Analysis for November 13th, 2015

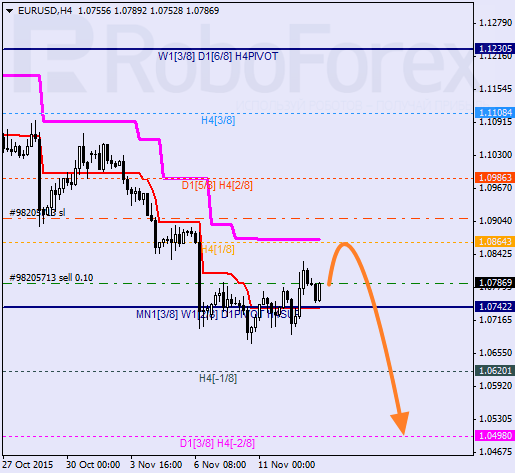

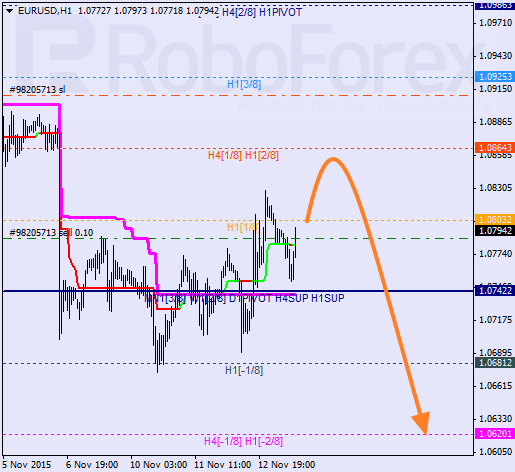

EUR USD, “Euro vs US Dollar”

Eurodollar is still being corrected. It’s highly likely that the price may test the daily Super Trend. If the pair rebounds from it, the market will resume its decline towards the -2/8 level.

At the H1 chart, Eurodollar is also moving at the bottom. If the price rebounds from the 2/8 level, bears will return to the market. I’m planning to increase my short position as soon as the pair stays below the 0/8 level.

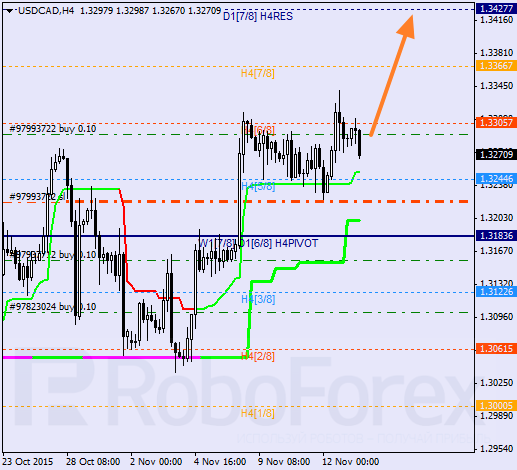

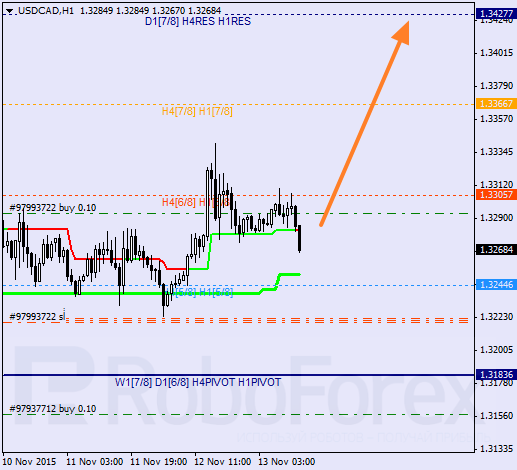

USD CAD, “US Dollar vs Canadian Dollar”

Canadian Dollar has rebounded from the H4 Super Trend and reached a new high. It’s highly likely that in the nearest future the market may continue growing. The closest target is at the 8/8 level. After reaching it, the price may start a descending correction.

The lines at the H4 and H1 charts are completely the same. If later the price is able to stay above the 6/8 level, I’m planning to open another buy order. It looks like the market may reach a new local high in the beginning of the next week.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD range bound around 200-DMA, awaiting BoE’s decision

The Pound Sterling registers anemic losses against the US Dollar as traders brace for the Bank of England’s (BoE) monetary policy decision on Thursday. The pair remained within the 1.2529-1.2594 boundaries during the last few days, capped by key support and resistance levels. The GBP/USD trades at 1.2556, down 0.04%.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.