GROWTHACES.COM Forex Trading Strategies

Taken Positions:

USD/CHF: (Full Access - VIP Subscription Only)

EUR/GBP: (Full Access - VIP Subscription Only)

EUR/CAD: (Full Access - VIP Subscription Only)

Pending Orders:

EUR/USD: (Full Access - VIP Subscription Only)

USD/JPY: buy at 122.10, target 124.50, stop-loss 121.20, risk factor **

AUD/USD: (Full Access - VIP Subscription Only)

CHF/JPY: (Full Access - VIP Subscription Only)

EUR/USD: Eurozone Inflation Revised Up

(Full Access - VIP Subscription Only)

USD/JPY: Japan Slipped Back Into Recession

(buy at 122.10)

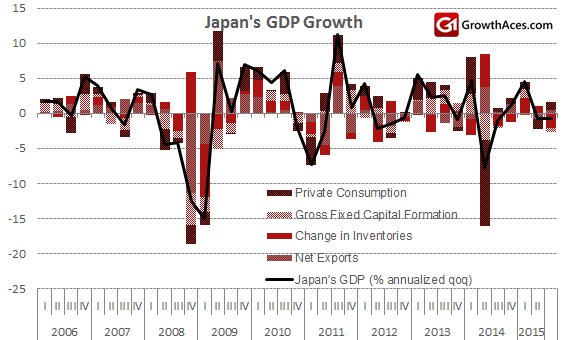

Japan’s economy shrank an annual 0.8% in July-September after a 0.7% contraction in the prior quarter, putting it firmly into recession - two consecutive quarters of declines.

Economics Minister Akira Amari, at a news conference noted a shortage of labour available for public works projects to stimulate the economy, highlighting a major constraint policymakers face - not enough suitable workers to build growth. Amari urged Japanese firms to use their record cash holdings to raise wages and boost capital spending to generate a virtuous circle of growth led by the private sector, instead of simply demanding yet more stimulus when such growth remained elusive.

Even though today's numbers were gloomy, the government maintained its cautiously upbeat outlook, saying that despite some weaknesses, the economy continued to recover moderately on improvements in job and income conditions. Amari said a big reduction in inventories was the major culprit in the third-quarter contraction. Excluding this effect, he said, final demand contributed an annualised 1.4 percentage point to growth.

Capital expenditure fell 1.3% to mark a second declining quarter, and revealing the sluggish state of manufacturing investment. Private consumption rose 0.5% from the previous quarter, in line with the median market forecast. While domestic demand shaved 0.3 percentage point off GDP growth, foreign demand for Japan's exports added 0.1 point, the data showed.

The weak data would have come as little surprise to Bank of Japan officials, who had also largely factored in the recession, and now expect growth to recover in coming quarters as consumption and factory output show signs of a pick-up, however modest.

The data will be closely scrutinised by the Bank of Japan, but board members are widely expected to keep monetary policy steady at the central bank's rate review this week.

The deadly attacks in Paris led to a bout of global risk aversion. The JPY, a traditional safe-haven currency, strengthened at the opening of the Asian session. However, weaker-than-expected GDP reading weakened the JPY again and the USD/JPY is near 123.00 now.

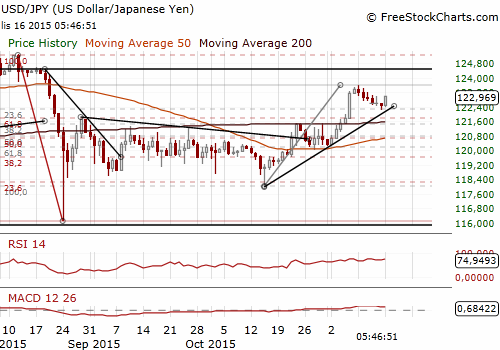

Our short USD/JPY position opened at 123.30 was closed with a small profit at 122.85. We are looking to buy the USD/JPY now as we expect the USD to strengthen in the short term. Hawkish FOMC minutes on Wednesday could trigger a new wave of the USD buying. We have placed our bid at 122.10, just above important support area.

Significant technical analysis' levels:

Resistance: 123.07 (high Nov 12), 123.22 (high Nov 11), 123.44 (high Nov 10)

Support: 122.23 (session low Nov 16), 122.00 (psychological level), 121.93 (50% fibo 120.26-123.60)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.