Analysis for May 4th, 2016

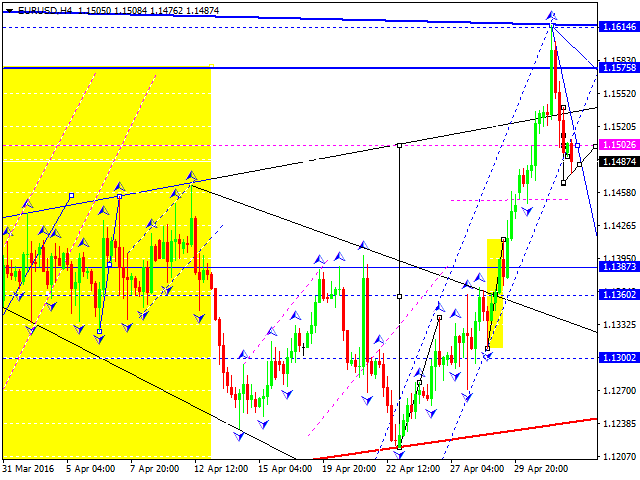

EURUSD, “Euro vs US Dollar”

Eurodollar has reached the target of its fifth ascending wave; the market has formed a new descending impulse and has broken the previous ascending channel. We think, today the price may reach 1.1466 and then test 1.1502 from below. After that, the pair may fall towards 1.1387 and then be corrected to return to 1.1500.

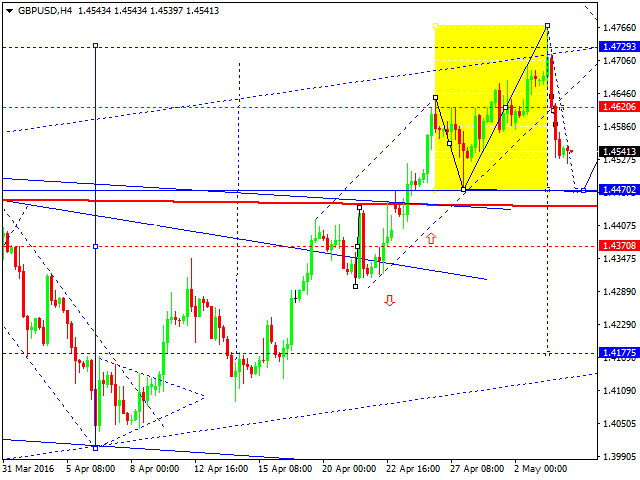

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has reached the target of its ascending wave. Today the price is moving inside the first descending wave and has already formed a continuation pattern. The downside target is at 1.4470. Later, in our opinion, the market may be corrected to return to 1.4620.

USDCHF, “US Dollar vs Swiss Franc”

Franc has reached the target of its descending wave. Today, the price is moving upwards, has already broken the previous channel at 0.9537, and may reach 0.9580. After that, the pair may test 0.9537 from above and then start growing to reach the target at 0.9650.

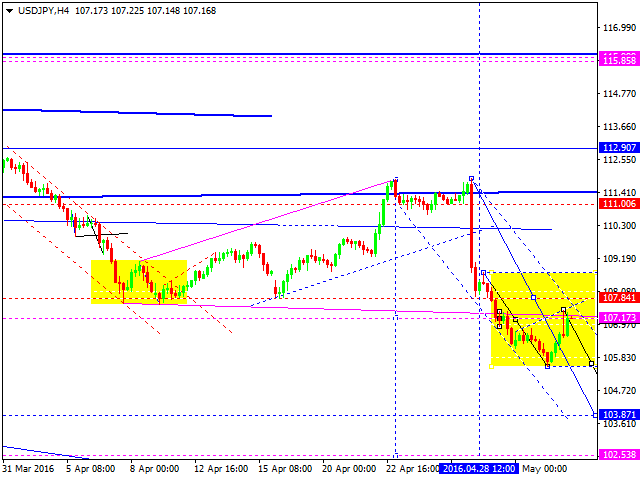

USDJPY, “US Dollar vs Japanese Yen”

Yen is still consolidating and may have formed a downside continuation pattern. We think, today the price may rebound from the pattern’s center downwards. After breaking the minimums of the consolidation range, the market may continue falling inside the downtrend to reach 104.00.

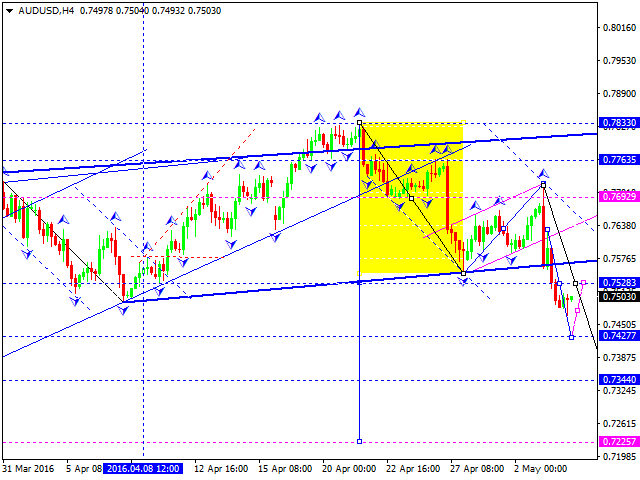

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has broken the minimum of its first descending wave and may be forming the third wave inside the downtrend. We think, today the price may reach 0.7427 and then return to 0.7530, at least. After that, the pair may continue forming the third wave with the target at 0.7344.

USDRUB, “US Dollar vs Russian Ruble”

We think today, after the market opening, Russian Ruble may return to 66.78. The main scenario implies that the pair may follow the oil market prices and start a new correction. The target of the correction is at 69.00, at least.

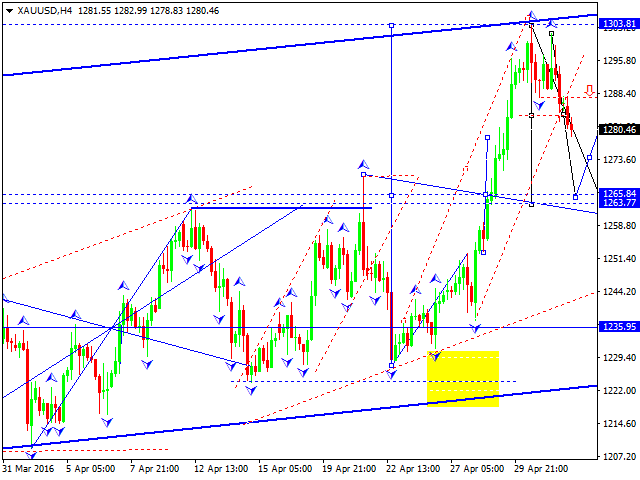

XAUUSD, “Gold vs US Dollar”

Gold is forming the third structure of the downtrend; the local target of the structure is at 1265. Later, in our opinion, the instrument may return to 1285, move downwards to reach 1265, and then start a new correction towards 1285.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.