The Dollar is heading to its highest level in ten years as recent US jobless claims fell by 43,000 to a near-15-year low at 265,000 in the last week. The data is fairly lower than what economists had expected. Indeed, very strong evidence to show that the US job market is recovering.

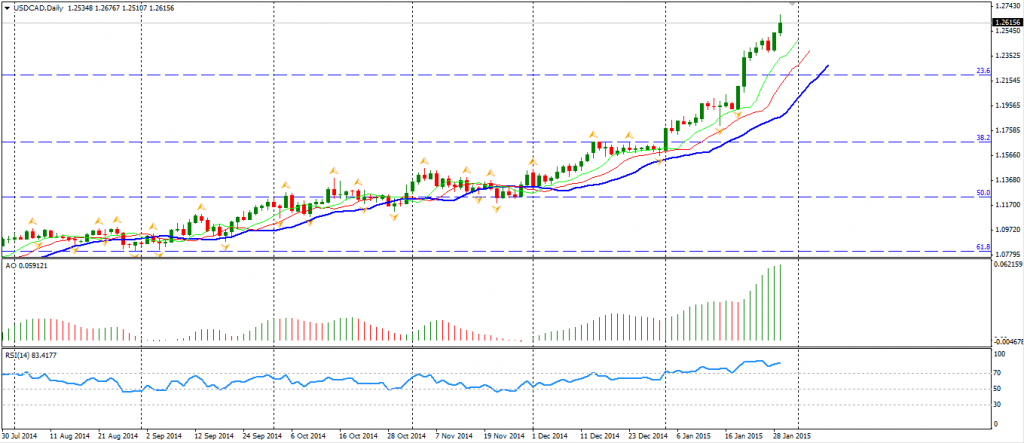

Commodity currencies refreshed their lows against the Dollar, as oil prices plunged to new lows of $43.60 per barrel. USDCAD once touched 1.2675 – the highest since April 2009. The CAD slumped right after the exchange level upwardly broke the 1.2580 level, triggering stop orders and pushing the price even higher.

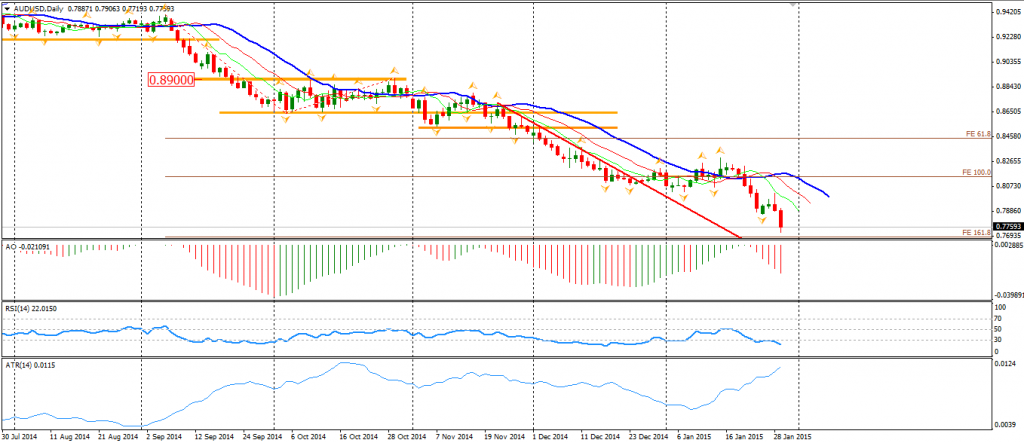

The Aussie Dollar hit a new low of 0.7720 this morning as well on heated speculation that the RBA will cut the interest rate next Tuesday. The currency was first dragged by its neighbour NZD as RBNZ stated its currency is still unsustainably high. If the RBA do cut their rate in the upcoming decision, the Aussie Dollar may soon hit the 0.75 level, which was mentioned as a favourable exchange level by RBA Governor Stevens.

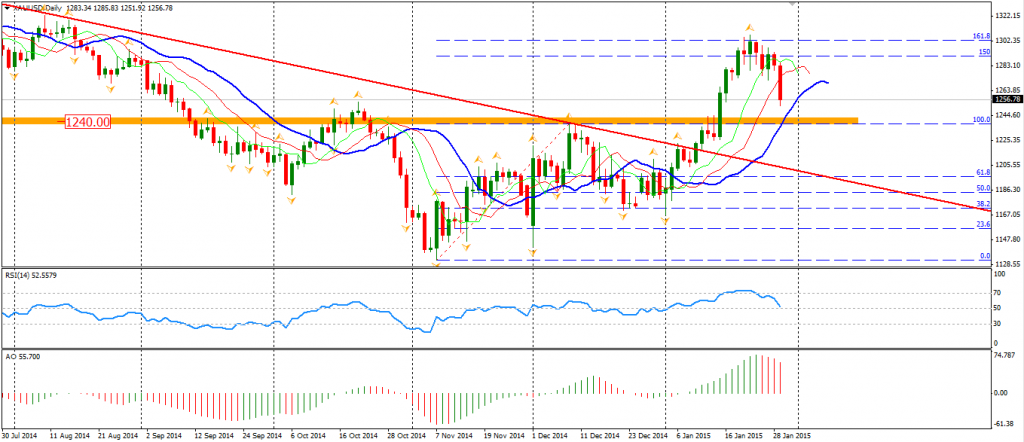

Gold fell the most since 2013 as the bright job market data reduced the attraction of safe-haven assets. The bulls in precious metals were betting on the Fed to be more dovish. However, now as the Fed kept its tone yesterday and jobless claims fell again, participants turned into bearish on yellow metal. $1240 will be the support level below.

Back to stock markets, the Shanghai Composite plunged 1.31% to 3262. The Nikkei Stock Average lost 1.06%. Australian ASX 200 rose 0.3% to 5569. In European markets, the UK FTSE was down 0.21%, the German DAX rebounded 0.25% and the French CAC Index fell 0.44%. The US market rose amid corporate earnings. The S&P 500 closed 0.46% higher to 2012. The Dow gained 0.92% to 17349, and the Nasdaq Composite Index rose 0.57% to 4664.

On the data front, Eurozone CPI will be at 21:00 AEDST. U.S. and Canada GDP will be released at 0:30 am AEDST.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.