Analysis for August 07th, 2014

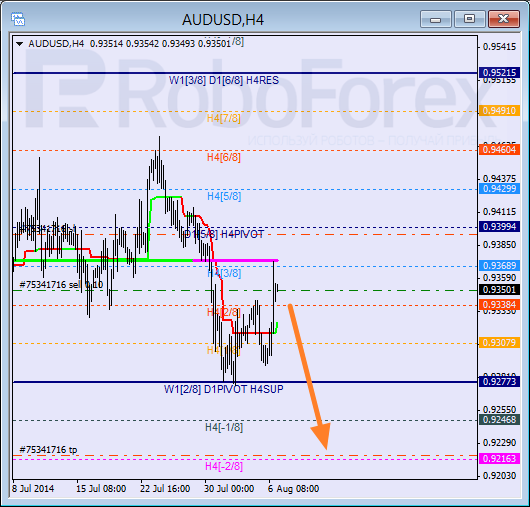

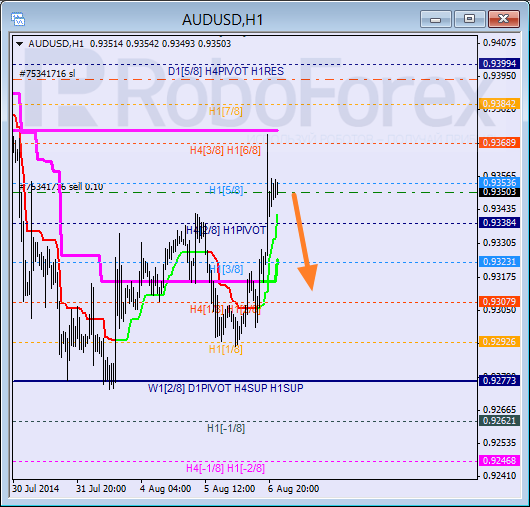

AUD USD, “Australian Dollar vs US Dollar”

AUDUSD has pulled back from daily Supertrend, my take-profit order for short-term long trade was executed. Support is also provided by 3/8 level. It’s not excluded that decline would be resumed and price will break out 0/8 level and enter «oversold area».

At H1 chart we might see that Supertrend lines are influenced by the «Bullish cross». However, there is a significant probability of acceptance below those lines, which can be a signal for entry.

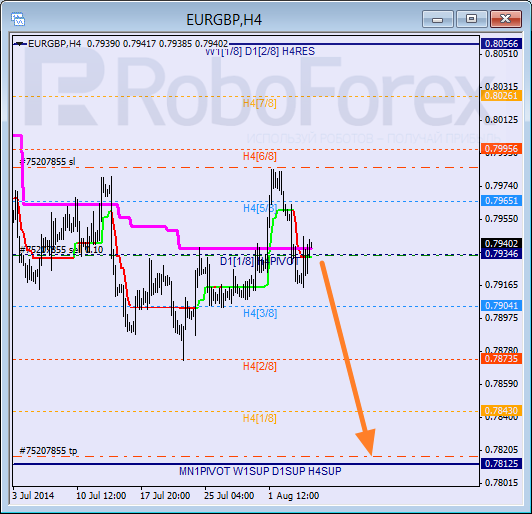

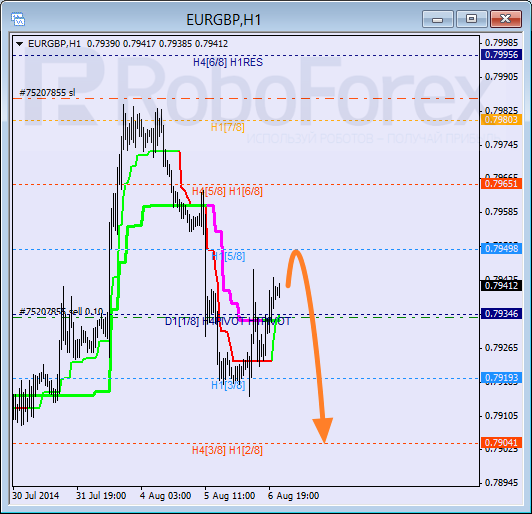

EUR GBP (“Euro vs British Pound”)

This pair was unable to hold above 5/8, but also it was unable to hold below Supertrend lines that have formed «bearish cross». If price will break 3/8, odds are high that 0/8 level can be visited.

At H1 chart market is trading between all levels. As pullback from 3/8 has occurred, 5/8 level can be tested as well. In case price pulls back from this level (5/8), it can be a trigger for a new bearish rally.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.