US oil reserves growth

Let us consider the WTI CFD. In theNetTradeX trading platform it is marked as OIL. On Wednesday Energy InformationAdministration reported that crude oil reserves increased last week by 2.4mlnbarrels. It happened for the first time since this April. For this reason WTIfutures dropped 3% to its 2-week low. We do not exclude the further bearish movement,which can be driven by a number of factors. The dollar is strengthening aheadof the probable Greek default and the weak euro. The sanctions against Iran aregoing to be lifted, so the oil export from the country may rise 60% within ayear. Meanwhile, the production may increase from 2.8mln to 3.6mln barrels perday. The overall oil extraction by OPEC countries in July grew to its 3-yearstrongest – 31.6mln barrels daily.

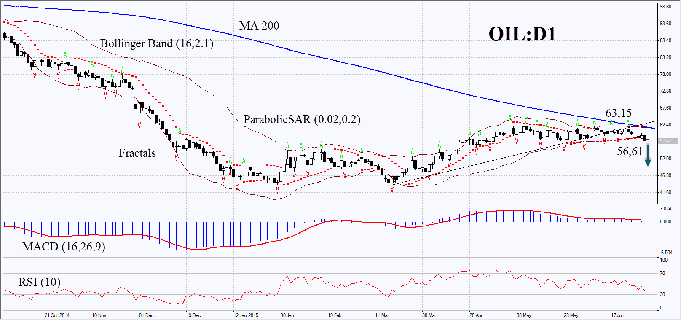

On the daily time frame the OIL futuresdid not manage to cross the 200-day Moving Average upwards. Last week itbreached the support line of the uptrend, which had been in effect for over 2months. The Parabolic indicator shaped a sell signal. Bollinger Bands narrowed,probably indicating low volatility. They have a negative slope as well. Thelatest daily bar has gone below the indicator's lower boundary. MACD has beengiving a rather weak sell signal, since its bars are too close to the zerolevel. RSI has been descending but has not yet reached the oversold zone. Thebearish momentum may continue, when the latest OIL bar closes under the fractallow at 56.61. A stop loss may be placed at 62.21 mark, supported by the latestParabolic signal, Bollinger Bands, the 200-day Moving Average and the fractal.It can also be set above the latest local low at 63.15. After pending orderplacing, the stop loss is supposed to be moved every four hours near the nextfractal high, following Parabolic and Bollinger signals. Thus, we are changingthe probable profit/loss ratio to the breakeven point. The most cautioustraders are recommended to switch to the H4 time frame and place a stop loss,moving it after the trend. If the price reaches the stop level withouttriggering the order we recommend to cancel the position: the market sustainsinternal changes that were not considered.

Position

Sell

Sell stop

below 56.61

Stop loss

above 62.21 or 63.15

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.