GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: (Full Content - VIP Subscription Only)

GBP/USD: long at 1.5275, target 1.5440, profit locked in at 1.5290, risk factor *

USD/CAD: short 1.3080, target 1.2730, profit locked in at 1.3070, risk factor **

AUD/USD: (Full Content - VIP Subscription Only)

AUD/JPY: long at 86.80, targer 89.80, stop-loss 85.80, risk factor **

Pending Orders:

USD/JPY: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

EUR/CAD: (Full Content - VIP Subscription Only)

AUD/NZD: (Full Content - VIP Subscription Only)

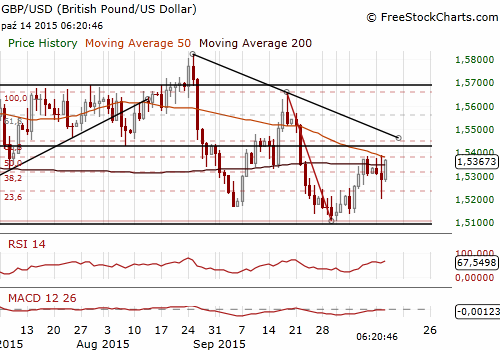

GBP/USD: Long In Good Shape After British Jobs Report

(long for 1.5440)

Britain's unemployment rate unexpectedly fell to its lowest level since mid-2008 in the three months to August. It fell to 5.4%, down from 5.5% in the three months to July and below the market forecast of 5.5%. The number of people in employment jumped by 140k, pushing the employment rate to 73.6%, the highest since records began in 1971, while those unemployed fell by 79k , the biggest fall since the three months to January.

The total earnings of workers, including bonuses, rose by 3.0%, edging up from the three months to July, but short of market expectations of 3.1%. In the month of August alone, total wages in the private sector, which are monitored closely by the Bank of England, rose by 3.5%, slowing from 4.3% in July. Excluding bonuses, average weekly earnings growth slowed slightly to 2.8% in the three months to August, down from 2.9% in the three months to July which was the strongest growth rate in over six years.

British jobs report was mixed – slightly weaker wages growth against lower-than-expected unemployment rate. The GBP/USD had fallen to 1.5285 after investors saw earnings data but it broke above the levels from before the release then.

British consumer price inflation in September dipped back below zero, according to data released on Tuesday. We used a fall in the GBP/USD after CPI data to get long. Our long is in good shape now and our target is 1.5440. The nearest resistance levels are not very strong - 1.5388 high on October 13 and psychological level of 1.5400.

Significant technical analysis' levels:

Resistance: 1.5388 (high on Oct 13), 1.5400 (psychological level), 1.5448 (61.8% fibo of 1.5659-1.5107)

Support: 1.5250 (session low Oct 14), 1.5201 (low Oct 14), 1.5141 (low Oct 6)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.