Analysis for July 24th, 2014

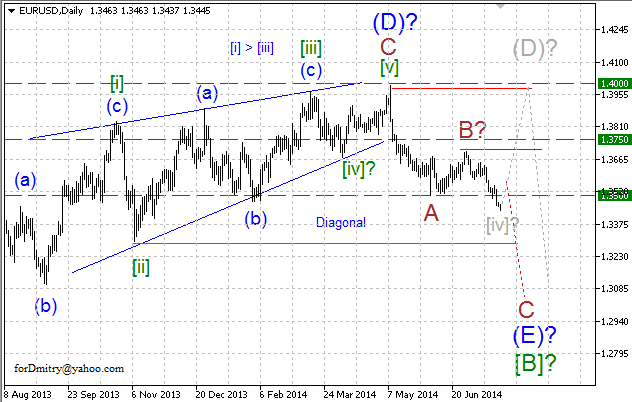

EUR USD, “Euro vs US Dollar”

Probably, Euro finished ascending zigzag (D) of [B]. In this case, price is expected to continue forming final descending zigzag (E) of [B]. However, alternative scenario (colored in grey) may still continue.

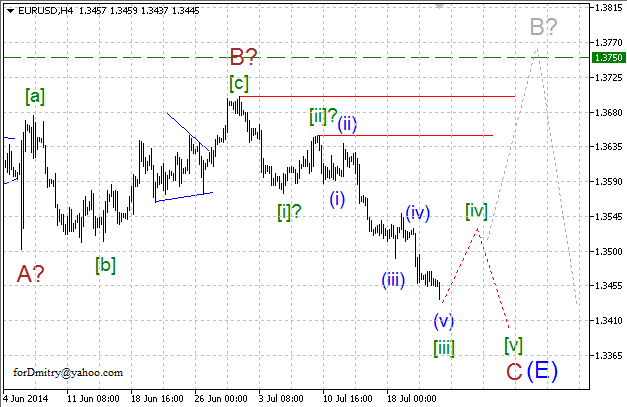

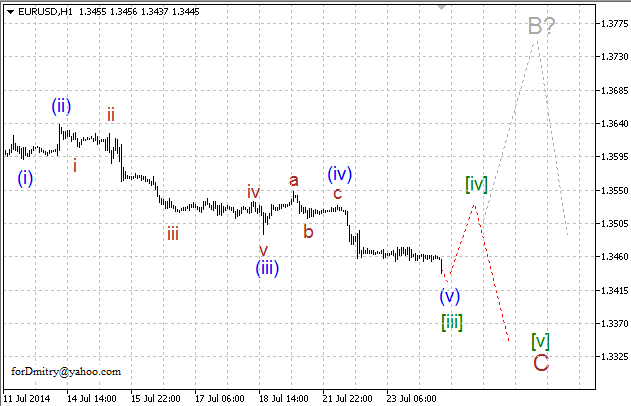

Probably, price is forming final descending zigzag (E). It looks like Euro completed ascending correction B of (E) and right now is finishing impulse [iii] of C of final descending wave C of (E), which may be followed by ascending correction [iv] of C.

Possibly, pair is forming descending wave C, which may take the form of impulse. In this case, price is expected to complete impulse [iii] of C and start forming ascending correction [iv] of C. However, one should remember that structure of impulse C might yet be changed.

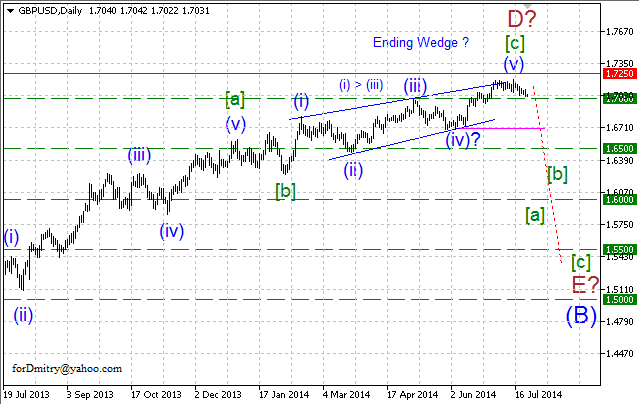

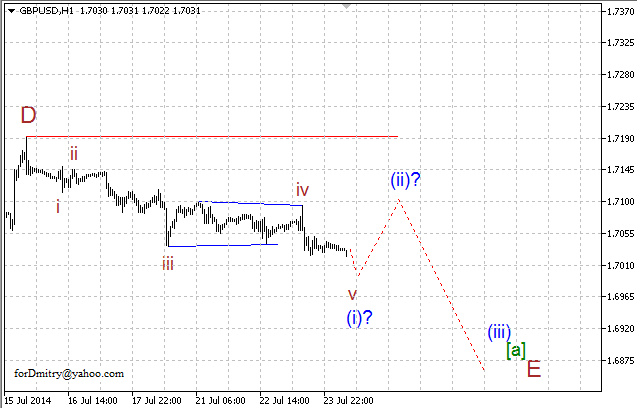

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed final wedge [c] of D of ascending zigzag D of (B) of large skewed triangle (B), which may be followed by final descending zigzag E of (B).

Possibly, price finished ascending impulse (v) of [c] of D of (B) of large skewed triangle (B), which may be followed by final descending zigzag [a]-[b]-[c] of E of (B).

Probably, price completed ascending wave D. If this assumption is correct, then pair is expected to continue falling down inside descending zigzag E without breaking the closest critical level.

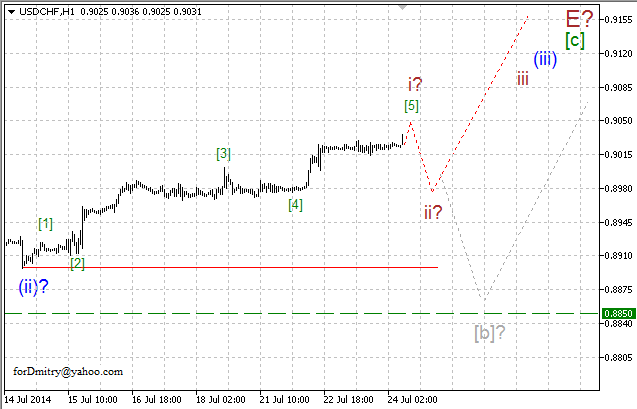

USD CHF, “US Dollar vs Swiss Franc”

Probably, Franc completed descending zigzag D of (4). If this assumption is correct, price is expected to continue forming final ascending zigzag E of (4). However, alternative scenario (colored in grey) may still continue.

Probably, price is forming final ascending zigzag E. Right now, Franc is forming its final ascending wave [c] of E.

Possibly, pair is forming final ascending wave [c] of E, which may take the form of impulse. In this case, price is expected to continue growing up inside impulse (iii) of [c]. However, one should remember that structure of impulse [c] might yet be changed.

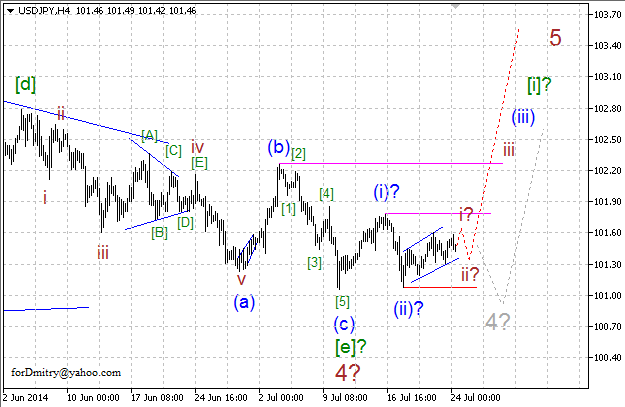

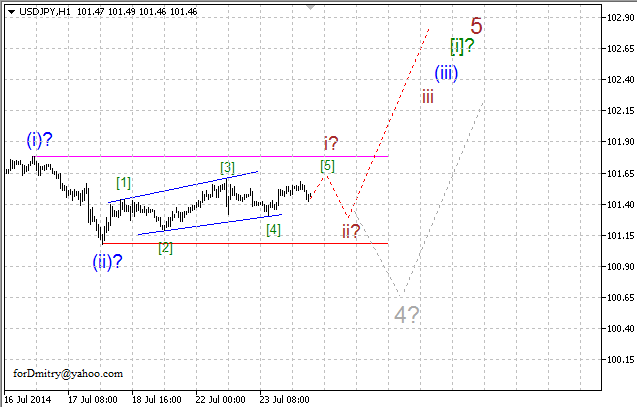

USD JPY, “US Dollar vs Japanese Yen”

Probably, Yen finished long horizontal correction 4 of (A). In this case, later price is expected to start final ascending movement inside wave 5 of (A).

Probably, pair finished descending zigzag [e] of 4 and the whole horizontal triangle 4. In this case, price is expected to start ascending wave 5.

Possibly, price is forming ascending wave 5, which may take the form of impulse. If this assumption is correct, pair is expected to continue growing up inside impulse (iii) of [i] of 5 without breaking the closest critical level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.