Treasury benchmark yields are on course to set a new all-time low in March if they keep rallying at the current pace.

Ten-year yields dropped almost 40 basis points during the past three weeks to 1.66 percent. The record low of 1.379 percent was set in July 2012. Plunging stock prices are driving demand for the relative safety of government debt, while traders abandon bets for the Federal Reserve to raise interest rates. Yields near zero in Japan and Germany are boosting the allure of U.S. Treasuries.

“We’ll see a record low around 1 percent” for the benchmark, said Toshifumi Sugimoto, chief investment officer at Capital Asset Management in Tokyo. “We’ll see more money going into U.S. Treasuries.” Sugimoto, who has 30 years of experience in fixed income, said he’s buying long-term securities and predicts the rally will last through April.

The 10-year Treasury yield was little changed Friday as of 10:20 a.m. in Tokyo, according to Bloomberg Bond Trader data. The price of the 1.625 percent security due in February 2026 was 99 22/32.

The Bloomberg U.S. Treasury Bond Index has returned 3.6 percent this year, while the MSCI All Country World Index of shares has slumped 12 percent.

The odds the Fed will follow its December rate increase with another in 2016 have dropped to 11 percent, from a probability of 93 percent at the start of the year, futures contracts indicate.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

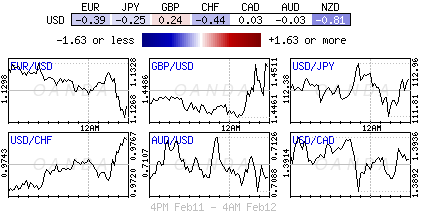

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.