Analysis for July 11th, 2014

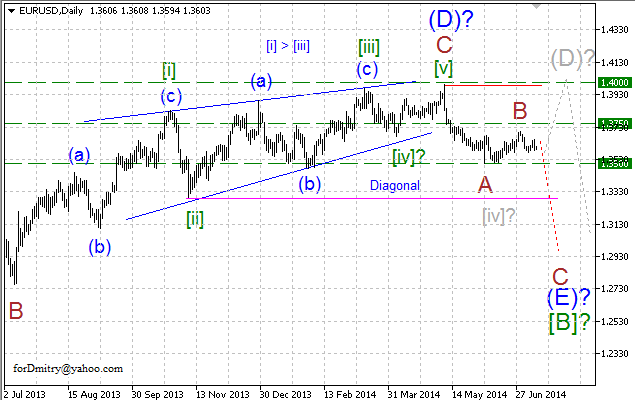

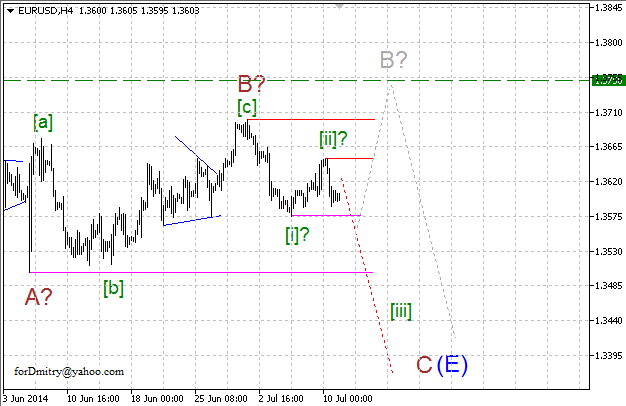

EUR USD, “Euro vs US Dollar”

Probably, Euro finished the second “leg” C of (D) of ascending zigzag (D) of [B] in the form of ending diagonal triangle. In this case, price is expected to continue forming final descending zigzag (E) of [B].

Possibly, price is forming final descending zigzag (E). It looks like Euro finished ascending correction B of (E) and started falling down inside final descending wave C of (E).

Probably, pair is forming descending wave C, which may take the form of impulse. In this case, price is expected to continue falling down inside impulse [iii] of C.

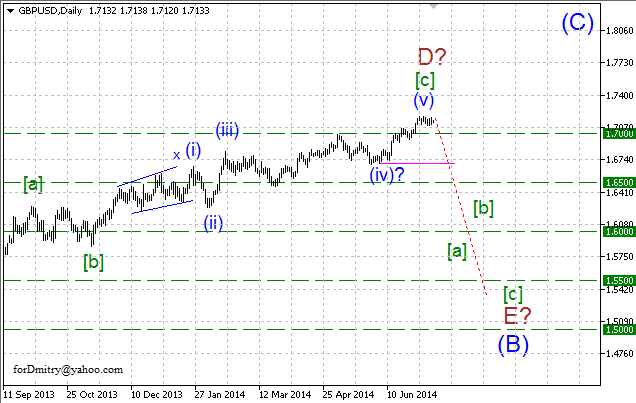

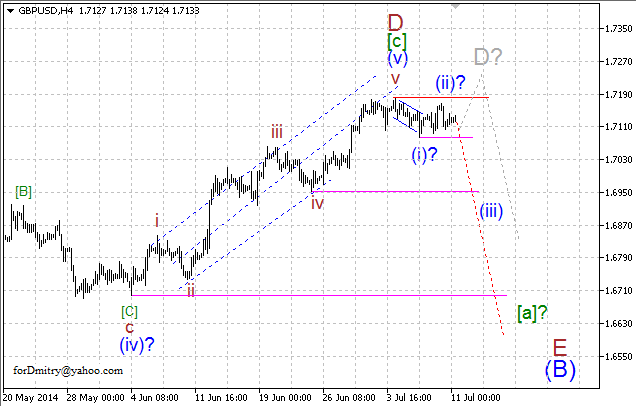

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed ascending zigzag D of (B) of large skewed triangle (B), which may be followed by final descending zigzag E of (B).

Probably, price finished ascending impulse (v) of [c] of D of (B) of large skewed triangle (B), which may be followed by final descending zigzag [a]-[b]-[c] of E of (B).

Possibly, price started forming descending zigzag [a]-[b]-[c] of E. If this assumption is correct, pair is expected to continue falling down inside impulse (iii) of [a].

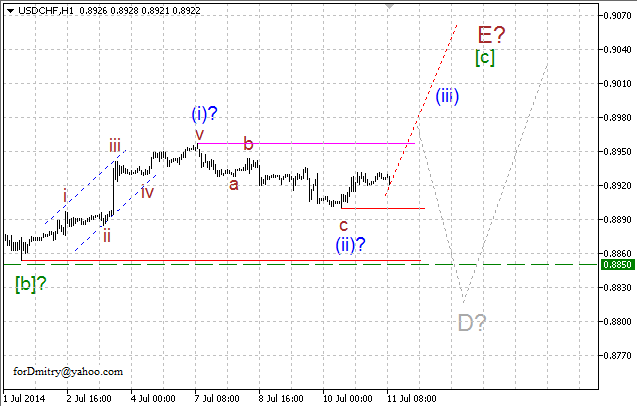

USD CHF, “US Dollar vs Swiss Franc”

Probably, Franc completed diagonal triangle [c] of D and the whole descending zigzag D of (4). In this case, price is expected to continue forming final ascending zigzag E of (4).

Possibly, price is forming final ascending zigzag E. Right now, Franc is forming its final ascending wave [c] of E.

Probably, pair is forming final ascending wave [c], which may take the form of impulse. In this case, price is expected to continue growing up inside impulse (iii) of [c].

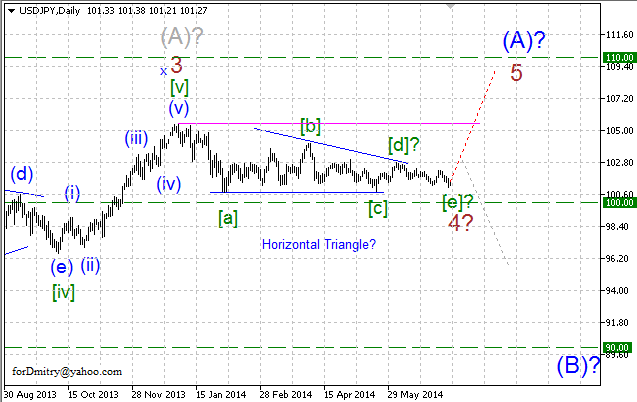

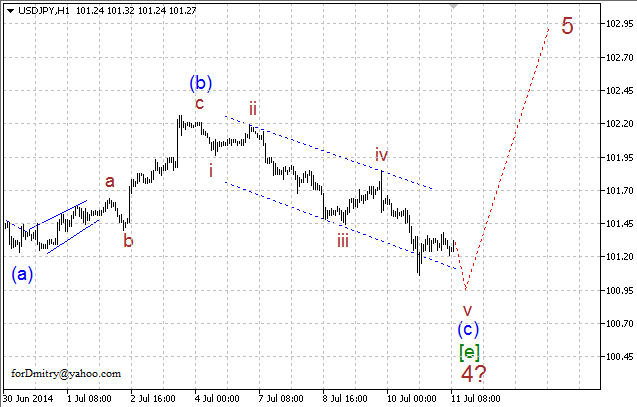

USD JPY, “US Dollar vs Japanese Yen”

Probably, Yen is finishing long horizontal correction 4 of (A). In this case, later price is expected to start final ascending movement inside wave 5 of (A).

Possibly, pair is finishing final descending wave [e] of 4 of horizontal triangle 4 in the form of small triangle. In this case, after completing horizontal correction 4, price is expected to start ascending wave 5.

Probably, price is completing impulse (c) of [e] of 4 of final descending zigzag [e] of 4. In this case, later pair is expected to form ascending wave 5.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.