Analysis for August 01st, 2014

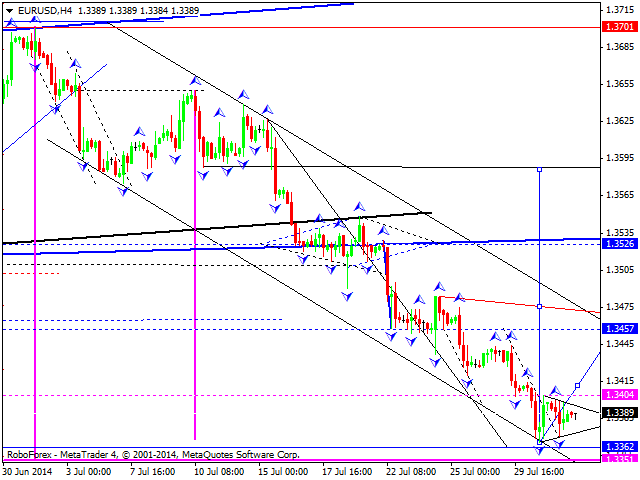

EUR USD, “Euro vs US Dollar”

EURUSD is probably building a consolidation around recent lows. I assume that this structure can be the part of reversal pattern. As basic scenario for today, I will expect retracement to 1.3590. As an alternative, price can first renew low, and rise only after that.

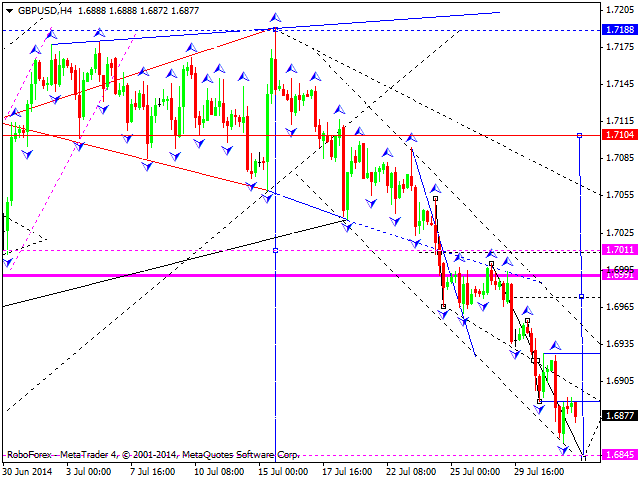

GBP USD, "British pound vs US Dollar"

GBPUSD is continuting to move inside descending channel. For today, I expect that 1.6845 might be violated. After that, I will look for possible consolidation with further reversal structure and continuation of the uptrend.

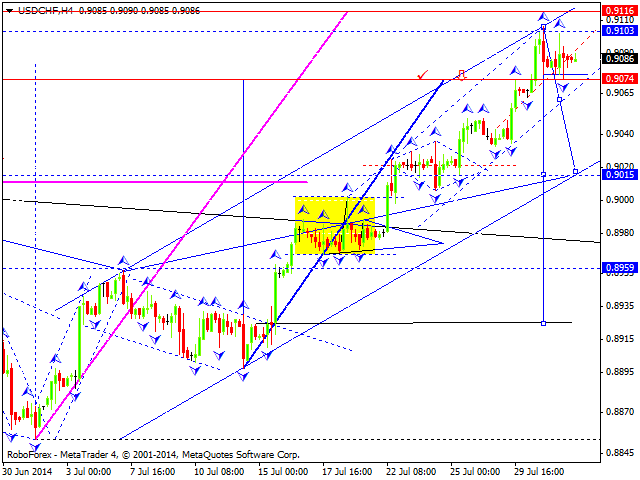

USD CHF, "US Dollar vs Swiss Franc"

USDCHF is building consolidation. I expect that it might be the part of possible reversal structure. As a basic scenario, I will expect descending wave to 0.8930. I will not exclude that price might renew highs first, and decline only after that.

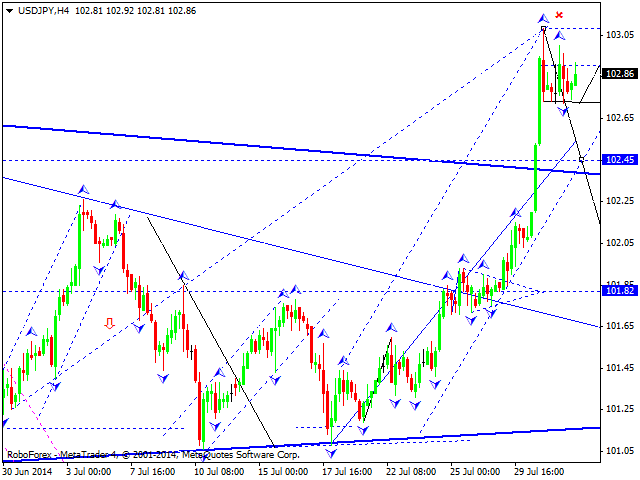

USD JPY, "US Dollar vs Japanese Yen"

USDCHF continues to consolidate on the top of the ascending wave. I assume that it can be the part of reversal structure. As a basic scenario, I will expect ascending wave with 101.70 as a target and continuation of descending impulse with target of 99.30.

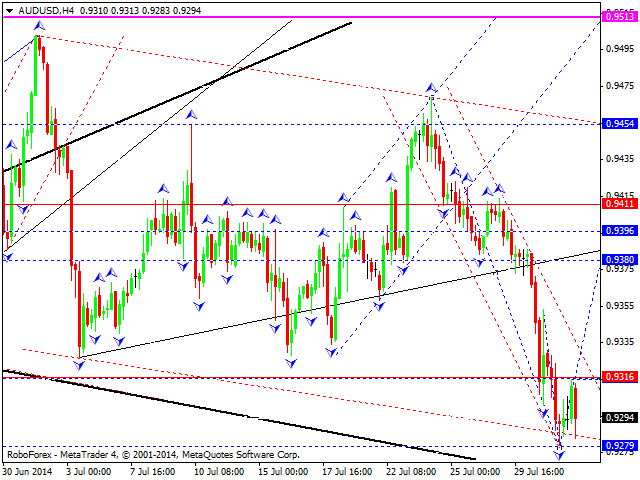

AUD USD, "Australian dollar vs US dollar"

AUDUSD continues to move within descending structure. Potential of this wave can be already exhausted. For today, I expect that consolidation will be continued, but might be extended to the upside with possible further ascending wave with 0.9510 as a target.

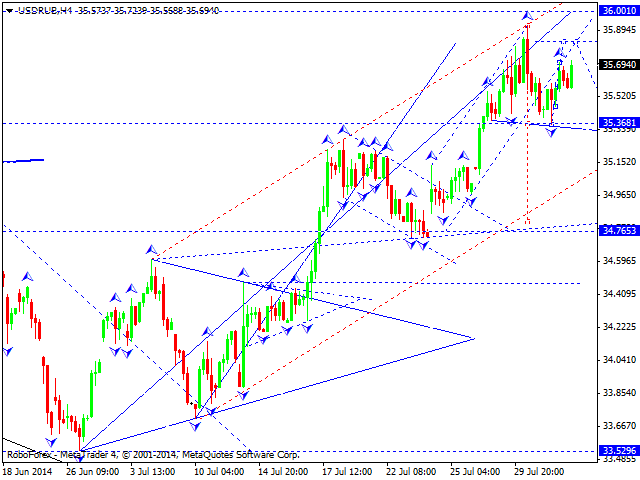

USD RUB, "US Dollar vs Russian Rouble"

Russian rouble is probably continuing to move in ascending structure. For today, I assume that 35.81 might be achieved. After that, I will expect that descending impulse might resumed with 34.70 as a target.

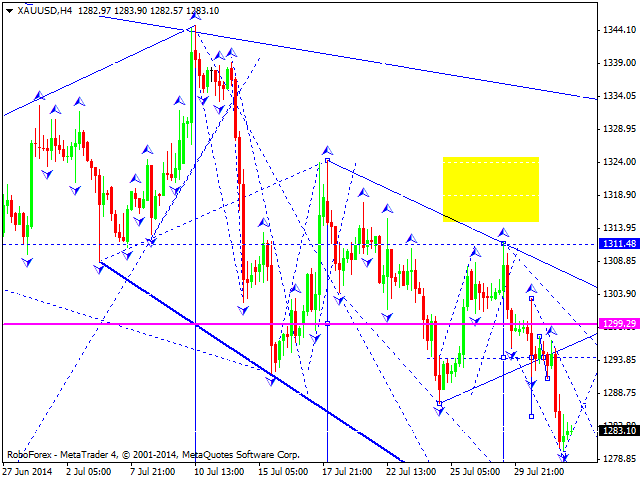

XAU USD, "Gold vs US Dollar"

Gold continues to move within descending structure. I expect consolidation around recent levels with further breakout to the downside and achieving 1275. After that I will expect that price can retrace to 1300.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.