US Dollar experienced worst day in a month and dropped against major peers yesterday after the US retail sales missed forecast. The data contracted 0.8% vs expected -0.4%, while the prior data was a 0.9% decline. It is the first time since 2012 when retail sales recorded second consecutive decline.

The negative data may be temporary as job market is recovering according to the recent job market report. However, majors took this opportunity to rebound against the Dollar.

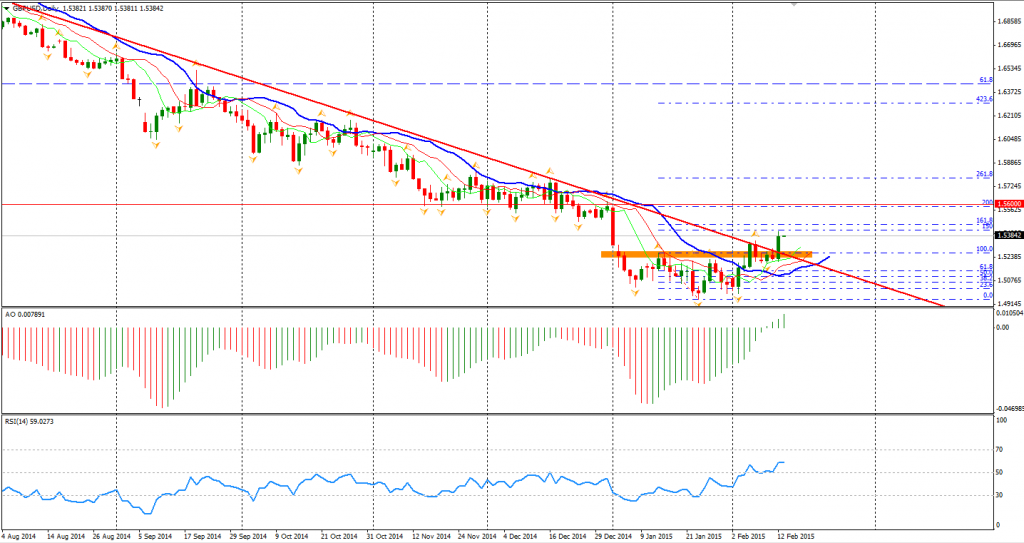

Sterling finally broke through the long-run downward trendline and refreshed recent high to 1.5415. The strong rally showed the bearish trend of Pound Dollar has ended. As UK is expected as the second nation to raise its benchmark interest rate after US, Pound recent performed much stronger than its neighbour Euro and commodity currencies. The next target for bulls is 1.56.

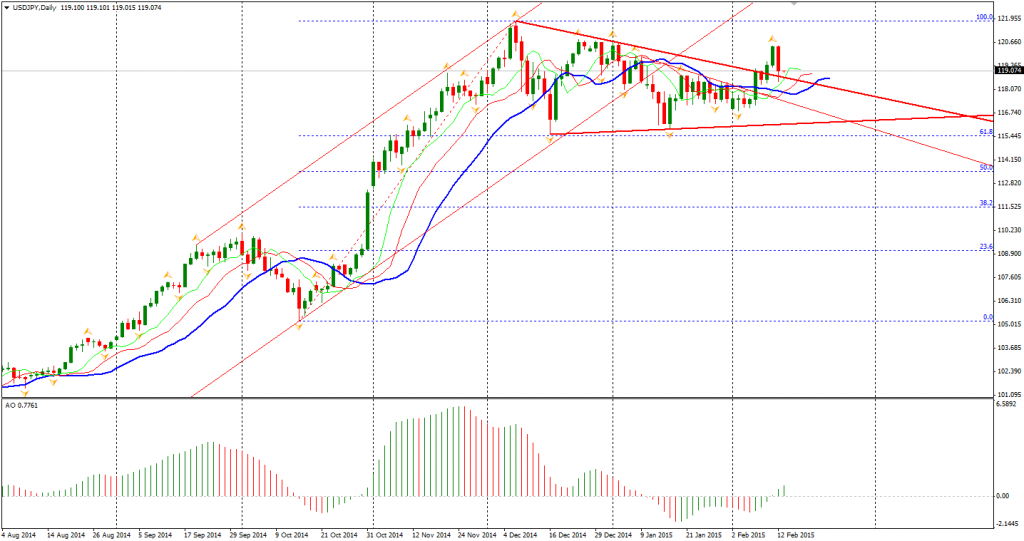

Yen surged over 1.3% against Dollar as the Bank of Japan Governor Kuroda said that further stimulus could be “counterproductive”. USDJPY plummeted over 150 pips after the speech and closed at 119, whilst the pre-news level was at 120.30. Technically, Dollar Yen is still bullish as the drop has not reversed the breakout yet. We shall wait longer to see whether the depreciation of Yen will continue without strong expectation of new stimulus program by BOJ.

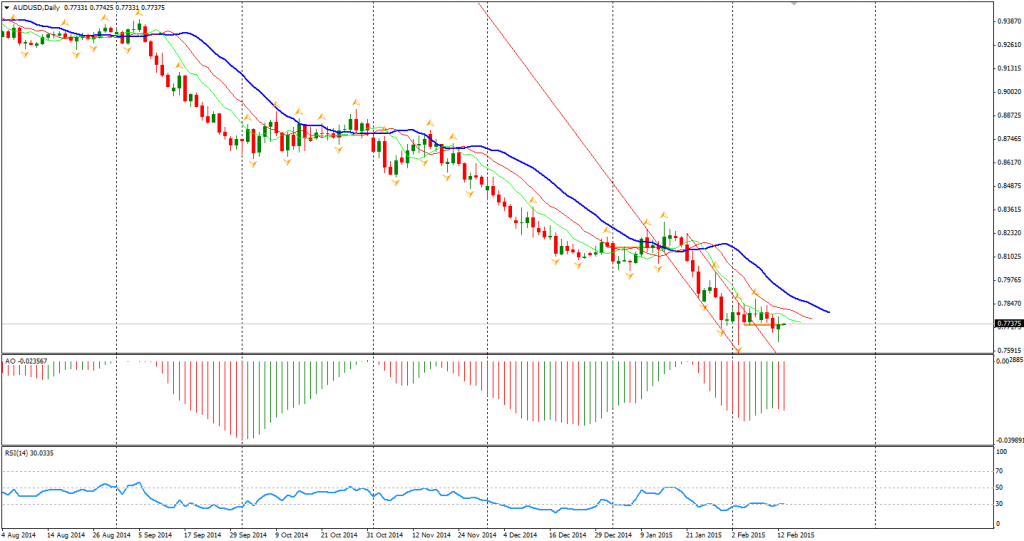

Aussie Dollar slid during the Asian trading hours as its unemployment rate surprisingly rose to 6.4%, the highest level since 2002. The data supported the recent rate-cut decision of RBA and increase the speculation of further cuts. AUDUSD recovered all lost later with major peers’ rally against Dollar, but the outlook is still bearish.

Back to stock markets, the Shanghai Composite rebounded 0.5% to 3173. The Nikkei Stock Average surged 1.85% on weaker Yen. Australian ASX 200 lost 0.44% to 5743. In European markets, the UK FTSE was up 0.16%, the German DAX surged 1.56% on Ukraine news and the French CAC Index gained 1%. US stocks rose broadly even after the downbeat data. The S&P 500 closed 0.96% higher at 2089. The Dow gained 0.62% to 17972, and the Nasdaq Composite Index rose 1.18% to 4858.

On the data front, Australian RBA Gov Stevens will have a speech at 9:30 am AEDST. Eurozone flash GDP will be released 21:00 pm AEDST. Canada Manufacturing Sale will be at 0:30 am AEDST at midnight.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.