Analysis for January 26th, 2015

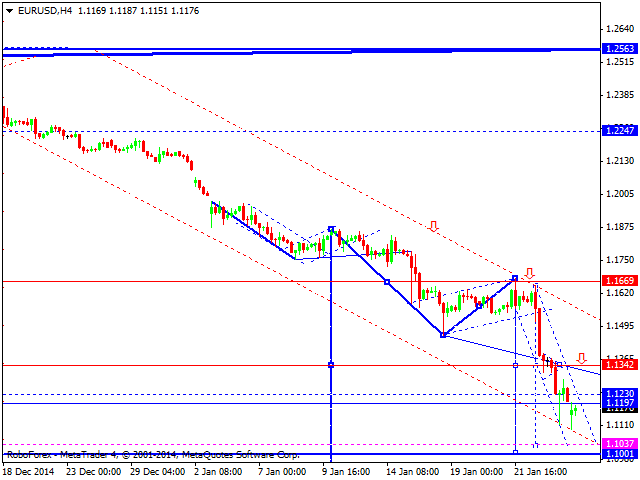

EUR USD, “Euro vs US Dollar”

As we can see at the H4 chart, the market was opened with a gap. Eurodollar has reached a new low and right now is trying to start a correctional impulse, which may reach level of 1.1300. Later, in our opinion, the price may continue moving inside the downtrend to reach the target at level of 1.1100.

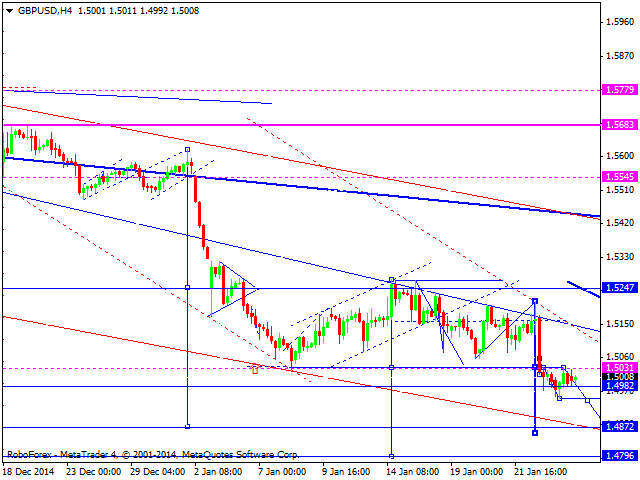

GBP USD, “Great Britain Pound vs US Dollar”

As we can see at the H4 chart, Pound is still forming a consolidation channel. Later, in our opinion, the market may continue falling to expand this channel towards level of 1.4870. After that, the pair may consolidate for a while again and then continue falling inside the downtrend. The next target is at level of 1.4800.

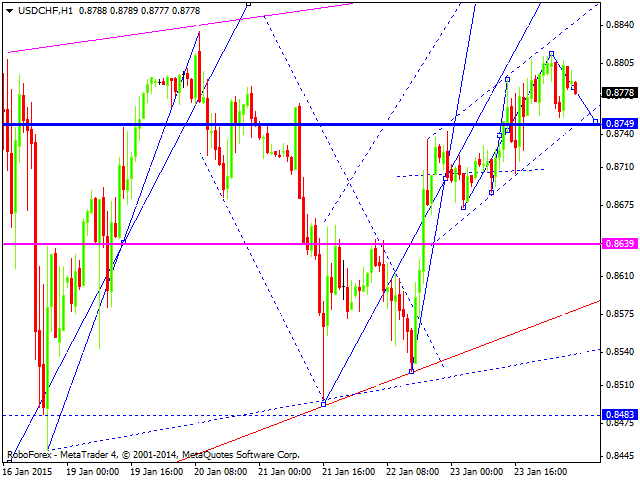

USD CHF, “US Dollar vs Swiss Franc”

As we can see at the H1 chart, Franc is growing slowly. We think, today the price may reach level of 0.8900, which may be considered as the upper border of this consolidation channel. Later, in our opinion, the market may move downwards to reach the lower border.

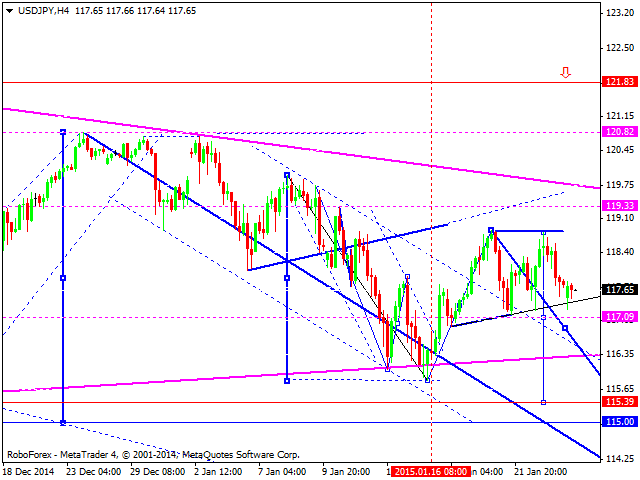

USD JPY, “US Dollar vs Japanese Yen”

As we can see at the H4 chart, Yen is still forming a consolidation channel. We think, today the price may fall to reach level of 115.00 and then return to level of 118.00. Later, in our opinion, the market may fall towards level of 115.00 again to break it downwards and then continue moving inside the downtrend.

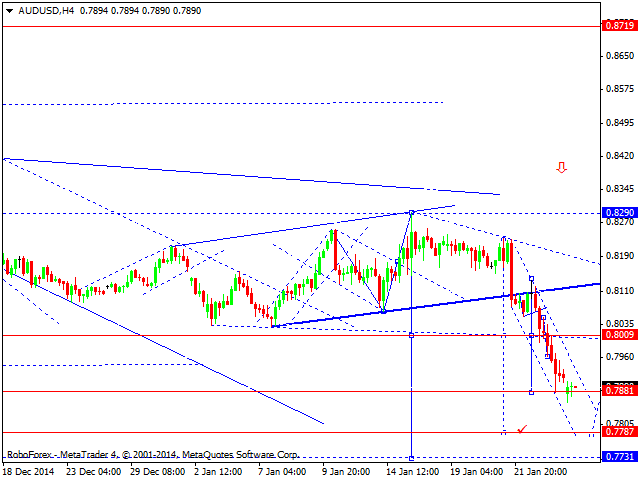

AUD USD, “Australian Dollar vs US Dollar”

As we can see at the H4 chart, the market was opened with a gap down and Australian Dollar continues forming a descending wave. We think, today the price may reach the next target at level of 0.7787. An alternative scenario implies that the pair may return to level of 0.8000 and then continue falling inside the downtrend.

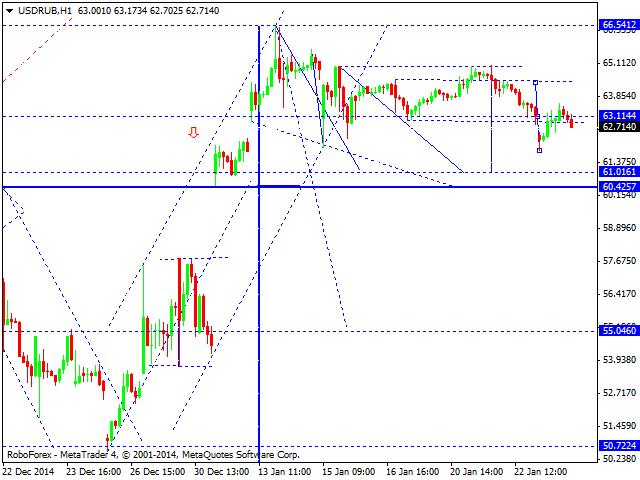

USD RUB, “US Dollar vs Russian Ruble”

As we can see at the H1 chart, Ruble has rebounded from the lower border of its consolidation channel and right now is trying to return to the upper one. We think, today the price may continue falling to break the lower border and reach the first target at level of 55.00.

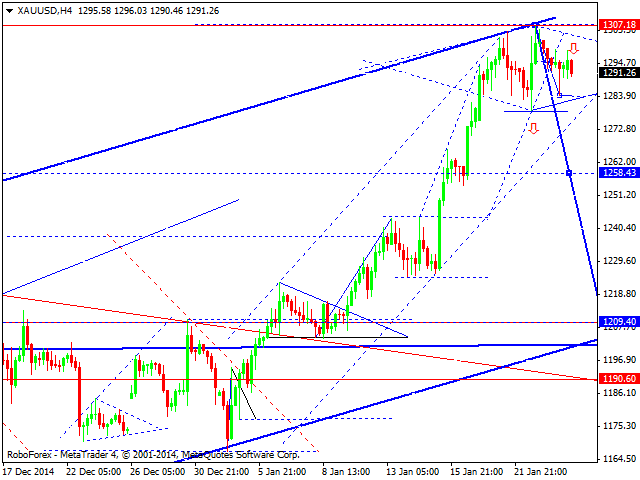

XAU USD, “Gold vs US Dollar”

As we can see at the H4 chart, Gold is moving downwards. We think, today the price may break its consolidation channel downwards and start forming the fifth descending wave. The first downside target is at level of 1209.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.