Taken Positions

EUR/USD: long at 1.1345, target 1.1550, stop-loss 1.1285, risk factor *

GBP/USD: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

USD/CAD: short at 1.3020, target 1.2850, stop-loss 1.3130, risk factor **

AUD/USD: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/JPY: long at 86.80, target 89.80, stop-loss at 86.10, risk factor **

AUD/NZD: (Full Content - VIP Subscription Only)

Pending Orders:

EUR/JPY: (Full Content - VIP Subscription Only)

EUR/CAD: (Full Content - VIP Subscription Only)

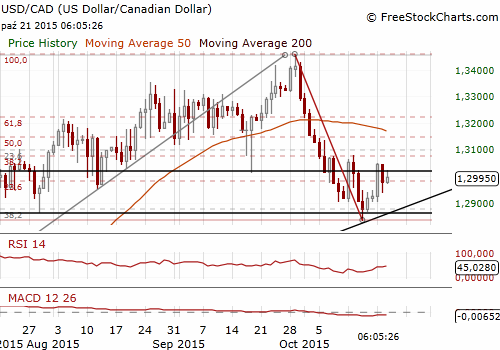

USD/CAD: BoC May Support The Loonie Today

(short at 1.3020)

- We expect the Bank of Canada to remain on hold today, leaving the overnight rate unchanged at its current level of 0.50%. The central bank’s statement is also likely to reaffirm the message it outlined at its 9 September meeting. The BoC is likely to say that the current stance of its monetary policy is appropriate and Inflation is evolving in line with the scenario described in the July policy report.

- The CAD has recovered substantially since the end of September, but we do not think that the BoC will see this move as strong enough to trigger a substantial change in its foreign exchange rhetoric as, even after the recent bounce, the currency remains much weaker than it was at the start of the year.

- Positive surprises, if any, may come from the new set of economic forecasts, given the likelihood that the BoC may signal slightly better trends than those outlined in its July Monetary Policy Report that projected Canadian growth just over 1% in 2015 and about 2.5% in 2016 and 2017.

- Data from Statistics Canada showed on Tuesday that the value of Canadian wholesale trade unexpectedly fell 0.1% in August as sales declined in sectors including machinery and motor vehicles. The machinery, equipment and supplies sector dropped 2.4% to its lowest level since April 2014, and the motor vehicle and parts sector fell 1.2%.

- In our opinion the outcome of the BoC’s meeting may support the loonie. We went short at 1.3020, in line with our trading strategy announced yesterday. The USD/CAD is close to the 10-day exponential moving average now. Breaking below this indicator, may open the way to stronger falls. The nearest strong support level is 1.2831 low on October 15. We have placed the target of our short slightly above this level, at 1.2850.

Significant technical analysis' levels:

Resistance: 1.3046 (high Oct 20), 1.3071 (38.2% fibo of 1.3457-1.2832), 1.3080 (high Oct 13)

Support: 1.2900 (psychological level), 1.2852 (low Oct 16), 1.2831 (low Oct 15)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.