The market did not get significant news from the January FOMC meeting. The committee said in its statement “it can be patient in the beginning to normalize the stance of the monetary policy”. U.S. seems to be the only advanced economy that has potential for interest rate hike within 2015. However, as the deflation risk is spreading around the globe and other major economies are struggling in the growth, the policymakers are still careful of using this option.

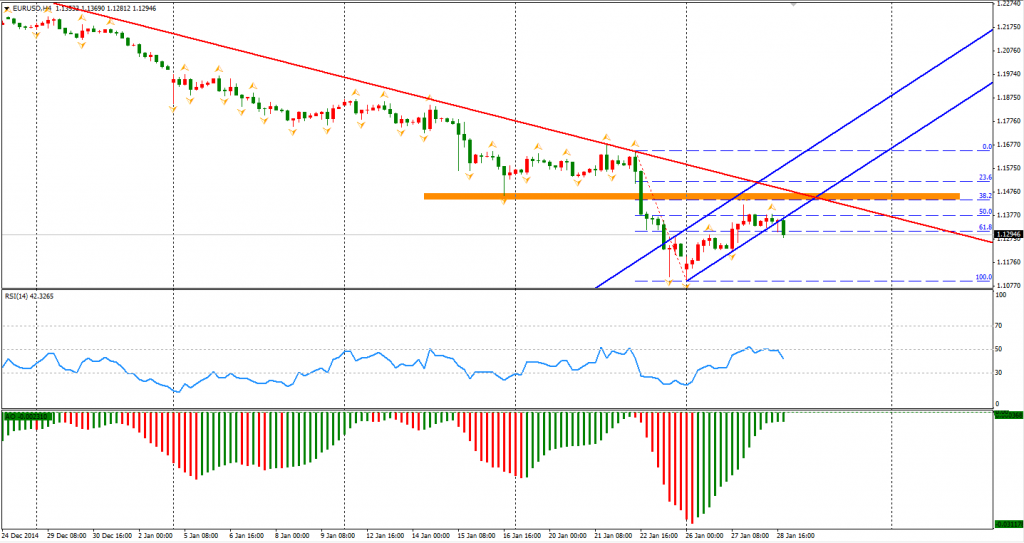

The market did not find the direction right after the statement was released, but the bullishness of USD managed to prevail in the later part of the day. Euro Dollar fell below the 1.13 mark again, implying that the rebound may be over. We can see in the H4 chart that the retracement stopped at 50% of the fall since QE program announcement. A new round of decline has just begun.

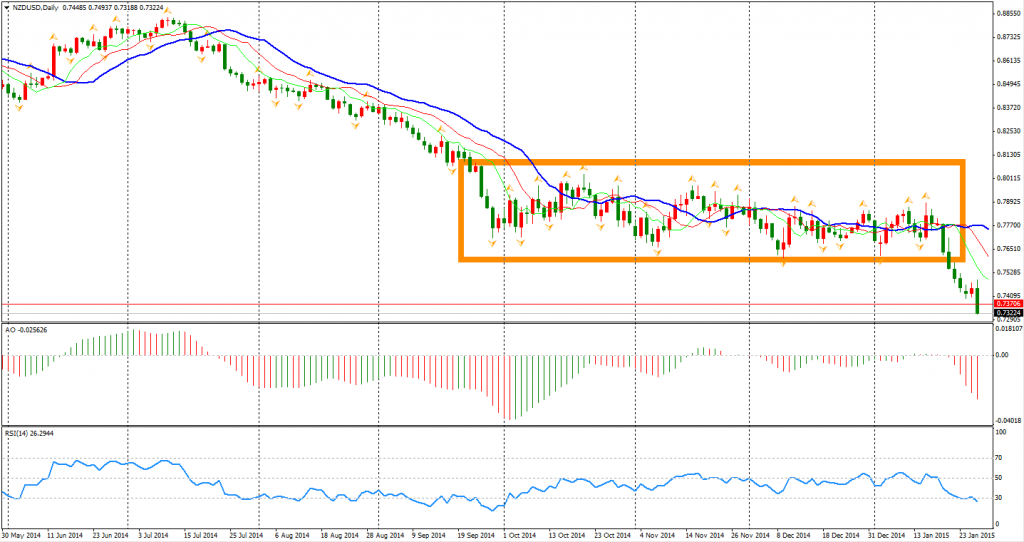

Reserve Bank of New Zealand disclosed its statement one hour after. NZDUSD slumped about 2% as the central bank’s rate remained but said that its currency is still unjustifiably and unsustainably high. Kiwi Dollar has refreshed its 3-year low to 0.7320 by the time of this report. As the speculations increases that RBNZ may cut the rate like Bank of Canada did, the next target below 0.7120, which is the low of 2011, may soon be reached.

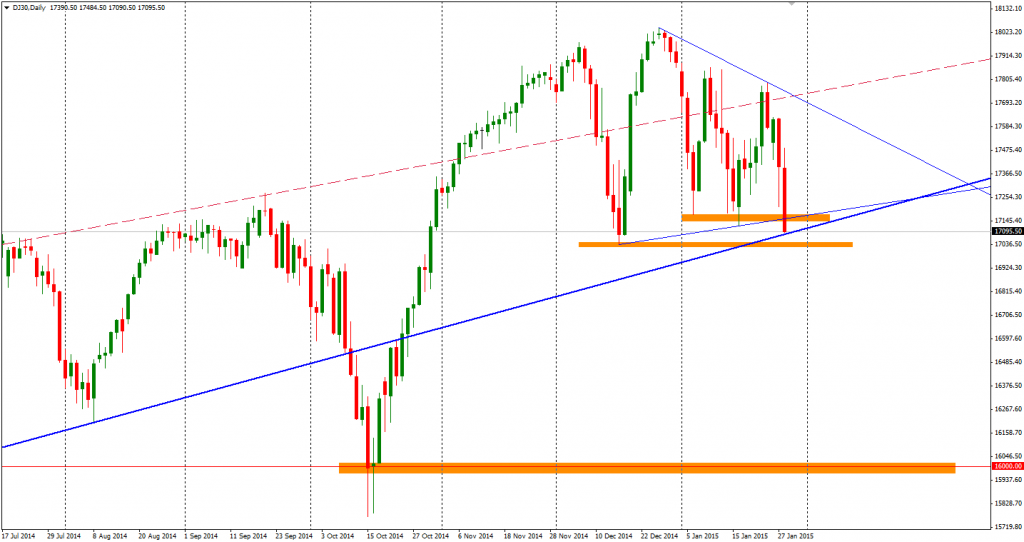

Back to stock markets, the Shanghai Composite fell 1.41% to 3306. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rose 0.1% to 5552. In European markets, the UK FTSE was up 0.21%, the German DAX rebounded 0.78% and the French CAC Index fell 0.29%. The US market mostly fell. The S&P 500 closed 1.35% lower to 2002. The Dow lost 1.12% to 17387, and the Nasdaq Composite Index fell 0.93% to 4638.

The strong Dollar has affected the profits of US listed company and participants see no sign of rate hike delay. The daily chart of Dow future tells us a potential medium run top is forming. If the 17000 integer level is broken, the index may fall to 16000.

On the data front, German Unemployment Change will be at 19:55 AEDST. US weekly Unemployment Claims and Pending Home Sales will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.