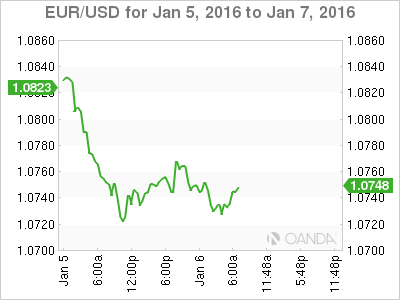

EUR/USD has posted small losses on Wednesday, continuing the trend which has marked the pair throughout the week. In the European session, the pair is trading at 1.0740. On the release front, it’s a busy day, which could result in some volatility from the pair. Eurozone and German Services PPI beat their estimates. Over in the US, there are a host of key events, highlighted by the FOMC Minutes and ADP Nonfarm Payrolls.

The euro continues its downward slide in the New Year, as EUR/USD has lost over 200 points since December 31st. The pair is trading at its lowest levels since December 3, the date on which the euro posted huge gains following the ECB policy meeting which saw the ECB balk at any significant monetary moves. Eurozone CPI posted a weak gain of 0.2% in December, as inflation levels remain very weak in the bloc. There was some good news on Wednesday, as Services PMIs out of Germany and the Eurozone both beat expectations, with both indicators pointing to expansion in the services sector.

The Federal Reserve will release the minutes of the momentous December policy meeting, at which the Fed opted to raise interest rates for the first time in over nine years, by 0.25 percent. The Fed has hinted that the December move will kick-off a series of incremental hikes in 2016, and the markets will be looking for confirmation, or at least a hint that this is the Fed’s monetary strategy. We’ll also get a look at employment data, with the release of the ADP Nonfarm Payrolls, which precedes the official Nonfarm Payroll report later in the week. As well, the US will release the ISM Non-Manufacturing PMI and Trade Balance. The markets will thus have plenty of data to sift through later today, and traders should be prepared for volatility from EUR/USD.

EUR/USD Fundamentals

Wednesday (Jan. 6)

8:15 Spanish Services PMI. Estimate 56.9 points. Actual 55.1 points

8:45 Italian Services PMI. Estimate 53.8 points. Actual 55.3 points

8:50 French Final Services PMI. Estimate 50.0 points. Actual 49.8 points

8:55 German Final Services PMI. Estimate 55.4 points. Actual 56.0 points

9:00 Eurozone Final Services PMI. Estimate 53.9 points. Actual 54.2 points

10:00 Eurozone PPI. Estimate -0.2%

13:15 US ADP Non-Farm Employment Change. Estimate 193K

13:30 US Trade Balance. Estimate -44.0B

14:45 US Final Services PMI. Estimate 55.1 points

15:00 US ISM Non-Manufacturing PMI. Estimate 56.0 points

15:00 US Factory Orders. Estimate -0.2%

15:30 US Crude Oil Inventories. Estimate 0.7M

19:00 US FOMC Meeting Minutes

EUR/USD 1.0736 H: 1.0772 L: 1.0719

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0537 | 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 |

The pair has been uneventful in the Asian and North American sessions. 1.0732 is a weak support level was tested earlier

There is resistance at 1.0847

Current range: 1.0732 to 1.0847

Further levels in both directions:

Below: 1.0732, 1.0659 and 1.0537

Above: 1.0847, 1.0941, 1.1087 and 1.1172

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.