People’s Bank of China (PBoC plans to relax rules of withdraw of QFII funds

PBOC also to loosen rules on when QFII funds enter the country

China’s central bank plans to loosen rules on when foreign investors can bring money in and out of the country, according to people with direct knowledge of the matter.

The rule changes would apply to funds under the Qualified Foreign Institutional Investor scheme, which grants quotas for money brought into China for investment in domestic stocks and bonds, said the people, who asked not to be identified as the plans have yet to be announced. Lock-up periods for the withdrawal of QFII funds from China would be relaxed and institutions would also be given more latitude over when they can bring money into the country, they said.

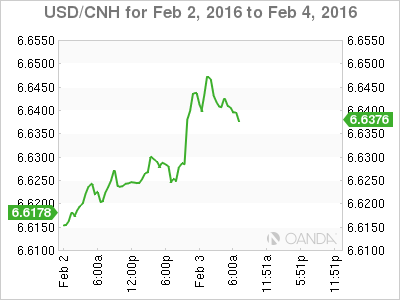

Such changes would suggest that turmoil in China’s stock market and the yuan’s exchange rate haven’t derailed plans by the People’s Bank of China to further open the nation’s capital account. The people who spoke about the plans to loosen controls on QFII funds described them as part of China’s efforts to further open its capital markets.

Under the planned changes, QFII funds would be allowed to withdraw money from China on a daily basis, one of the people said. They are currently subject to lock-ups of either one week or one month, depending on the type of quota.

Institutions would also be allowed to bring in portions of their QFII quotas at different times, the person said. They are currently given specific QFII quotas and only allowed to bring in an amount equal to that quota in a single transaction.

These changes would bring rules for the QFII scheme in line with those for the Renminbi Qualified Foreign Institutional Investor scheme, which allows institutions to raise yuan overseas for investment in China, one person said. Announcement of the changes is pending final approval of the plan by senior Chinese leaders, they said.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.