GROWTHACES.COM Forex Trading Strategies

Trading Positions

AUD/USD trading strategy: long at 0.7815, target 0.8020, stop-loss moved to 0.7725

Pending Orders

EUR/USD trading strategy: buy at 1.0990, if filled – target 1.1200, stop-loss 1.0890, risk factor *

GBP/USD trading strategy: buy at 1.5180, if filled - target 1.5350, stop-loss 1.5080, risk factor *

EUR/CHF trading strategy: buy at 1.0640, if filled - target 1.0990, stop-loss 1.0540, risk factor *

EUR/JPY trading strategy: buy at 131.80, if filled - target 134.00, stop-loss 130.80, risk factor **

GBP/JPY trading strategy: buy at 182.20, if filled - target 184.50, stop-loss 181.10, risk factor **

AUD/JPY trading strategy: buy at 92.55, if filled - target 94.80, stop-loss 91.40, risk factor **

EUR/USD: All Eyes On The ECB QE Details

(stop-loss reached, buy at 1.0990)

Investors are focused on the ECB meeting today. The ECB will keep rates on hold and probably lift growth forecasts to reflect a string of positive data surprises. Higher economic growth forecasts will be good news for the EUR bulls. On the other hand, the ECB could cut inflation projections as it incorporates the full effect of a dramatic oil price fall, backing its case to buy EUR 60 billion worth of bonds a month from March to spur inflation.

Anticipation of the announced QE programme has already driven euro zone borrowing costs down. Yields in Italy, Spain and Portugal dropped to record lows this week. Moreover, investors actually pay for the privilege of lending to Germany. The market is filled with uninvested cash as banks are under obligation to hold top tier assets, like government debt. There are some concerns whether the ECB will find enough bonds to buy, especially that the ECB will start its QE programme in times of stable supply at the bond market.

Fourth quarter growth beat expectations in the Euro zone. Recent sentiment indicators have improved as growth is benefiting from lower energy prices and a weaker euro. A fall in the EUR value is probably the most important channel, through which the QE has an influence on the economy. Businesses may also benefit from higher capital inflow on the equity market as a result of launching QE programme.

Chicago Federal Reserve Bank President Charles Evans, a voting member this year on the Fed's policy-setting panel, said the Fed should wait until next year before raising interest rates. He said: “Given uncomfortably low inflation and an uncertain global environment, there are few benefits and significant risks to increasing interest rates prematurely.”

Yesterday’s Fed Beige Book showed that the U.S. economy continued to expand across most regions and sectors from early January through mid-February. The Fed said wage pressures were moderate across most districts. Oil and gas producers in certain districts anticipate cuts in capital expenditures this year, in a sign of low energy prices biting the industry.

U.S. ISM Non-Manufacturing rose to 56.9 for February, a touch above January's 56.7 and the expected 56.5.

In our opinion a further significant fall of the EUR/USD is unlikely as it will make the Fed delay its interest rates hikes, which is negative for the USD. We reiterate that this-year FOMC composition is really dovish – see yesterday’s Evans’ comments. On the other hand, further depreciation of the EUR will give a boost to the Euro zone economy and will be reflected in much better macroeconomic figures, but this should lead to strengthening of the common currency.

The EUR hit a new 11-year low against the USD. The EUR/USD fell to as low as 1.1026, its lowest since September 2003. Our EUR/USD long reached the stop-loss level at 1.1090.

We are looking to get long again at 1.0990, just below the psychological level of 1.1000 that may be broken during today’s ECB Draghi’s press conference.

Significant technical analysis' levels:

Resistance: 1.1218 (high Mar 3), 1.1245 (high Feb 27), 1.1271 (10-dma)

Support: 1.1098 (low Jan 26), 1.1047 (low Sep 8, 2003), 1.1000 (psychological level)

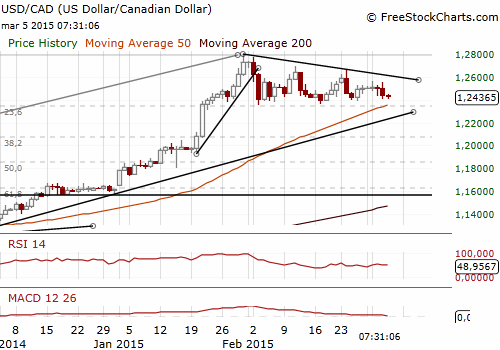

USD/CAD: No Rate Cut, In Line With Our Expectations

(profit taken, stay sideways)

The Bank of Canada kept its target for the overnight at 0.75%. The decision was in line with our expectations. The central bank signaled it was satisfied with how markets and the economy have reacted to its surprise rate cut in January. The bank said: “The risks around the inflation profile are now more balanced and financial stability risks are evolving as expected in January.” Canadian economic growth in the fourth quarter of 2014 was consistent with the central bank's expectations. In the opinion of the bank the oil price shock had a modest early impact on aggregate demand, and a larger effect on income.

Given the more optimistic tone, markets dramatically pared back bets on another cut in April to less than a 25% likelihood from 60% just before the statement. In our opinion there will be no rate cut in April.

The USD/CAD fell after the decision, as expected, but did not reach our target of 1.2380. We closed our USD/CAD short position at 1.2440 and stay sideways now.

Significant technical analysis' levels:

Resistance: 1.2500 (psychological level), 1.2543 (high Mar 3), 1.2565 (high Mar 2)

Support: 1.2433 (low Mar 3), 1.2388 (low Feb 26), 1.2360 (low Feb 17)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.