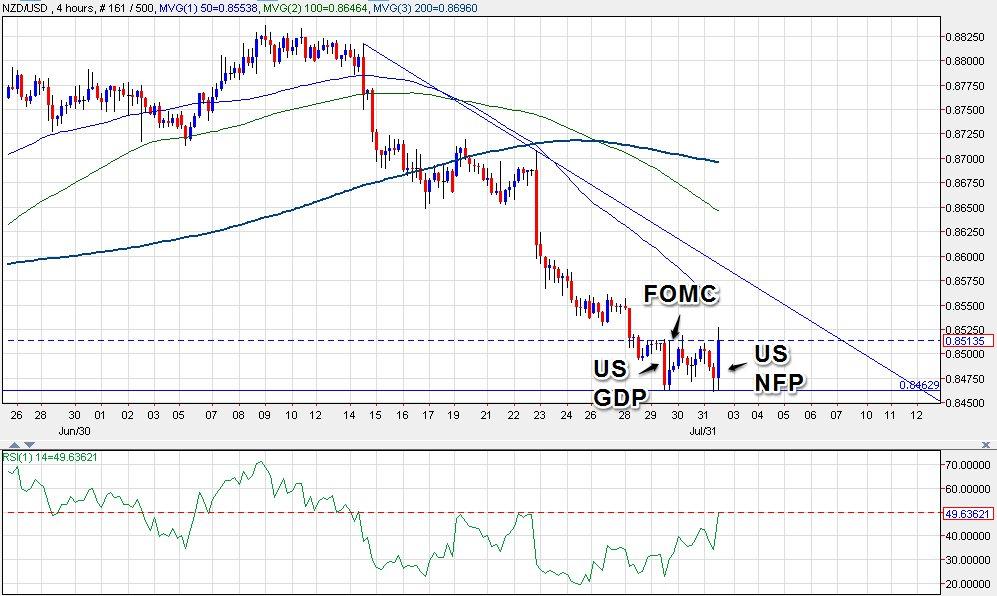

The NZD/USD is forming a mini-price bottom (double bottom) in the 4H chart. This is after a week of key US data, which collectively failed to impress, though they were decent. The lack of fundamental fuel opens up room for some USD-consolidation. In the NZD/USD, this means upside toward the 0.8575-0.86 area in the upcoming week. But before of the prevailing downtrend, we should keep the bullish outlook to the short-term.

NZD/USD 4H Chart:

Reward to Risk Assessment:

Price action in the 4H chart formed a double bottom this week, Now, if there is a pullback, we should consider going long around 0.85. Give it some elbow space, and let's say we put a long entry at 0.8490. A stop low just below this week's low can be around 0.8455. The target should be limited for now to, let's be conservative and say, 0.8575. This offers a reward to risk of 85 to 35, which is about a 2.4:1 ratio. If the entry is at 0.85, the R:R would be 75:45, which is 1.6:1.

The barely decent reward to risk ratio and the prevailing bearish trend suggests we should indeed wait for a pullback to dip below 0.85 before the long entry. However, if the pullback is fast and quickly dips below 0.8480, we should look for another low before considering any bullish trade idea.

We should probably monitor the 1H chart for the entry:

NZD/USD 1H Chart:

Look for the pullback to come back to 0.8490, where we have the 50-hour SMA and a previous support pivot. Also look for the 1H RSI to dip to 40, and hold. If it can do that and start turning back up, price should also be respecting this week's double bottom, and should be helping the bullish outlook gain confidence.

Trade Safe, Trade Well!- Fan Yang

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.