USD/JPY has posted gains on Monday, following huge losses last week as the yen rebounded. In the European session, the pair is trading just shy of the 119 line. On Sunday, Prime Minister Shinzo Abe’s Liberal Democratic party swept to victory in parliamentary elections. On the release front, the all-important Tankan releases were mixed. In the US, there are no major events to start off the week. Empire State Manufacturing Index looked awful, slipping to -3.6 points. Later in the day, we’ll get a look at Industrial Production. Both indicators are expected to improve, which could give the US dollar a boost. There are no Japanese releases on Monday.

Japan’s ruling Liberal Democratic party registered a convincing election victory, giving Prime Minister Abe a comfortable majority in the lower house of parliament. However, winning the election is likely to be the easy part, as the economy is stumbling and Abe’s economic reforms will face resistance from the upper house. Growth and inflation have not met the government’s target, and the yen has tumbled to around 120 under “Abenomics”, with the BoJ implementing radical monetary easing. Meanwhile, the Japanese Tankan indices were a mix in the Q3 readings. The Manufacturing Index dipped to 12 points, down from 13 points in Q2. There was better news from the Non-Manufacturing Index, improving to 16 points, up from 14 points in Q2. The yen showed little response to these key releases.

The US ended the week with mixed news, as inflation dipped while consumer confidence jumped. The Producer Price Index, the primary gauge of manufacturing inflation, dropped by 0.2%, its worst showing in six months. The estimate stood at -0.1%. Meanwhile, UoM Consumer Sentiment moved higher for a fourth straight month, pointing to increased optimism among US consumers. The key indicator soared to 93.8 points, its highest level since January 2007 and well above the forecast of 89.6 points. On Friday, there was good news from retail sales and jobless claims. Core Retail Sales came in at 0.5%, ahead of the estimate of 0.1%. Not to be undone, Retail Sales posted a gain of 0.7%, beating the estimate of 0.4%. This was the indicator’s strongest showing in 12 months. There was more good news on the job front, as Unemployment Claims dipped to 294 thousand, below the forecast of 299 thousand.

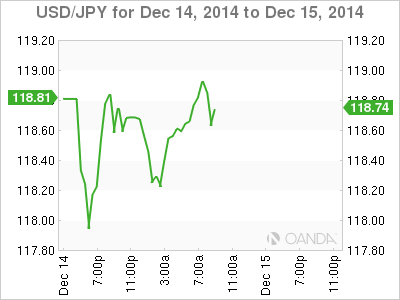

USD/JPY 118.77 H: 119.04 L: 117.96

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.