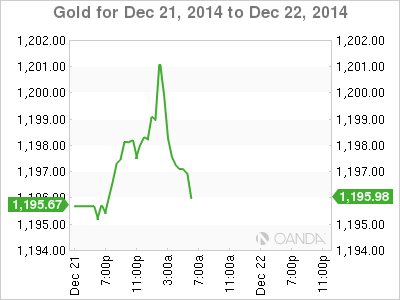

Gold is showing little movement on Monday, as XAU/USD trades slightly below the $1200 level. In the European session, the spot price stands at $1195.94. It could be a quiet week for gold ahead of the Christmas holiday. On the release front, today’s sole event is US Existing Home Sales. The markets are expecting the indicator to soften in November, with an estimate of 5.21 million.

In the US, employment numbers continued to impress last week, as unemployment claims dropped to 289 thousand, the lowest level in six weeks. The easily beat the estimate of 297 thousand. The news was not as good on the manufacturing front, as the Philly Fed Manufacturing Index slid to 24.5 points, down from 40.6 points in November. The November reading was unusually high, and the markets had expected a sharp downturn, with the estimate standing at 26.3 points.

Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. Gold prices remained steady after the Fed statement, but as an interest rate hike by mid-2015 seems likely, there is room for the dollar to make gains against gold.

XAU/USD 1195.94 H: 1203.36 L: 1194.80

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.