Analysis for April 1st, 2014

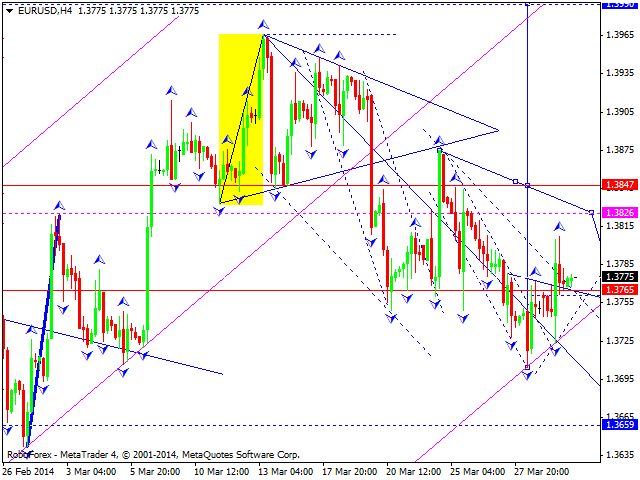

EUR USD, “Euro vs US Dollar”

Euro completed the third ascending impulse. We think, today price may form the fifth structure of this wave with target at 1.3826 and then start falling down towards level of 1.3765. Later, in our opinion, instrument may start new ascending wave towards level of 1.3990.

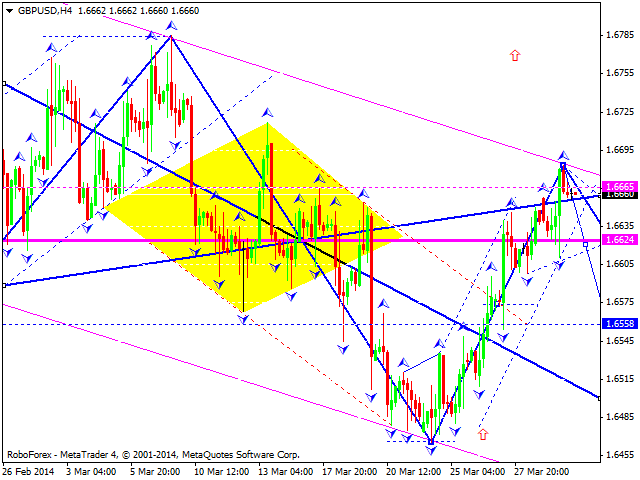

GBP USD, “Great Britain Pound vs US Dollar”

Pound reached new maximum and is still moving upwards. We think, today price may form consolidation channel and reversal pattern to start new descending wave with target at level of 1.6558.

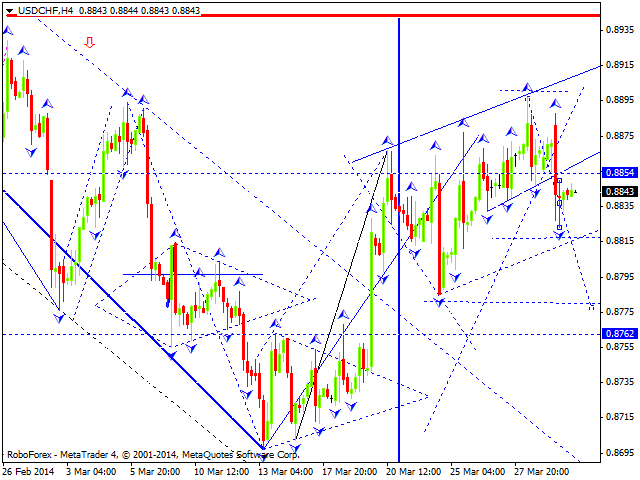

USD CHF, “US Dollar vs Swiss Franc”

Franc completed another descending impulse and right now is consolidating near its minimum; this consolidation may be considered as the third wave. We think, today price may continue moving downwards to reach target at level of 0.8780.

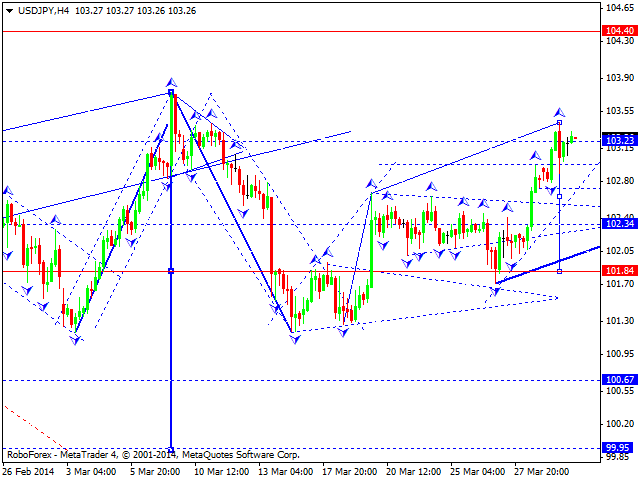

USD JPY, “US Dollar vs Japanese Yen”

Yen rebounded from the upper border of its consolidation channel and may renew maximum of current wave. We think, today price may form reversal pattern to start new descending movement towards level of 100.00.

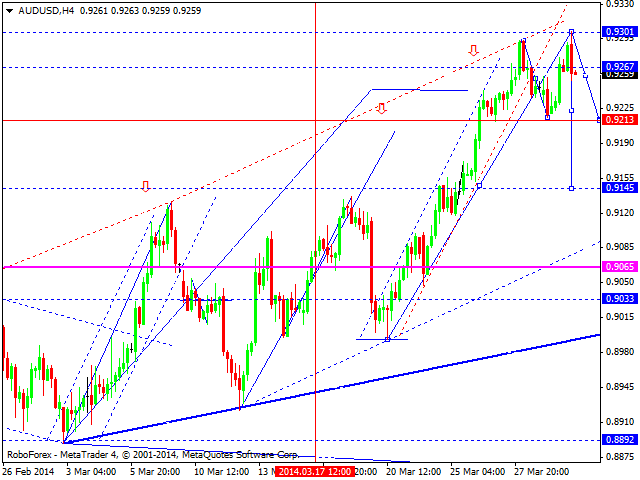

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar formed another descending impulse. We think, today price may consolidate for a while and then form reversal pattern to start new descending movement towards level of 0.9200. Later, in our opinion, instrument may continue falling down to reach level of 0.9150.

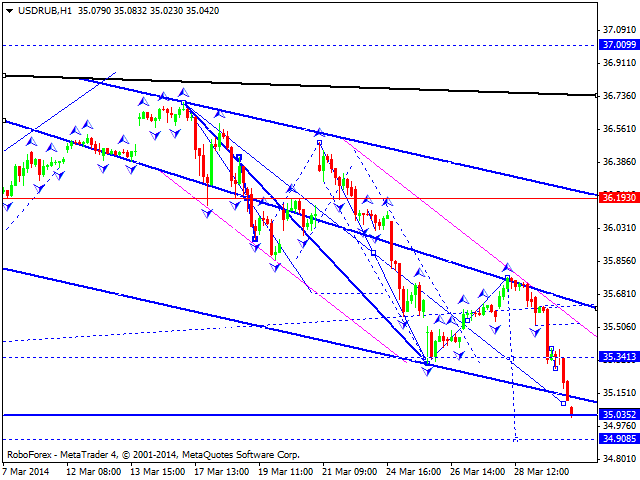

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still forming descending structure. We think, today price may reach level of 34.90 and then return to 36.20. Later, in our opinion, instrument may start new descending wave.

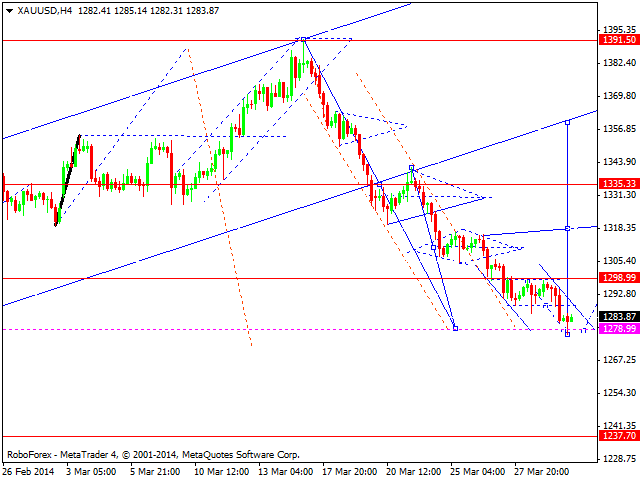

XAU USD, “Gold vs US Dollar”

Gold reached target of its descending movement. We think, today price may consolidate for a while, form reversal pattern, and start forming new ascending wave. Target is at level of 1435.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.