- Rate hike dependant on data not the calendar

- Normalization process has begun

- Short term rate and funds rate is part of normalization

What seems to be a trend after Bank of Canada governor Stephen Poloz gave a speech yesterday that read like central Banking 101 the Chair of the US Federal Reserve Janet Yellen stressed that the twin mandates of the central bank are full employment and inflation. Market watchers are well aware of how monetary policy works under normal conditions. Chair Yellen and her team want to communicate that the Fed is ready to get back to “normal” after the events of the crisis and the aftermath of the recession.

Chair Yellen stated that the effects of the credit crisis still impact US growth. The Federal Funds rate will probably reach what the Fed members consider normal by the end of 2017.

Those hikes are contingent on economic outlook. Positive growth can accelerate the pace of hikes to reach normal levels, while disappointing economic figures could put a hold the process.

Fed’s Balance Sheet

It is the intention of the Fed to reduce holdings in a gradual and transparent manner. The Fed’s balance sheet needs to come down. No Asset Backed Securities are part of normalization at the moment. Timing and size will be communicated as part of the process. The goal of the Fed is to hold treasuries needed to maintain monetary policy.

The question and answer period with Chair Yellen 30 minutes after the FOMC statement gave some insight into the Fed’s thinking. Yellen spoke about the use of “considerable time” as again it was deemed appropriate to communicate the timing of the rate hikes.

Considerable Time

Chair Yellen wants it to be understood that this is not calendar based guidance. There cannot be a mechanical interpretation to the phrase as the Federal Reserve wants to maintain the flexibility to adjust their policy as needed, and not be bound by their own statements that might not be appropriate to the situation at hand as new data or situations appear.

Unemployment

The slow pace of wage increases relates to unemployment slack. This is the aftermath of the financial crisis. The economy faced headwinds in recovery. Growth has been positive, but it is slow relative to non-crisis periods. Unemployment rate is still significantly above normal in the long run.

Dissents

Vice Chair Fisher and President Plosser were the two dissenters on current policy. Yellen addressed their dissent as natural when asked about it. They both have been clear that they expect a faster schedule for rate hikes. The Fed Chair believes is it normal to have a range of opinions that they have communicated with clarity.

The Fed Chair declined to comment on Scottish elections.

Yellen’s forecast

Given the rise of the dot plots as part of the Fed’s tool kit it was interesting to hear Chair Yellen’s answer to the question about her own forecast of rates. She said it is not the policy of the central bank to disclose the individual forecasts. This is currently under review by the Communication Committee headed by Vice Chair Fisher.

Volatility

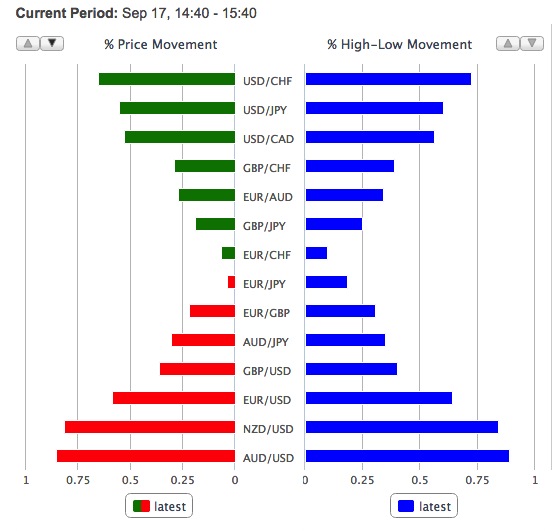

In a week that had Chinese growth outlook reduced as well as other major economies the market was focusing on the Fed for guidance. The Fed while maintaining the current language did increase the rate forecasts at the end of 2015. That move boosted the USD against all majors. The Scottish independence vote is next in the radar and the uncertainty around the outcome is also keeping the dollar bid.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.