Analysis for March 3rd, 2015

EURUSD, “Euro vs US Dollar”

Eurodollar is still consolidating. The main scenario for today remains the same – the price is expected to continue falling; the main target is at level of 1.1000. An alternative scenario implies that the market may try to expand this consolidation channel upwards to return to level of 1.1280 and then continue moving inside the downtrend.

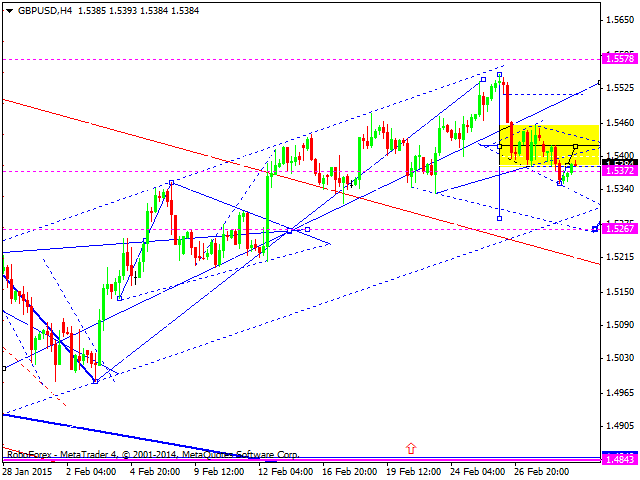

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has broken its consolidation channel downwards and may continue falling to reach level of 1.5280. After that, the pair may return to level of 1.5370.

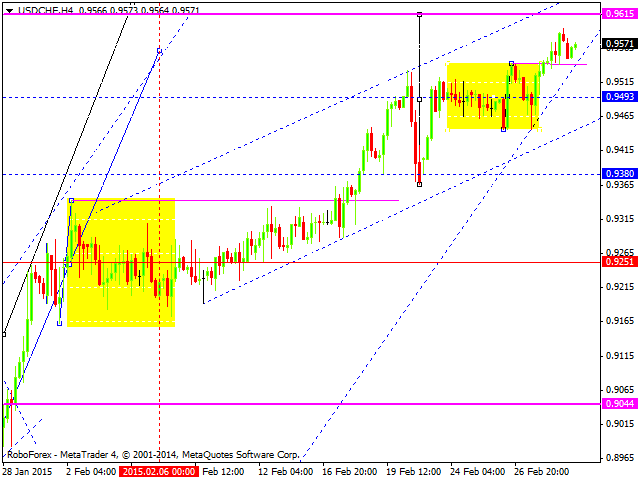

USDCHF, “US Dollar vs Swiss Franc”

Franc continues moving upwards. We think, today the price may reach level of 0.9615. One should note that this ascending movement is the result of regulator’s influence and can stop at any moment. The next downside target is at level of 0.8200; a local one – at 0.8830.

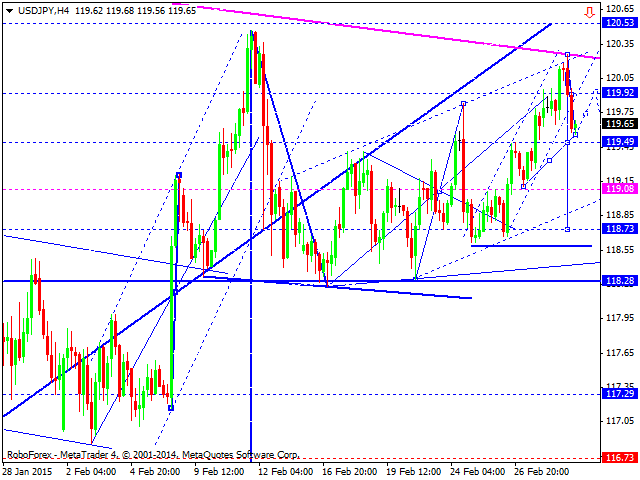

USDJPY, “US Dollar vs Japanese Yen”

Yen has finished another descending impulse. We think, today the price may start a correction towards level of 119.90. After that, the pair may fall to reach level of 118.30.

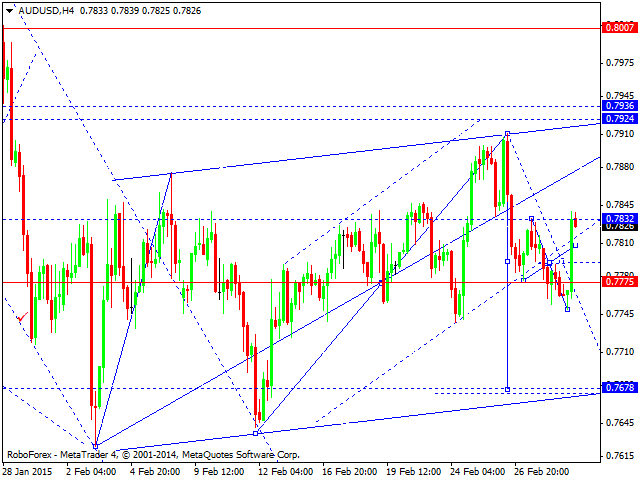

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is moving upwards and may continue up to level of 0.7925. However, the main scenario hasn’t changed – the price is expected to fall towards level of 0.7680 and then return to level of 0.7830. Thus, these fluctuations of the price may form another consolidation channel.

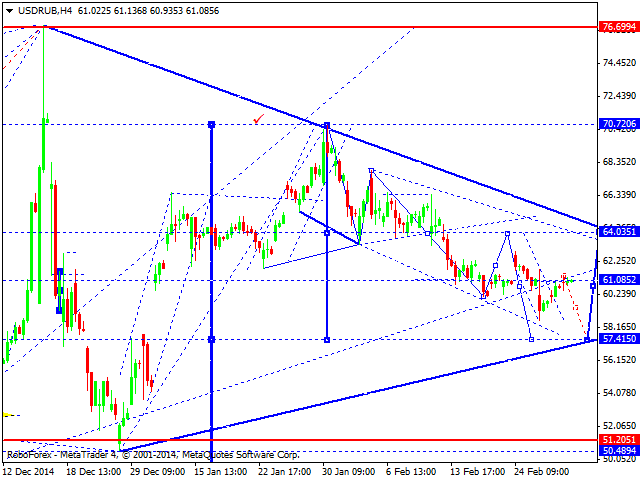

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving inside a descending structure towards level of 57.40. This movement may be considered as the first wave of another descending structure. After that, the pair may start a correction to return to level of 64.00 and then continue falling inside the downtrend.

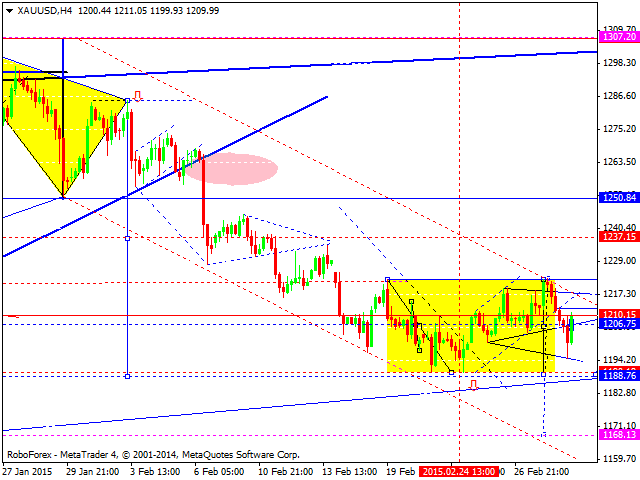

XAUUSD, “Gold vs US Dollar”

Gold is consolidating. If the price breaks this channel downwards, the downtrend may continue. The main target is at level of 1113. However, if the piece breaks the channel upwards, it may form a correction to return to level of 1250. In any case, after that the market is expected to fall towards the above-mentioned target.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.