EURUSD – Euro/dollar weakens and forms bearish pin bar

The weekly chart of the EURUSD below shows us a clear indication that this currency pair may want to move lower this week. Notice the large pin bar reversal signal that formed last week as price made a false-break above 1.1450 key resistance. This keeps price contained within the trading range between about 1.1450 – 1.0800 and we can look to be sellers this week on a 1 hour, 4 hour or daily chart sell signal should price retrace slightly higher, in anticipation of price falling further, perhaps down to re-test support near 1.0800.

GBPUSD – Sterling/dollar false-break of key resistance

The GBPUSD also created a false break of resistance last week, and that false break was followed by a powerful move lower. Notice that price ended the week right at key support near 1.5330; if price closes under that 1.5330 level we will become more bearish and will look for selling opportunities. However, there is a small chance price may rally from this support near 1.5330, so if that happens we will remain neutral and wait for an obvious signal either long or short to set up.

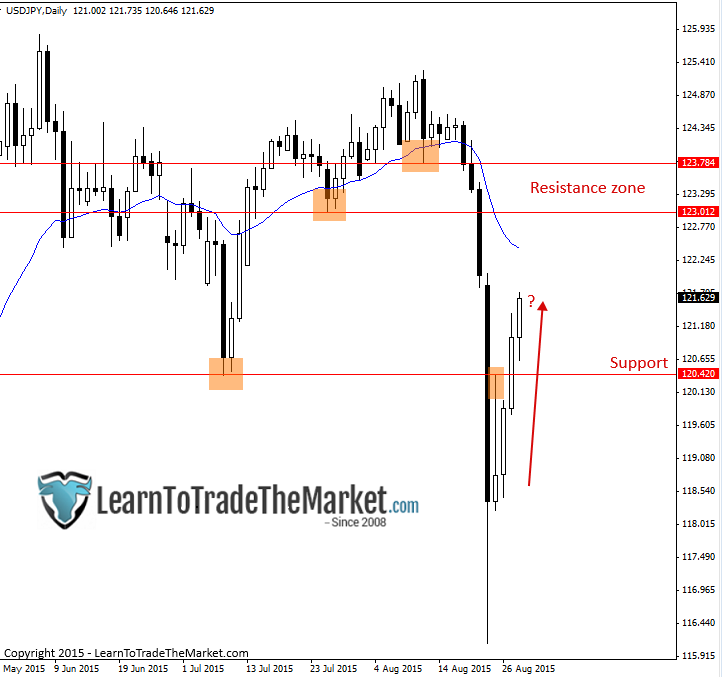

USDJPY – Dollar/yen recovers after sell-off

The USDJPY recovered quite aggressively last week following Monday’s powerful sell-off. I expect price to try and continue pushing higher from here, however, we still have a lot of resistance overhead, so be careful. Price could easily move lower again before building enough bullish momentum to resume the longer-term uptrend.

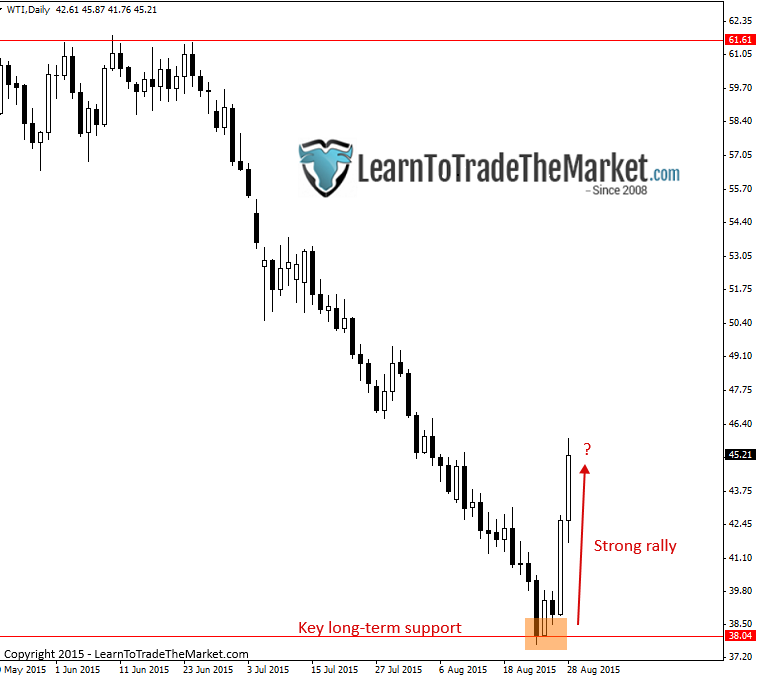

Crude Oil – Crude oil rallies significantly higher after hitting key support

Crude Oil has rallied aggressively higher after hitting key long-term support down near 38.00 last week. We are moving to a more neutral stance on this market for the time being, but if an obvious buy signal forms following a small retrace lower whilst above that 38.00 level, we will consider a long entry.

Copyright 2015 LearnToTradeTheMarket.com

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.