Yesterday, the Fed announced that it had decided to leave the interest rates unchanged. However, this doesn’t mean that nothing changed. There was something that the Fed said that altered the outlook.

What was it? The Fed now signals two rate hikes in 2016 instead of four. Some investors even say that the Fed’s tightening cycle is over. Either way that’s a bearish piece of information for the USD Index, so yesterday’s move lower in itmay (!) be followed by a few additional daily downswings (and it appears that we are seeing one now).

In our opinion the following forex trading positions are justified - summary:

EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

GBP/USD: none

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

In today’s alert we’ll focus on the USD Index as the outlook for it is the thing that is likely to determine the key moves in individual currency pairs. Let’s start with the long-term chart.

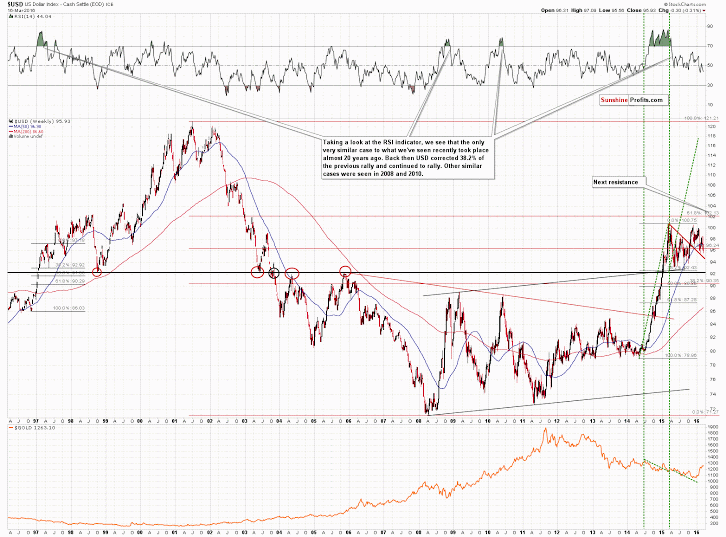

The most important thing visible on the above chart is that the USD Index is in a major uptrend, and more precisely in a consolidation within it. After breaking through the resistance of 92, the USD Index has been consolidating – and that’s perfectly natural, because the previous rally was both big and sharp.

Once the consolidation is over, the move that follows it is likely to be similar to the one that preceded it (note the green lines on the above chart) and this implies a huge rally in the coming months (likely later in 2016).

The question is when the current consolidation is going to end and the answer is based on the support levels. First of all, we don’t expect the 92 level to be broken, so even if the USD slides much lower, it doesn’t seem likely that it would result in a breakdown. Secondly, the declining, red support line is something that is likely to keep declines in check – this line is more or less being reached at the moment of writing these words.

Let’s take a look at the short-term chart.

The USD Index moved to the rising support line yesterday, but this line was broken in today’s pre-market trading, so the question is:“What is the next level that could trigger a bounce or a rally?”

The February 2016 low and the lower border of the declining trend channel are both good candidates. Since they are relatively close to each other it’s quite likely that the USD will reverse either right at one of them or somewhere in between. This is where the USD Index is right now (slightly above 95).

There is one additional important factor that should be considered here –the cyclical turning point. Yesterday’s decline took place right at it and today’s move lower is still very close to it. In almost all recent cases, the turning points in the USD Index were followed by rallies and since the most recent move was definitely to the downside it appears likely that the USD Index will move higher relatively soon (perhaps even this week).

All in all, the technical picture for the USD Index is bullish.

Now, how does the announcement regarding interest rates impact the above? The impact of all important announcements should be discussed along with discussing previous expectations. Remember when the Fed lowered rates by 0.75 and the stock market plunged? It was because people were expecting an even bigger cut. It didn’t matter that the rates were lowered dramatically – it only mattered that they were lowered less than market had expected.

What did the market expect of yesterday’s announcement? Pretty much what the Fed delivered. As we are writing in today’s Gold News Monitor, investors are expecting only one rate hike this year. Consequently, since yesterday’s comments more or less confirmed the investors’ expectations, did anything change? On a “nominal” level – yes, the Fed said something else than it had been saying previously, however, on a “real” level – how this will likely impact the markets – not much changed, if anything.

Consequently, yesterday’s news is not likely to have a major impact on the markets, including the USD Index, except for a short-term impact – and this short-term impact (based on yesterday’s and today’s declines) could already be over.

Summing up, yesterday’s comments from the Fed include changes that are likely not to have a major impact on the main trends because they were in tune with what the investors had been expecting. Consequently, the technical patterns are likely to remain the key source of signals (as the news was not a game-changer) and the outlook (based on the above) for the USD Index is bullish for the medium term and there are good reasons for the USD Index to rally shortly (being at about 95 at the moment of writing these words). If it doesn’t rally, then it could move even to 92 without major medium-term implications.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.