The global meat prices reached the local low early in June 2015. Since then the beef lost 30% while pork became 16% cheaper. Does this mean the price disparity between the meat prices? Let’s study the personal composite instrument (PCI) chart of Fcattle/Lhog to look into the matter.

The global pork production will amount to 25.03bn pounds, while beef to 24.58bn pounds in 2016, according to the latest February USDA report “World Agricultural Supply and Demand Estimates”. In 2014 22.84bn of pork and 24.25bn of beef were produced. USDA expects the global pork production to increase with steading beef output. If the beef prices outpace those of pork or decline less, the PCI will grow.

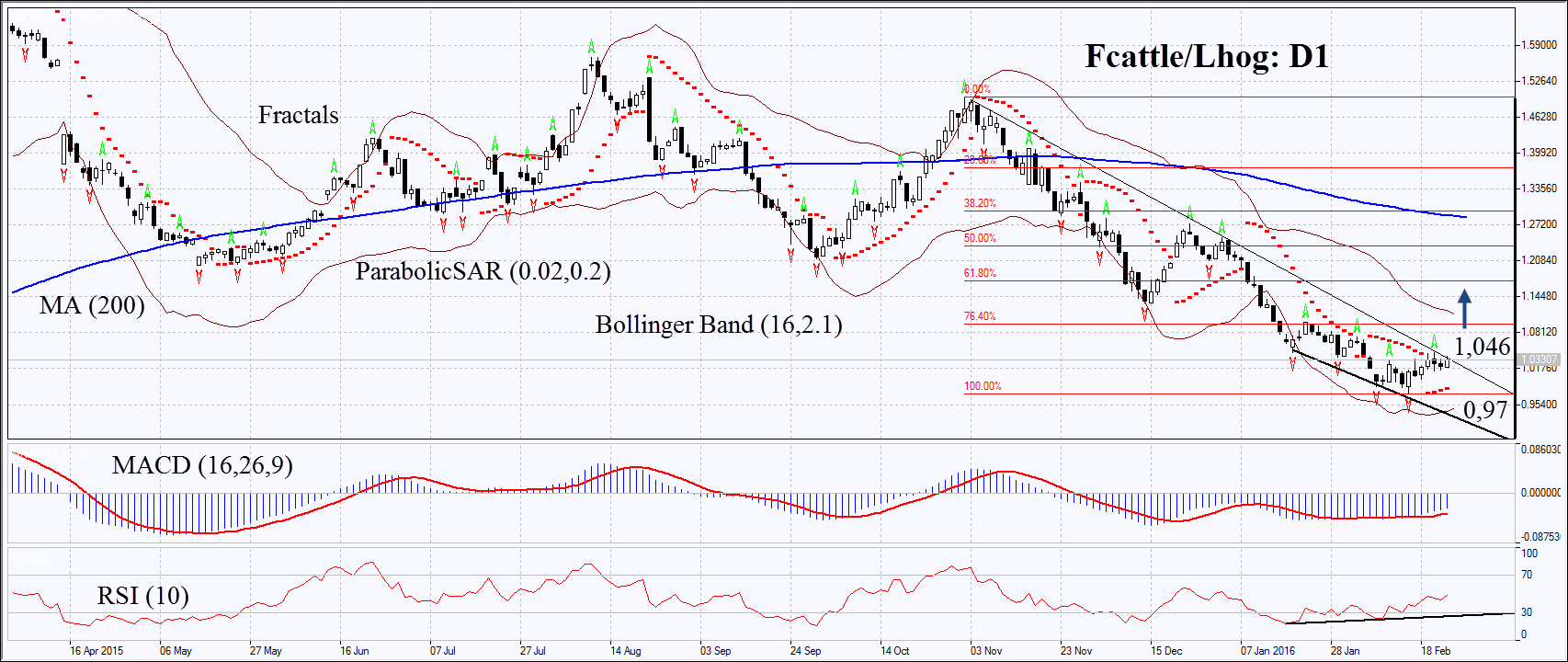

On the daily chart Fcattle/Lhog: D1 is correcting upwards from the year low and has verged the resistance of the downtrend. The Parabolic and MACD indicators have formed the signals to buy. RSI is tilted upwards but has not yet surpassed the level of 50. It has formed the positive divergence. The Bollinger bands are contracting which means lower volatility. The bullish momentum may develop in case the personal composite instrument surpasses the last fractal high and the resistance of the downtrend at 1.046. This level may serve the point of entry. The initial risk-limit may be placed below the last fractal low at 0.97. Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 0.97 without reaching the order at 1.046, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position BuyBuy stop above 1.046

Stop loss below 0.97

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.