GROWTHACES.COM Forex Trading Strategies

Trading Postions

EUR/USD trading strategy: long at 1.1370, target 1.1550, stop-loss 1.1290

AUD/USD trading strategy: long at 0.7680, target 0.7900, stop-loss 0.7730

NZD/USD trading strategy: long at 0.7340, target 0.7660 stop-loss 0.7450

Pending Orders

GBP/USD trading strategy: buy at 1.5400, if filled - target 1.5580, stop-loss 1.5320, risk factor **

EUR/CHF trading strategy: buy at 1.0630, if filled - target 1.0990, stop-loss 1.0540, risk factor *

EUR/JPY trading strategy: buy at 135.05, if filled - target 137.70, stop-loss 134.20, risk factor ***

GBP/JPY trading strategy: buy at 183.00, if filled - target 186.20, stop-loss 182.00, risk factor ***

AUD/JPY trading strategy: buy at 92.30, if filled - target 94.30, stop-loss 91.60, risk factor ***

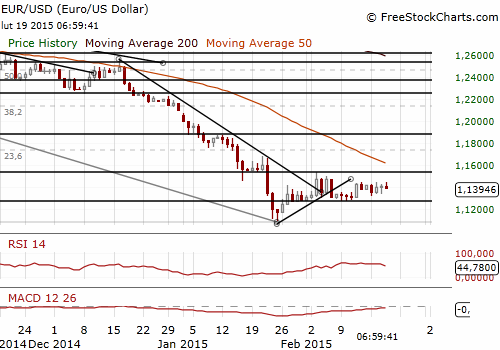

EUR/USD: Dovish FOMC Minutes, What About Greece?

(long for 1.1550)

The minutes from the Fed's January 27-28 policy-setting meeting released yesterday expressed concern last month that raising interest rates too soon may be harmful to U.S. economic recovery.

FOMC members remain cautious, worried about further growth in the labor market as well as low inflation with slow wage growth weighing on spending. The minutes showed U.S. policymakers were generally against removing the word "patient" as it could result in expectations for a rate hike sooner rather than later. Fed officials maintained in the minutes released on Wednesday that a decision on when to raise rates would remain dependent on economic data, though moving too early was cause for concern.

Though policymakers expect the recent bout of low U.S. inflation to prove transitory, they also said the different measures of expectations needed to be monitored closely.

In its January policy statement, the Fed gave a nod to turmoil in markets across the globe, saying it would take financial and international developments into account. It was the first time since January 2013 that the Fed made an overt reference to overseas economic events in its policy statement.

In our opinion FOMC minutes were much more dovish than widely expected. Let us remind that January Fed statement was interpreted rather as hawkish by the market.

Fed Governor Jerome Powell sked how the central bank plans to manage market expectations when it eventually drops the key "patient" word from its policy statement, said the Fed aims not to surprise investors.

The USD was strengthening before the release of the minutes yesterday and the EUR/USD reached a day’s low at 1.1335. We got long on the EUR/USD at 1.1370, in line with our strategy. The USD returned its gains against the EUR in the wake of the minutes.

EUR/USD investors are also focused on Greek bailout compromise proposal sent to European creditors. Greece requested a six-month extension in its rescue loan agreement without the associated budget measures. Euro zone finance ministers will meet in Brussels on Friday to discuss Greece's request for an extension of its bailout programme. A solution of the Greek debt problem will be welcomed by the EUR bulls.

Significant technical analysis' levels:

Resistance: 1.1450 (high Feb 17), 1.1486 (high Feb 6), 1.1499 (high Feb 5)

Support: 1.1351 (21-dma), 1.1335 (low Feb 18), 1.1322 (low Feb 17)

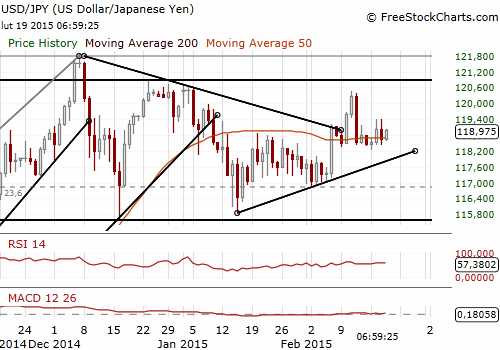

USD/JPY: Strong Exports Data Did Not Help The JPY

(stay sideways)

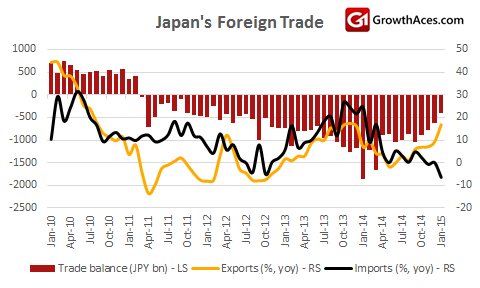

- Japan's trade deficit fell in January to JPY 1.18 trillion. Exports surged a stronger-than-expected 17% yoy to JPY 6.1 trillion, powered by strong shipments of vehicles and machinery. Imports fell 9% to JPY 7.32 trillion, with a nearly 25% drop in imports of oil and gas.

Exports to the United States rose 16.5% yoy in January, while exports to China, whose economy has been slowing, jumped nearly 21% yoy.

Japan's government upgraded its outlook for exports, but left its overall economic assessment of a moderate recovery unchanged. The Cabinet Office also raised its view of the employment situation in Japan, but said a weak consumer mindset and consumption could remain a drag on the overall economy.

Japanese Economics Minister Akira Amari said on Thursday that it will take more time for Japan's economy to escape from chronic trade deficits because of energy imports.

Japan's economy rebounded from a recession to grow an annualised 2.2% in the final quarter of last year, but the expansion was much lower than expected due to weak consumer demand.

In the monthly Tankan survey, sentiment index for manufacturers rose in February to 11 from 9 in January, led by gains in autos/transport equipment industry. On the other hand the managers complained about the lack of strength in private consumption amid the lingering effects of the tax hike as well as of the subdued external demand. The service-sector index rose to 22 from 20 in January. A positive number means optimists outnumber pessimists.

The USD/JPY fell yesterday to a day’s low of 118.55 as the USD was under pressure of dovish FOMC minutes and pared-down expectations of a June Fed rate hike. Good trade data had little impact on the exchange rate. The trade is thin today due to lunar new year holidays.

We stay sideways on the USD/JPY, but are looking to get long on the EUR/JPY and GBP/JPY pairs.

Significant technical analysis' levels:

Resistance: 119.41 (high Feb 18), 120.46 (high Feb 12), 120.48 (high Feb 11)

Support: 118.25 (low Feb 17), 118.20 (low Feb 16), 117.19 (low Feb 6)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.