FOMC to Show Patient Fed Awaits More Signs of US Recovery

The main event this week in the forex markets will be the Federal Open Market Committee (FOMC) in Washington. The European Central Bank (ECB) has made it clear that low rates will continue in Europe for the time being unless growth picks up. Germany has never agreed on principle to the easing monetary policy and protest each time there is to be a new round of quantitative easing stimulus making even Draghi’s vague promises of deeper negative rates a tough sell on the market. The USD has not gained from the ECB dovish tone as there Fed is anticipated to keep rates unchanged.

The Fed is now in the spotlight, but if any central bank has learnt from the lessons of the past it seems its the Washington based institution. The Fed will not over promise and is willing to let the economy “run a little hot” with inflation before making an interest rate move. The April FOMC meeting does not feature a press conference with Chair Janet Yellen; leaving the market to scan through the statement for clues on the June 15 FOMC which is still a heavy candidate for a rate hike before the U.S. presidential elections heat up. Foregoing June will force the Fed to a repeat scenario of last year where it waited until December to make the now historic rate hike.

The Fed will release its Federal Open Market Committee (FOMC) statement on Wednesday, April 27 at 2:00 pm EDT. The market is not expecting a rate hike at this point, but the language of the statement will be closely scrutinized for clues about the path of future rate hikes. The Fed has downgraded its rate hike expectations for 2016 citing global headwinds that have limited U.S. growth. So far employment remains the strongest pillar of said recovery but the job gains and the lowest unemployment claims in 42 years won’t be enough to sway the opinion of Fed members to vote for a rate hike until other economic gauges show improvement.

The EUR/USD advanced 0.185 percent in the last 24 hours ahead of the FOMC. The pair is trading at 1.1289 as a the U.S. core durable good orders came in under expectations at -0.2 percent and the addition of the volatile transportation items also disappointed with a 0.8 percent gain instead of the expected 1.8 percent increase.

Fed Wary of Communication Blunders

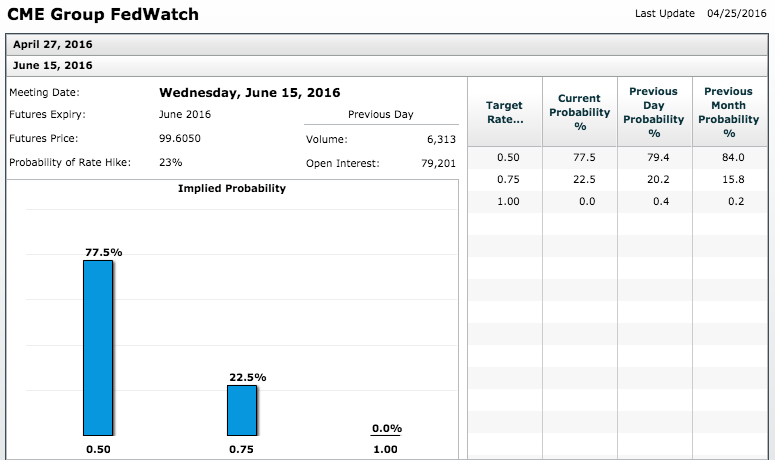

The members of the U.S. Federal Reserve remain divided on the path of interest rate hikes for 2016. The unanimous vote for the December rate hike was overstated when the minutes from that FOMC meeting showed some members that despite their vote for a higher interest rate had doubts. Those doubts in retrospect were well funded. The Fed has had to reduced their number of rate forecasts as the global economic growth is still weak and on the domestic front the economic indicators point to a bearish growth outcome. The challenge facing the Fed is that things could change between April and June, so the central bank will want to keep a potential rate hike on the table for the summer. The flip side is how to communicate that without the market getting their hopes up, after the market has already taken June off the table. The CME FedWatch shows 22.5 percent chance of a rate.

The biggest signal expected on Wednesday by the Fed is the reintroduction of the “nearly balanced” language in the FOMC statement. The two words have been missing in the last two central bank meetings and if they reappear would boost the chances of a June rate hike. Their absence would have the opposite effect as the USD has suffered as interest rate divergence probabilities shrink.

Forex market events to watch this week:

Wednesday, April 27

4:30am GBP Prelim GDP q/q

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

5:00pm NZD Official Cash Rate

5:00pm NZD RBNZ Rate Statement

Tentative JPY Monetary Policy Statement

Thursday, April 28

1:00am JPY BOJ Outlook Report

Tentative JPY BOJ Press Conference

8:30am USD Advance GDP q/q

8:30am USD Unemployment Claims

Friday, April 29

4:00am CHF SNB Chairman Jordan Speaks

8:30am CAD GDP m/m

Saturday, April 30

9:00pm CNY Manufacturing PMI

*All times EDT

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.