Analysis for October 21st, 2015

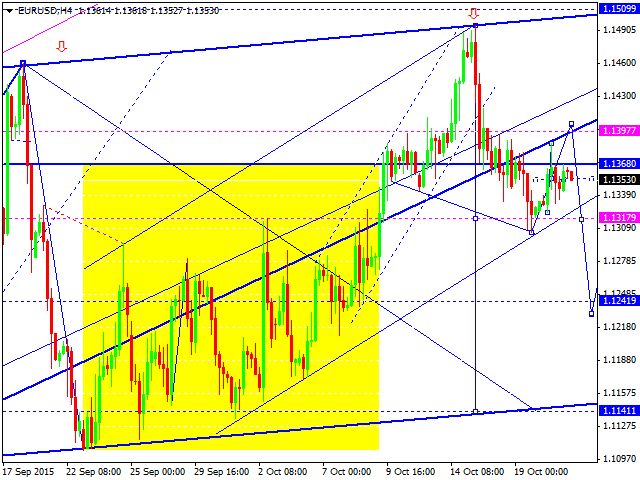

EURUSD, “Euro vs US Dollar”

Eurodollar may form the correction towards 1.1400, but this growth may be considered only as an alternative scenario. The main scenario implies that the price may fall to reach the next target at 1.1242 and then test 1.1317 from below.

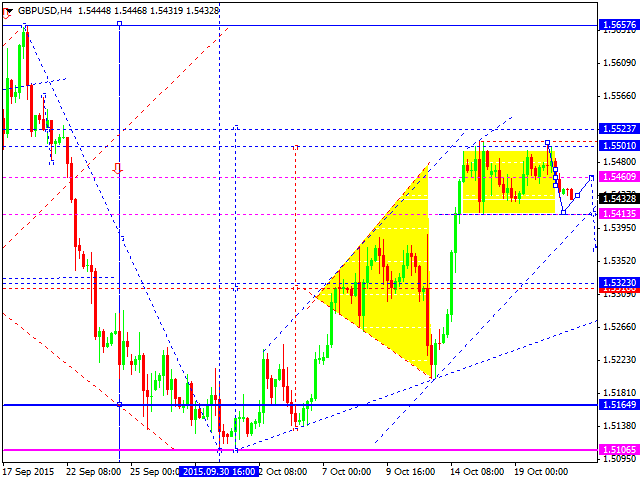

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is consolidating; the pair has fallen to reach 1.5413. After that, the instrument may return to 1.5460. If the price rebounds from this level, it may continue falling towards 1.5320.

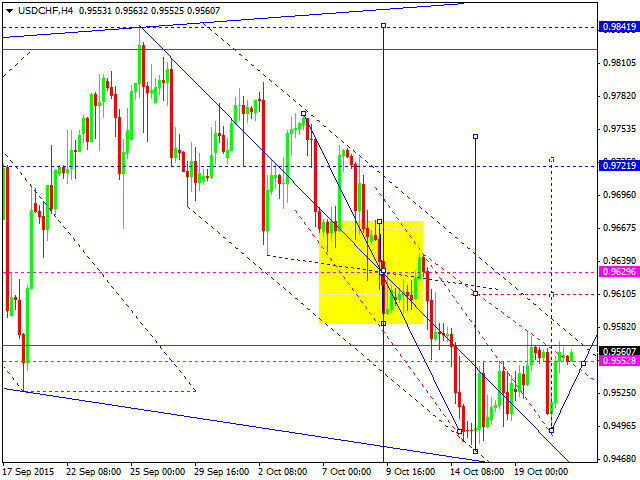

USDCHF, “US Dollar vs Swiss Franc”

Franc is moving upwards. We think, today, the price may break the descending channel. The main scenario implies that the pair may start forming another structure to reach the target at 0.9630.

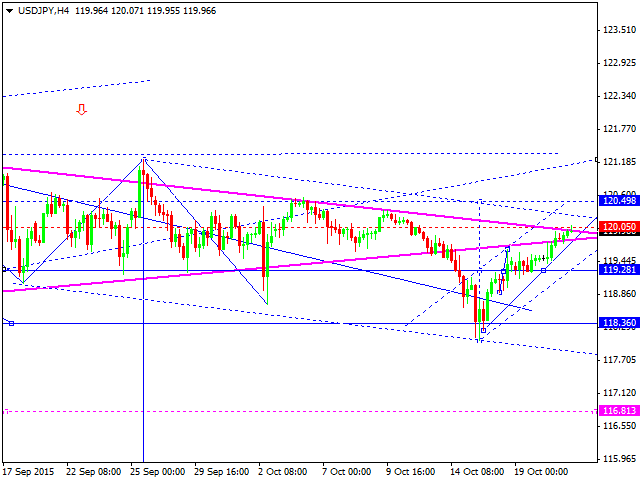

USDJPY, “US Dollar vs Japanese Yen”

Yen has tested 120.00 from below. We think, today, the price may fall towards 119.28 and then form another consolidation channel. After that, the instrument may break the channel downwards and then continue falling to reach 117.00. An alternative scenario suggests that the pair may move upwards to reach 120.50 and after that – continue falling inside the downtrend.

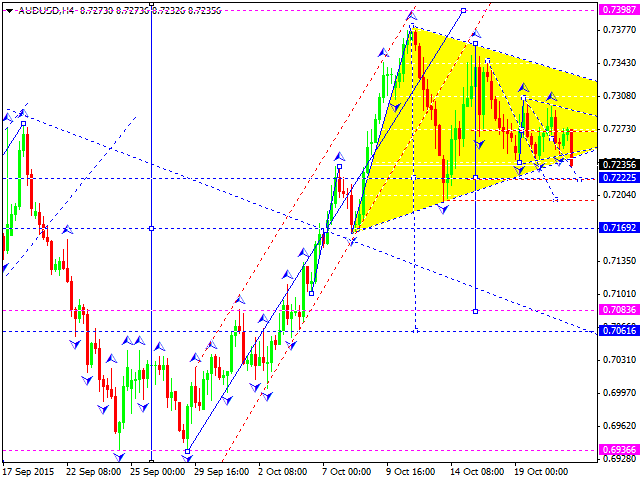

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is falling. We think, the price may be corrected towards 0.7070. After that, the instrument may start growing to reach 0.7420.

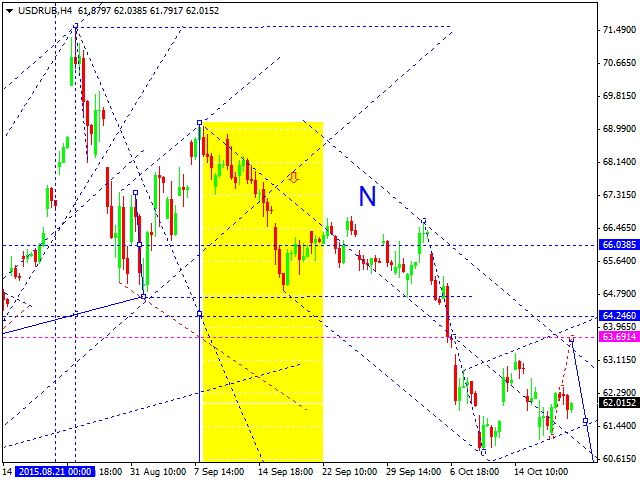

USDRUB, “US Dollar vs Russian Ruble”

Ruble is moving in the center of its consolidation channel. Considering that the oil prices are falling, the price is expected to grow towards 63.50. After that, the instrument may resume falling to reach the target at 60.00.

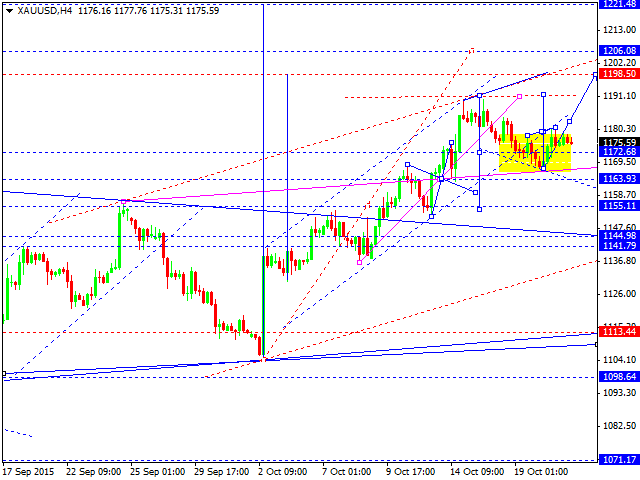

XAUUSD, “Gold vs US Dollar”

After forming the descending impulse and breaking the ascending channel, Gold is consolidating. The main scenario implies that the price may reach 1155 to test it from above. An alternative scenario suggests that the market may continue growing towards 1198.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.