USD/JPY is almost unchanged on Monday, as the pair trades at 106.50 in the European session. On the release front, manufacturing indicators are the focus at the start of the trading week. In Japan, Final Manufacturing PMI continued to lose ground, dropping to 48.2 points in April. This marked a second straight reading below the 50 line, pointing to contraction in the manufacturing sector. Over in the US, today’s highlight is ISM Manufacturing PMI. The estimate stands at 51.6 points. Japanese markets are closed for a holiday, so we’re unlikely to see much movement from the pair in the Monday session.

The Bank of Japan surprised the markets last week, holding off from further easing at its Wednesday policy meeting. The yen surged on Thursday and Friday, gaining 500 points in response. USD/JPY is currently trading close to its lowest level since mid-October 2015. The BoJ left unchanged its 80 trillion yen for expanding the monetary base and the 0.1% negative rate on some bank funds held by the central bank. The BoJ also postponed its time frame for its target of 2 percent inflation until 2017. In remaining on the sidelines, the BoJ sent a message that it won’t be rushed into more monetary action and will any further easing will be data-dependent. The BoJ remains concerned about the strengthening yen, but may have concluded that there is little it can do to stop the currency from breaking below the symbolic 100 level, which last occurred in November 2013.

US GDP climbed 0.5% in the first quarter, shy of the estimate of 0.7%. This was considerably lower than the 1.4% gain in the fourth quarter of 2015, and marked the weakest quarter of growth in two years. Although economic growth remains moderate, the lukewarm reading will not help the cause of Fed policymakers who favor a rate hike, especially with inflation at low levels. The markets, which were not expecting an April hike, are keeping a close eye on key numbers, looking for clues as to whether the Fed will make a move at its June policy meeting. The April policy statement sounded cautiously optimistic about the US economy, but did not provide any clues about a hike in June.

One sore spot in the US economy remains the manufacturing sector. Last week, Core Durable Goods dropped 0.2%, well off the estimate of a 0.6% gain. This marked the fourth decline in five months. Durable Goods Orders was stronger at 0.8%, but also missed expectations, as the estimate stood at 1.9%. Recent manufacturing reports, such as the Philly Fed Manufacturing Index have also been soft, as the industry has been hard-hit by weak global demand and a downturn in the US oil industry due to low crude prices. We’ll get a look at the ISM Manufacturing Index later on Monday.

USD/JPY Fundamentals

Sunday (May 1)

- 10:00 Japanese Final Manufacturing PMI. Estimate 48.0. Actual 48.2

Monday (May 2)

-

13:45 US Final Manufacturing PMI. Estimate 51.0

-

14:00 ISM Manufacturing PMI. Estimate 51.6 points

-

14:00 US Construction Spending. Estimate 0.5%

-

14:00 ISM Manufacturing Prices. Estimate 51.0

-

Tentative – US Loan Officer Survey

| S3 | S2 | S1 | R1 | R2 | R3 |

| 104.12 | 105.18 | 106.19 | 107.57 | 108.37 | 109.87 |

-

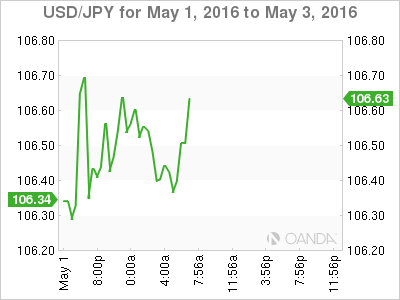

USD/JPY has been drifting in Monday’s Asian and European sessions

-

106.19 is providing weak support, following strong losses by USD/JPY on Friday

-

There is resistance at 107.57

-

Current range: 106.19 to 107.57

Further levels in both directions:

-

Below: 106.19, 105.18 and 104.12

-

Above: 107.57, 108.37, 109.87 and 110.66

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The markets remain unconvinced that the Fed will pivot earlier than previously expected.

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

Gold gains ground above $2,400, eyes on Fedspeak

Gold price gathers strength around $2,415 during the early Asian session on Monday. The softer US inflation data in April provides some support to the yellow metal. Meanwhile, the USD Index edges lower to 104.50, losing 0.03% on the day.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.