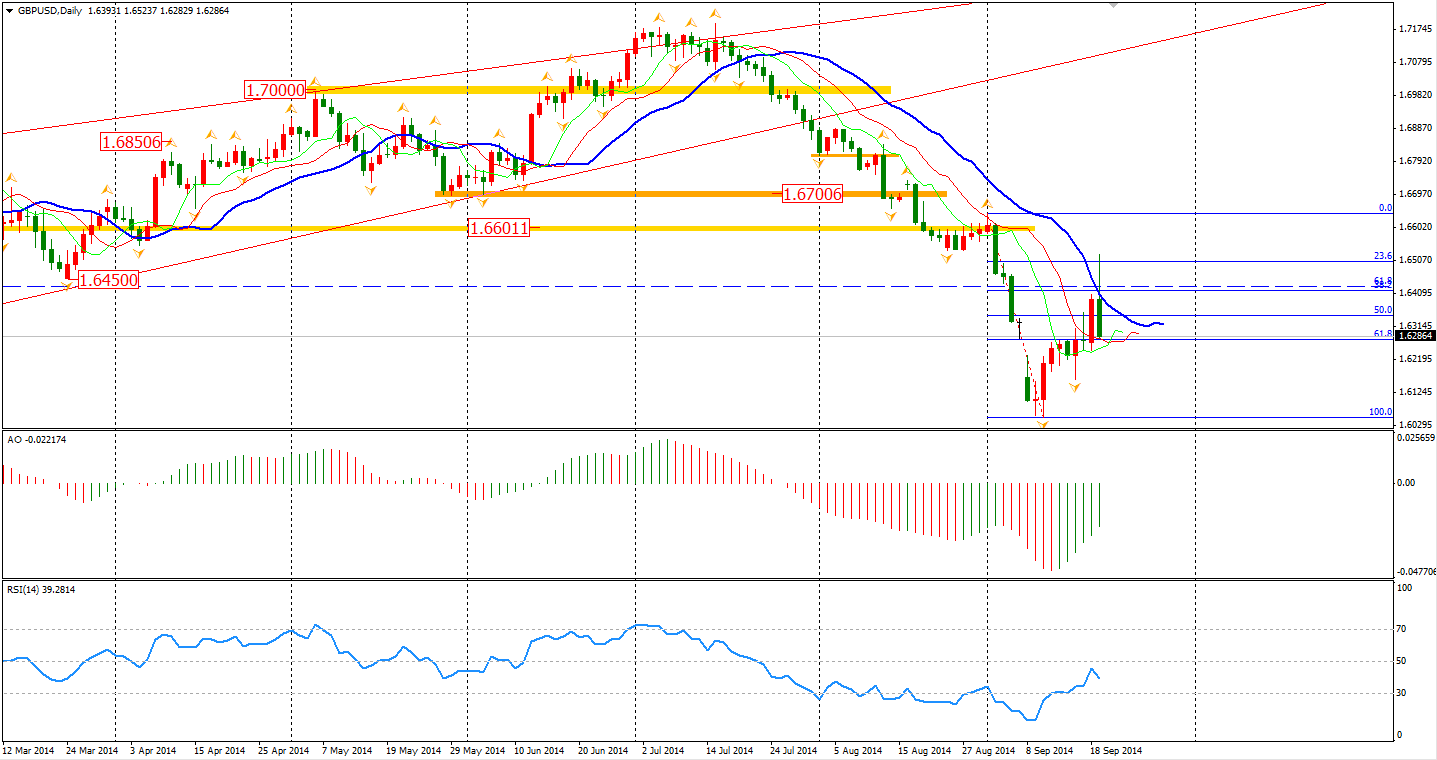

The Scottish independence referendum hoo-ha is finally over. The Sterling/Dollar almost reversed all its rebound on Friday after the final result confirmed Scotland will be staying with the United Kingdom. The less-than-300-pips bounce during last week was quite disappointing, and the slump from 1.6520 to an area below 1.63 was another sign that the Pound may continue its bearishness.

Few people noticed last Tuesday that the U.K. inflation rate had continued to fall in August. Considering the lower exchange rate of the Pound, it may have pushed up import costs with the domestic goods price level even weaker. The Bank of England will probably hold the current interest rate level for longer, maintaining a negative aspect for the Pound.

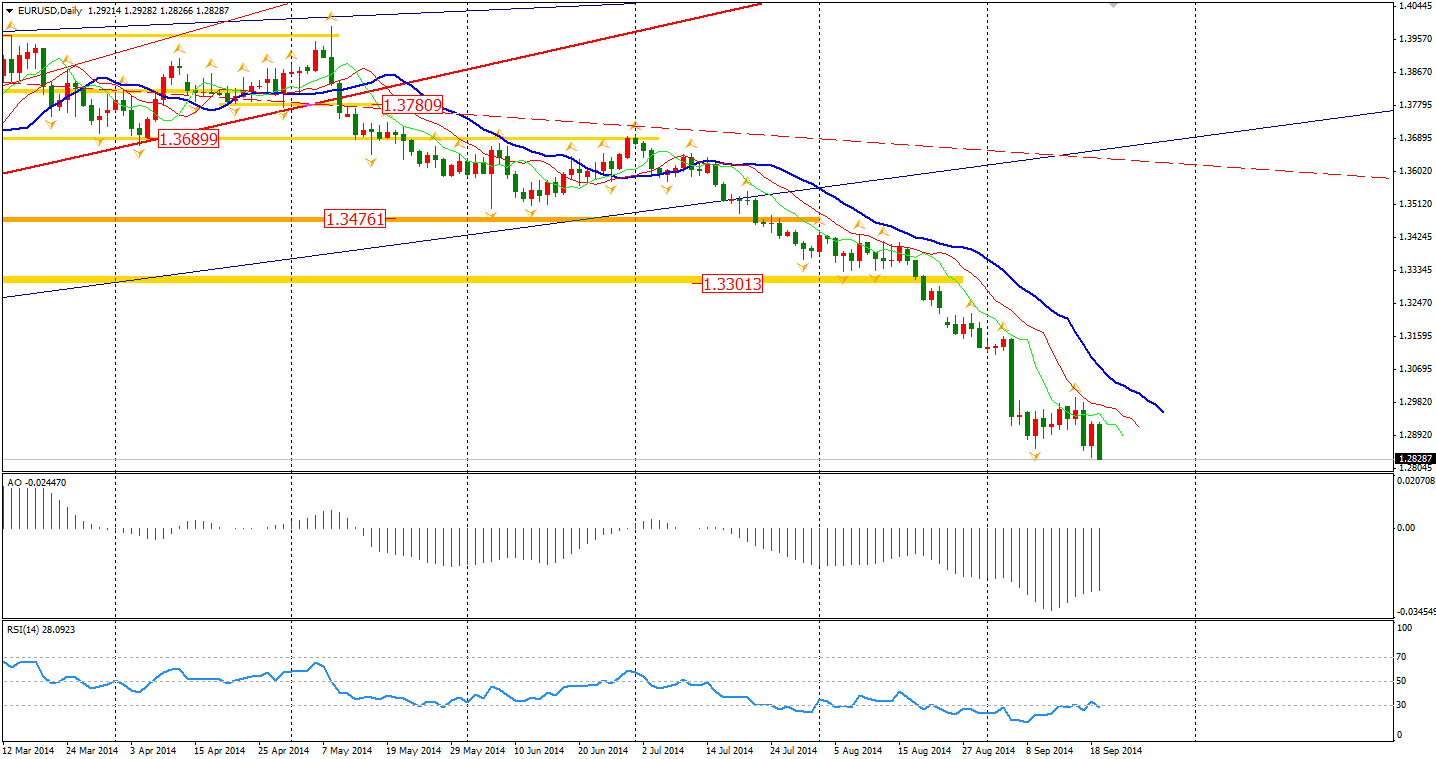

Looking at other majors, the USD bull continued on Friday as it refreshed its new high against the Euro, Yen and Aussie Dollar. Euro/Dollar closed below the last-two-week sideway range, implying that the pair may start the fall again to a lower area around 1.2750, the double bottom of 2013. Even though the rise of separatism within European nations was relieved at the failed Scottish Votes, the recent Eurozone economic data may still leave the ECB no other choice but a further easing like ABS purchasing.

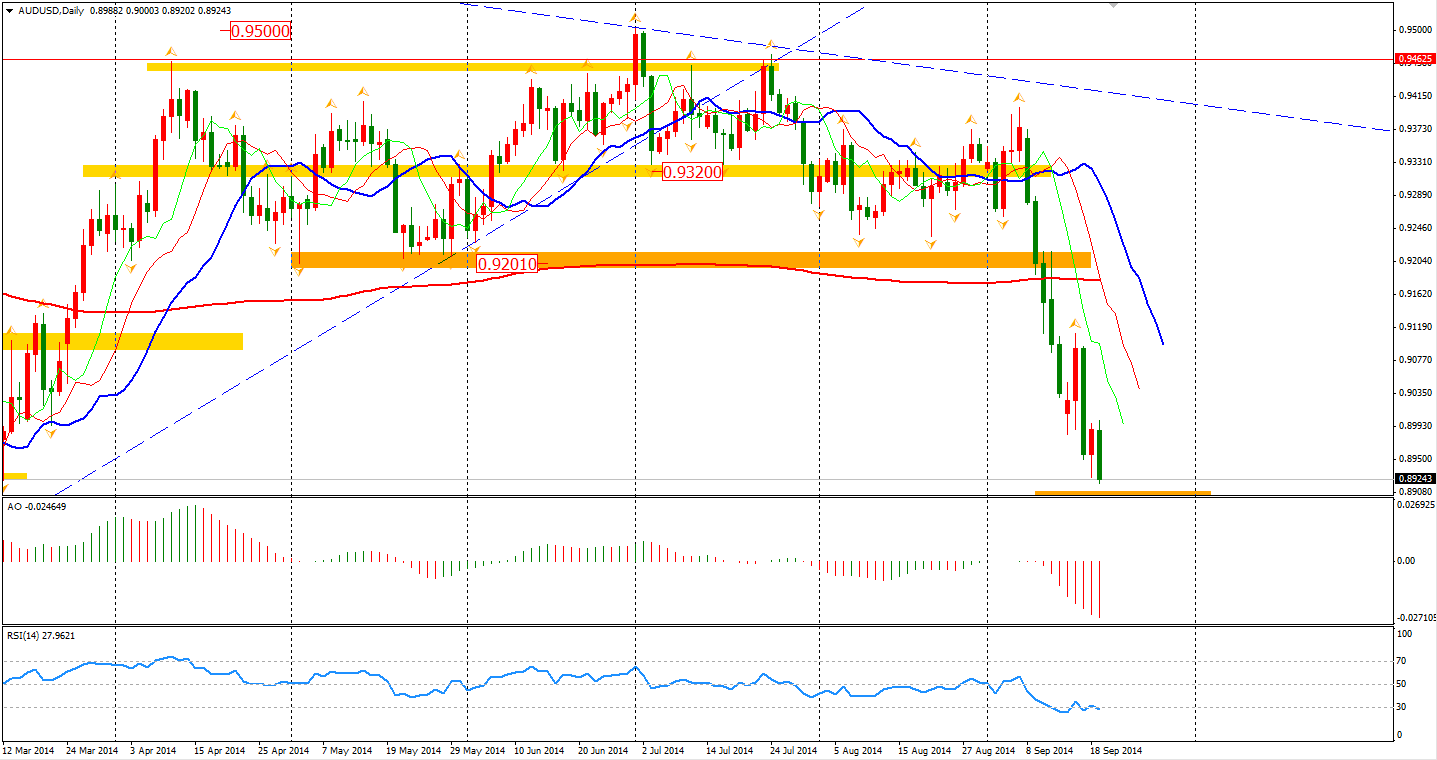

The prices of Iron ore hit a 5-year-low last week as the Australian future prices slumped 1.6% to US$81.70 per tonne as the Chinese port inventories remain high and steel products prices are still weak. With contracting China demands and the expansion of major mining giants, the Iron ore price has fallen 40% this year and the trend may continue. As it is the largest export goods from Australia to China and a similar scenario occurring with coal and gold, the Aussie Dollar will struggle to maintain an high exchange level from the fundamental aspect.

The Asian stocks markets rose on Friday. The Shanghai Composite bounced 0.58% to 2329. The Nikkei Stock Average surged 1.58%. The Australian ASX 200 rebounded 0.32% to 5433. In European stock markets, the UK FTSE was up 0.27%, the German DAX closed flat and the French CAC Index lost 0.08%. U.S. stocks closed in mixed territory Friday. The S&P 500 fell by 0.05% to 2010. The Dow gained 0.08% to 17279, while the Nasdaq Composite Index was down 0.3% to 4580.

Today is fairly light on data releases. ECB President Draghi’s speech will be the only noticeable event. Flash PMI’s will be released from Tuesday.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.