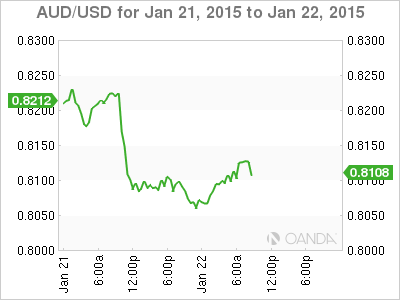

AUD/USD is calm on Thursday, as the pair trades in the low-0.81 range. In Australia, MI Inflation Expectations posted a gain of 3.2%. HIA New Home Sales softened in December, with a gain of 2.2%. Over in the US, today’s highlight was Unemployment Claims. The indicator dipped to 301 thousand, short of expectations.

US unemployment claims missed expectations for the second straight week. The key indicator improved to 309 thousand, better than the previous reading of 316 thousand. This fell short of the estimate of 301 thousand. Although the US labor market has improved, this is the fourth straight reading where unemployment claims has missed expectations. On Wednesday, construction readings were a mix. Building Permits came in at 1.03 million, short of the estimate of 1.06M. Housing Starts improved to 1.09 million, beating expectations of 1.04M.

Earlier in the week, there was good news from Australian consumer indicators. Westpac Consumer Sentiment impressed in December, as the indicator posted a strong gain of 2.4%, rebounding from a sharp decline of 5.7% a month earlier. The indicator has fluctuated considerably, making it a tricky task to gauge the mood of the Australian consumer. New Motor Vehicle Sales also looked sharp, posting an excellent gain of 3.0% gain.

AUD/USD 0.8085 H: 0.8136 L: 0.8056

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.