Taken Positions

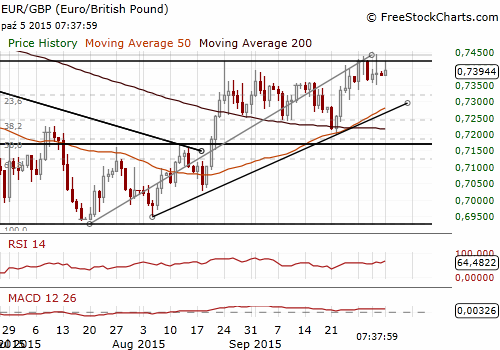

EUR/GBP: short at 0.7435, target 0.7290, profit locked in at 0.7430, risk factor *

More profitable strategies - GrowthAces VIP Subscription Only

EUR/GBP: All Eyes On BoE This Week

(short at 0.7435)

British services PMI fell for the third month in succession to 53.3, from August’s 55.6, indicating the weakest rate of growth since April 2013. PMI showed some firms reported hesitation among clients in placing new contracts, linked to global economic uncertainty. The forward-looking indicator for business expectations fell to a 13-month low in September, but still signaled solid overall growth. What is important, employment at service providers rose at a stronger rate in September.

PMI data indicate that GDP growth slowed to 0.5% in the third quarter, but that the economy is entering the fourth quarter at a pace down to just 0.3%. At the moment, sustained strong hiring in services and construction suggests that companies are generally expecting the slowdown to be short-lived.

The GBP/USD reaction to weaker US non-farm payrolls on Friday was limited, as we expected. Expectations for a Fed hike are strongly correlated to expectations for a BoE hike, so weaker US data mean later monetary tightening in the UK. The EUR/USD reaction was much stronger and as a result the EUR/GBP went up on Friday and we used this jump to go short at 0.7435.

This could be an important week for the GBP traders. On Thursday, October 8, the BoE announces its monetary policy decision and publishes the minutes of its meeting. We expect no change in policy. However, the minutes are likely to be significantly “less dovish” than the market is expecting – see our yesterday’s The Week Ahead for a rationale. Relatively hawkish minutes should support our short EUR/GBP position.

Significant technical analysis' levels:

Resistance: 0.7442 (high Oct 2), 0.7482 (high May 7), 0.7510 (high Feb 5)

Support: 0.7371 (10-dma), 0.7350 (low Oct 2), 0.7348 (38.2% of 0.7197-0.7442)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.