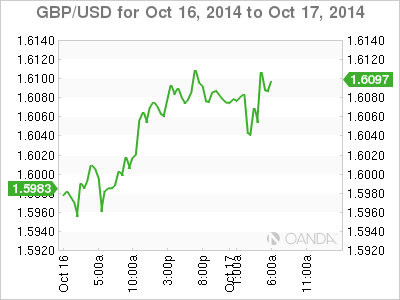

After sharp losses earlier in the week, the pound has rebounded. In Friday’s European session, GBP/USD is trading at the 1.61 line. On the release front, there are no UK releases on Friday. Over in the US, it’s another busy day, with the release of Building Permits and UoM Consumer Sentiment. As well, Federal Reserve Chair Janet Yellen will deliver remarks at an event in Boston.

On Wednesday, the pound got a boost thanks to strong British numbers and disappointing US data. In the UK, Average Earnings Index edged up to 0.7%, matching the estimate. This was a four-month high for the indicator, which is an important indicator of consumer inflation. On the employment front, Claimant Count Change continues to drop, but the reading of -18.6 thousand was well of the forecast of -34.2 thousand. Meanwhile, the unemployment rate dropped from 6.2% to 6.0%, its lowest level since November 2008. In the US, retail sales and inflation numbers sagged, Core Retail Sales dipped 0.2%, its first decline since April 2013. It was a similar story with Core Retail Sales, which posted a decline of 0.3%, its first loss since January. This points to a decrease in consumer spending, a key component of economic growth. Meanwhile, PPI fell by 0.1%, after a reading of 0.0% a month earlier. All three events missed their estimates.

There was better news on Thursday, as US Unemployment Claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand. Manufacturing numbers were a mix, as Industrial Production gained 1.0%, its best showing since November. The Philly Fed Manufacturing Index dipped to 20.7 points, but this beat the estimate of 19.9 points.

British CPI, the primary gauge of consumer inflation, continues to lose ground. The index dropped to 1.2%, a five-year low and short of the estimate of 1.4%. Core CPI and PPI Input also missed their estimates, as inflation indicators continue to point downwards. The weak CPI reading gives Governor Mark Carney more breathing room to maintain current interest rate levels, and investors responded to the news by dumping their pound holdings on Tuesday. There is growing sentiment that the BoE could delay a rate hike until the second half of 2014, with inflationary pressures continuing to recede.

GBP/USD 1.6101 H: 1.6130 L: 1.6030

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.