Analysis for April 1st, 2016

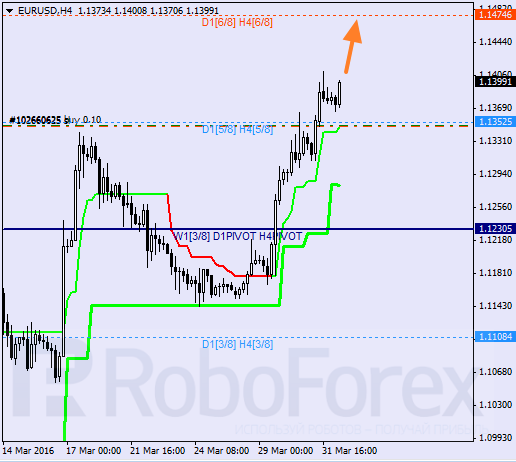

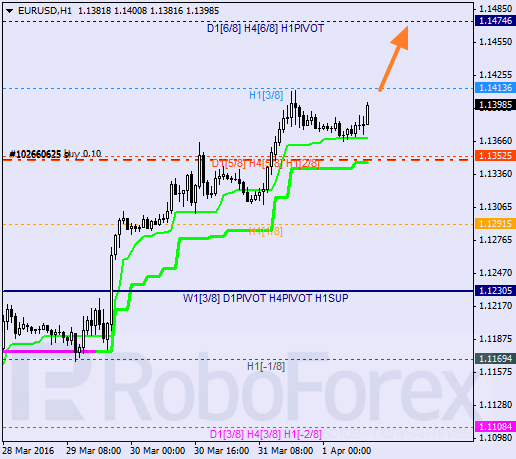

EUR USD, “Euro vs US Dollar”

Eurodollar has been able to stay above the 5/8 level, which means that the pair may continue moving upwards. Bulls are supported by the H4 Super Trend. On Friday, the market may grow to reach the 6/8 level. If the price rebounds from this level, it may start a new correction.

At the H1 chart, the price has rebounded from the H1 Super Trend, which earlier provided support to the current growth. The closest target for bulls is the 8/8 level. In the price rebounds from this level, I’m planning to close my order.

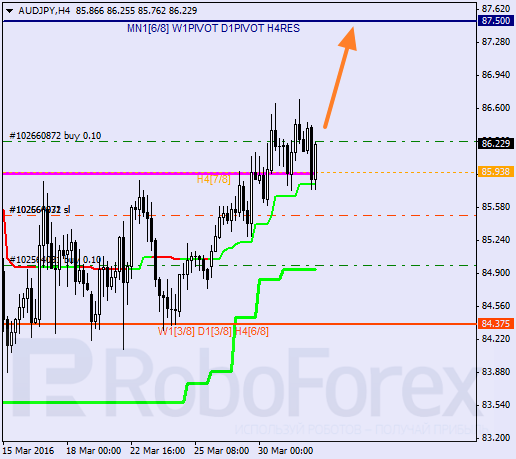

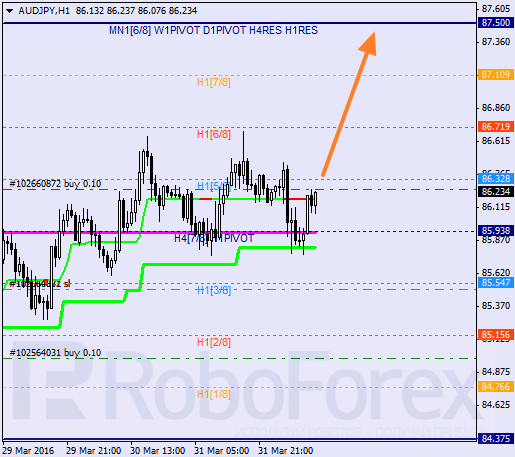

AUD JPY, “Australian Dollar vs Japanese Yen”

The pair has rebounded from the H4 and weekly Super Trends and the 7/8 level. Consequently, in the nearest future the market may grow to reach the 8/8 level. If the price rebounds this level, the pair will start a new descending correction.

At the H1 chart, the pair is moving in the middle. Taking into account that the price has already rebounded from the 4/8 level twice, the pair may move upwards a bit. If the market is able to keep the price above the 5/8 level, it will continue growing towards the closest target at the 8/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The Fed’s Bostic, Barr, Waller, Jefferson, and Mester are set to speak on Monday.

EUR/USD: Could FOMC Minutes provide fresh clues?

The EUR/USD pair advanced for a fourth consecutive week, comfortably trading around 1.0860 ahead of the close. Progress had been shallow, as the pair is up roughly 250 pips from the year low of 1.0600 posted mid-April.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.