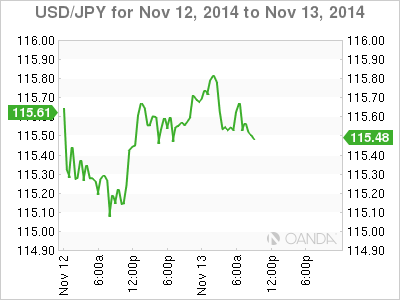

The Japanese yen is showing little movement on Thursday, as USD/JPY trades in the mid-115 range. On the release front, Japanese Core Machinery Orders posted a strong gain of 2.9%. In the US, Unemployment Claims rose to 290 thousand. Later in the day, Fed Chair Janet Yellen will speak at a conference in Washington hosted by the ECB and Federal Reserve.

US Unemployment Claims has looked solid in recent readings, but the key indicator jumped to 290 thousand, missing the estimate of 282 thousand. This marked a seven-week high for the key indicator. USD/JPY shrugged off the weak reading and continues to show little movement. On Friday, we’ll get a look at US retail and consumer confidence numbers, so we could see some movement from USD/JPY.

Japanese manufacturing data has looked sharp this week. Core Machinery Orders gained 2.7%, crushing the estimate of -1.0%. Revised Industrial Production posted a gain of 2.9%, bouncing back after a decline of -1.9%. The estimate stood at 2.7%. Earlier in the week, Tertiary Industry Activity gained 1.0%, its best showing since April.

USD/JPY 115.54 H: 115.87 L: 115.31

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.