The global market experienced a significant fluctuation yesterday with the Russian Ruble crisis causing a chain effect. The Ruble once plummeted by 20% hitting 80 per Dollar, after the central bank raised the interest rate to 17%. As Russia faces falling oil prices and sanctions from international society, their economy is devastated. Traders now are comparing the current situation to 1998 and capital control may be the next move of the authority led by Putin.

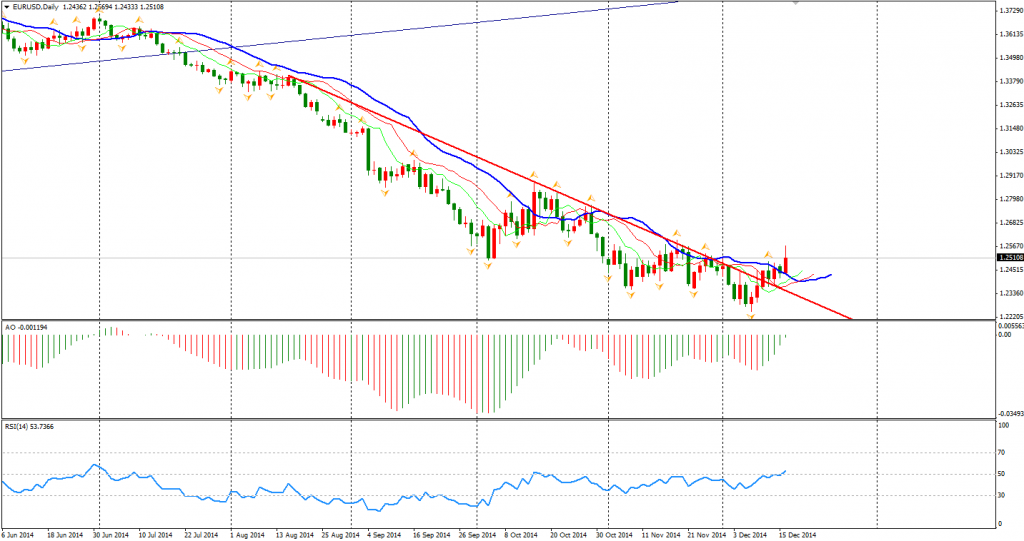

The Dollar index fell as the Euro area confidence rose on QE expectations while US manufacturing PMI fell for the fourth month. The Eurozone composite PMI is 51.7 – higher than the forecast and former reading. The data also showed that demand is recovering in the Euro area and job position growth hit a 5-month high. The Euro Dollar broke the 1.25 resistance after the data release and touched the month high of 1.2570, giving a more confirming sign of bullish reversal.

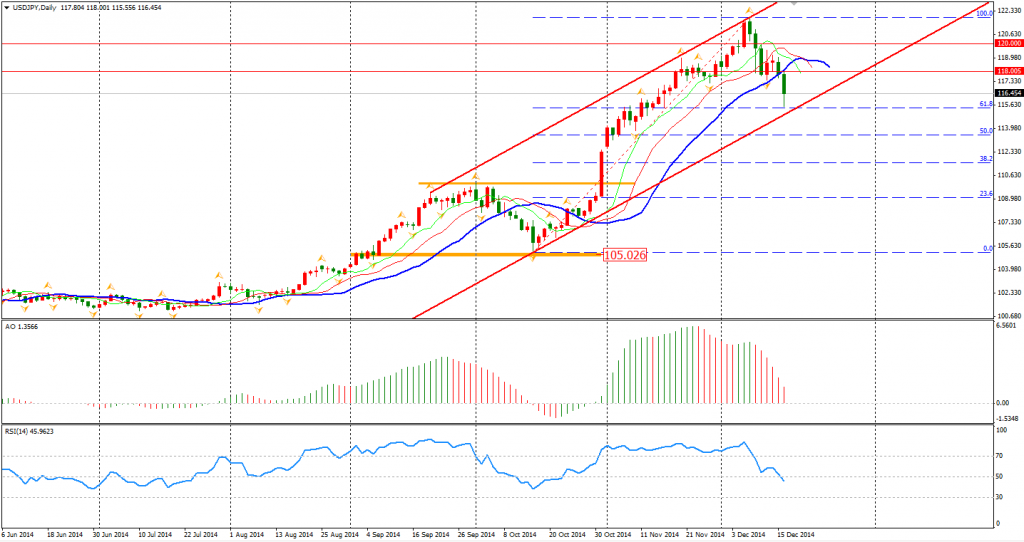

Dollar Yen triggered 115.60 last night. The level is the 38.2% retracement level of the last round of rally from 105 to 122 and lower band of bullish trend. As the middle run outlook of Yen is still bearish, the retreat of the Dollar Yen may be offering a great entry chance for traders using long term strategies.

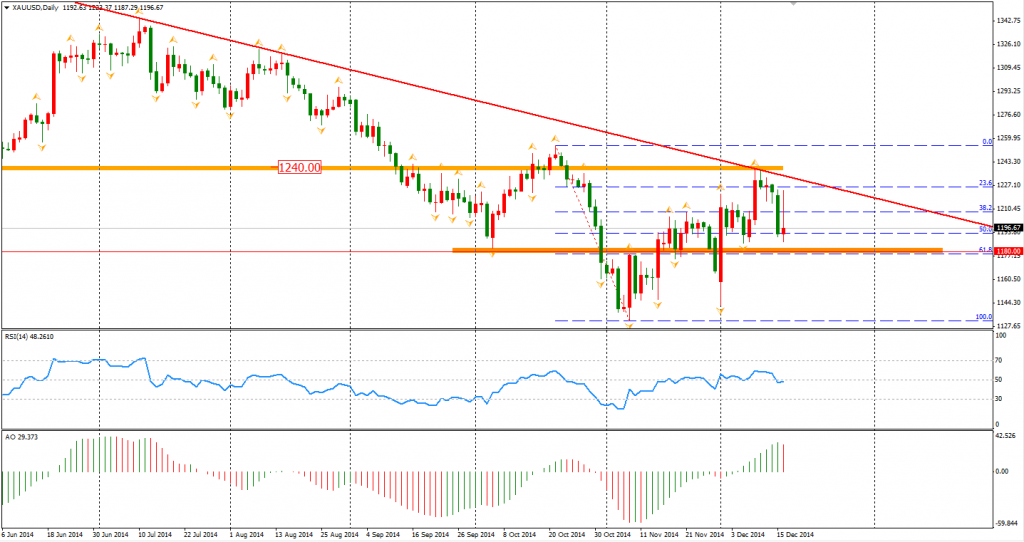

The gold price was on a rollercoaster yesterday. First rallying between $1196 and $1222 and then all gains were erased hitting the day low at $1187. The ripples of the Russian crisis will certainly impact other emerging nations and exacerbate the concerns of the global economy, which support gold‘s safe-haven needs. On the other side, US rate hike expectation limits the upside space. Traders are now waiting for the 2014 last statement of FOMC.

Now to the stock markets. The Shanghai Composite surged 2.31% to 3022 as poor PMI data raised hopes of a stimulus. ASX 200 lost 0.65% to 5152. The Nikkei Stock Average was down 2%. The European markets were inspired by upbeat PMI data, the UK FTSE rebounded by 2.41%, the German DAX and the French CAC Index both bounced over 2%. The US market mostly traded lower. The S&P 500 closed 0.84% lower to 1972. The Dow dropped 0.65% to 17069, and the Nasdaq Composite Index lost 1.24% to 4548.

On the data front, UK Unemployment Rate and Bank of England’s decision will be released at 20:30 AEDST. Euro area final CPI will be at 21:00 AEDST. US CPI and Canadian Wholesale Sales will be out at midnight.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.