Analysis for February 13th, 2015

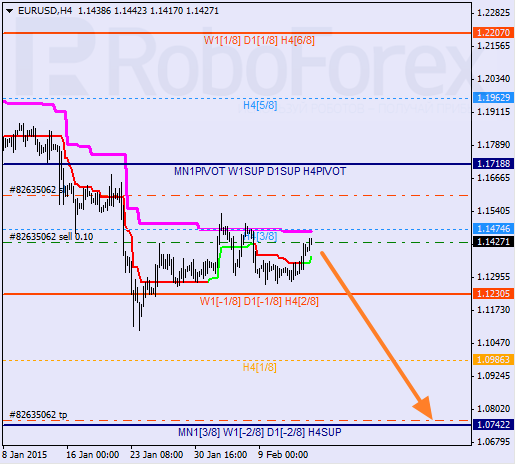

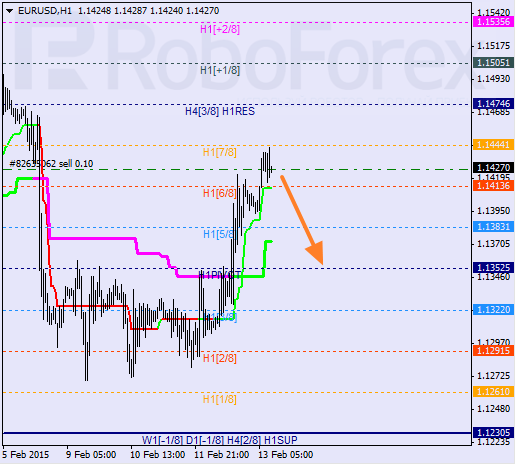

EUR USD, “Euro vs US Dollar”

After rebounding from the daily Super Trend and the 3/8 level several times, Eurodollar is back to falling. If the price is able to stay below the 2/8 level, it may start moving towards the 0/8 one, which is the closest target.

As we can see at the H1 chart, the pair has reached the 7/8 level and Super Trends have formed “bullish cross”. I’m planning to increase my short position as soon as the pair is able to stay below the 5/8 level.

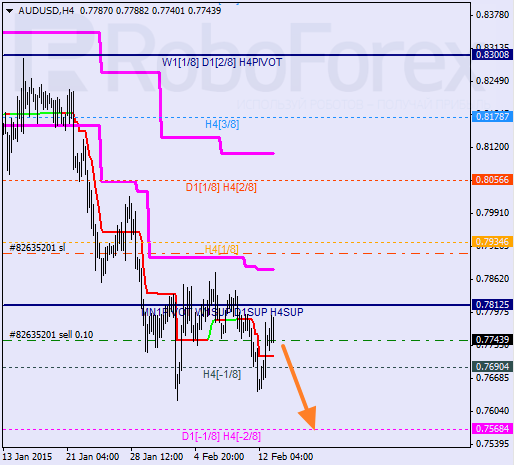

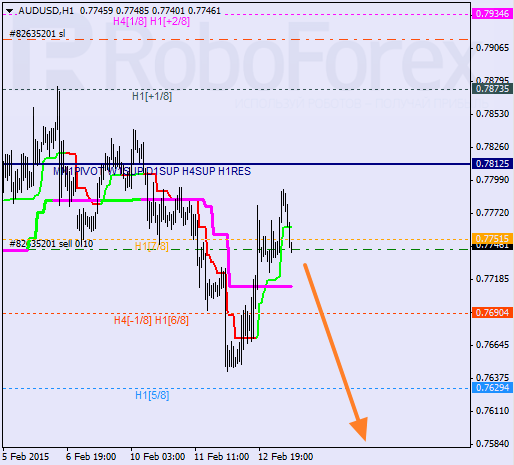

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has been moving between Super Trends inside “oversold zone” for quite a long time. If the market rebounds from the 0/8 level again, it may continue falling.

At the H1 chart, Super Trends have formed “bullish cross” during the correction. I’m planning to open another sell order as soon as the pair is able to break Super Trends and stay below the 6/8 level.

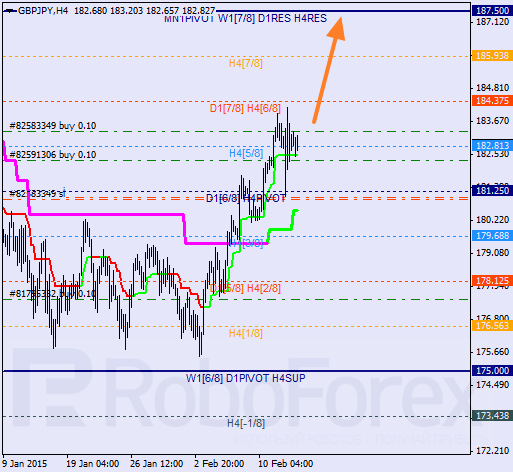

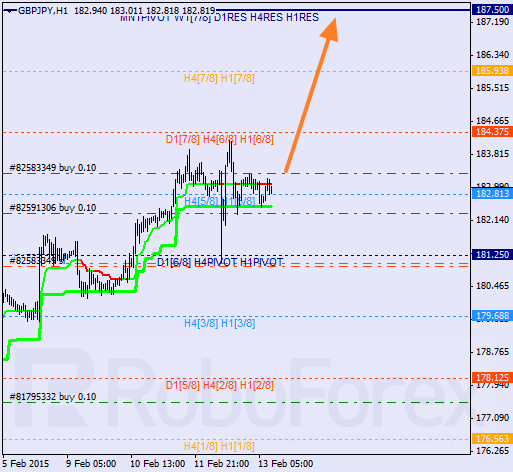

GBP JPY, “Great Britain Pound vs Japanese Yen”

The price is still moving upwards, being supported by Super Trends. If the pair is able to stay above the 5/8 level, it may continue growing to reach the 8/8 one and then start a more serious correction.

The lines at the H4 and H1 charts are completely the same. Possibly, the pair has completed a local correction near the H1 Super Trend, and that’s why I’ve decided to open another buy order. However, if the price rebounds from the 7/8 level fast, I’ll close the most of my orders.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.