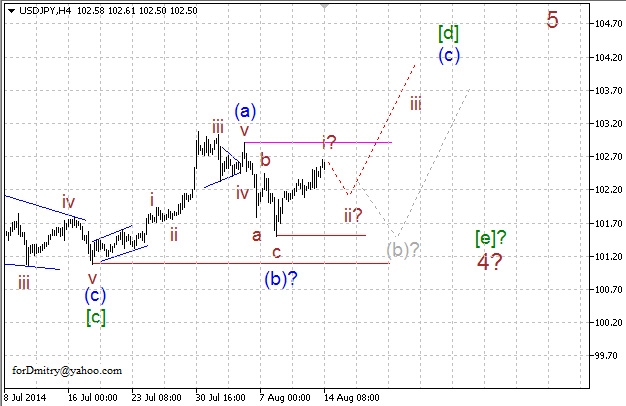

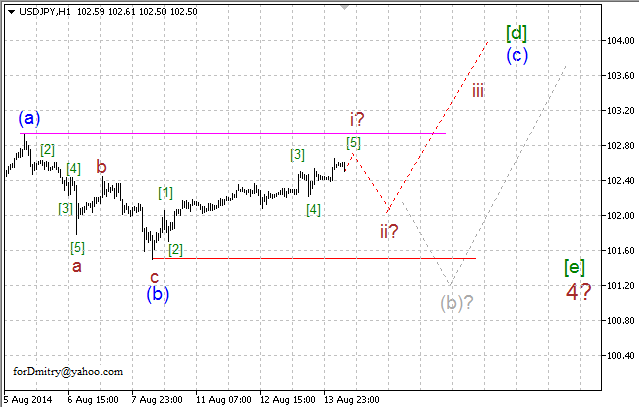

USDJPY, “US Dollar vs Japanese Yen”

Probably, right now Yen is forming an ascending zigzag [d] of 4 of (A) of a long horizontal correction 4 of (A). In this case, later price is expected to start the final ascending movement inside wave 5 of (A).

Probably, the pair finished a descending zigzag [c] of 4 and right now is forming the final ascending wave (c) of [d] of an ascending zigzag [d] of 4, which may take the form of an impulse or a diagonal triangle.

Possibly, the price completed a descending correction (b) of [d] of an ascending zigzag [d]. If this assumption is correct, then the pair is expected to continue forming the final ascending wave (c) of [d], which may take the form of an impulse or a diagonal triangle without breaking the critical level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.