Good afternoon, dear investors. Today we consider the example of unbalanced spread trading, a trading method effectively used within Personal Composite Instruments - PCI Technology. The basis of this method is the expression of the underlying asset in units of the quoted one, provided that both assets have a negative relation: the underlying asset price growth causes the price drop of the quoted asset and vice versa.

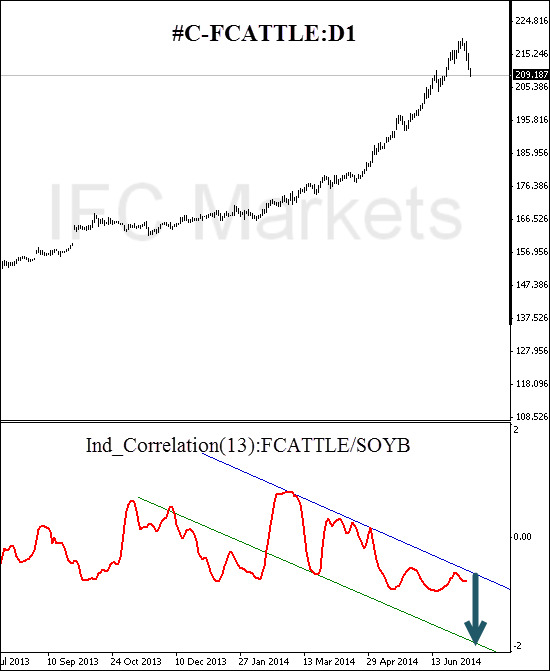

Today as such assets we consider the frozen beef and soybean commodity futures: #C-FCATTLE, #C-SOYB. It is quite natural to assume that soy is a cheap filler and a meat product substitute, and under certain conditions we can observe the demand substitution effect. Most apparently this effect appears at the vegetarian lifestyle macro trend expansion, or a drop in personal income. An opposite situation is possible to happen: the meat consumption growth in Asian countries (European influence) eventually leads to a drop in soy demand and increased meat demand, including beef. One of these trends immediately results in #C-FCATTLE and #C-SOYB reverse relation boost.

We draw your attention to the fact that since the reverse spread beginning (April 30) #C-FCATTLE futures price has increased by 15% while the PCI price of #C-FCATTLE/#C-SOYB rose by 57%. The reverse spread use multiplied 4 times the yield growth. At the same time we are safe from systematic risks such as falling food demand. We are interested only in the relative movement. The synthetic instrument allows hedging the order, while providing the instrument persistence, i.e. its trend behavior.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.